Through its subsidies Arvest bank provides banking products and services. The bank was founded in 1976 and is based in Lowell, Arkansas.

- Branch / ATM Locator

- Website: https://www.arvest.com/

- Routing Number: 082900872

- Swift Code: See Details

- Telephone Number: +1 866-952-9523

- Mobile App: Android | iPhone

- Founded: 1976 (49 years ago)

- Bank's Rating:

Arvest Bank offers internet banking services that make it easy for customers like you to manage their bank accounts. The bank has embraced technology and with its internet banking services, it has become convenient for customers to manage their bank accounts. And with smartphones, customers can also download apps and use them to login into their online accounts. Here is a guide on how Arvest Bank customers can login, reset their passwords and enroll for the online banking services.

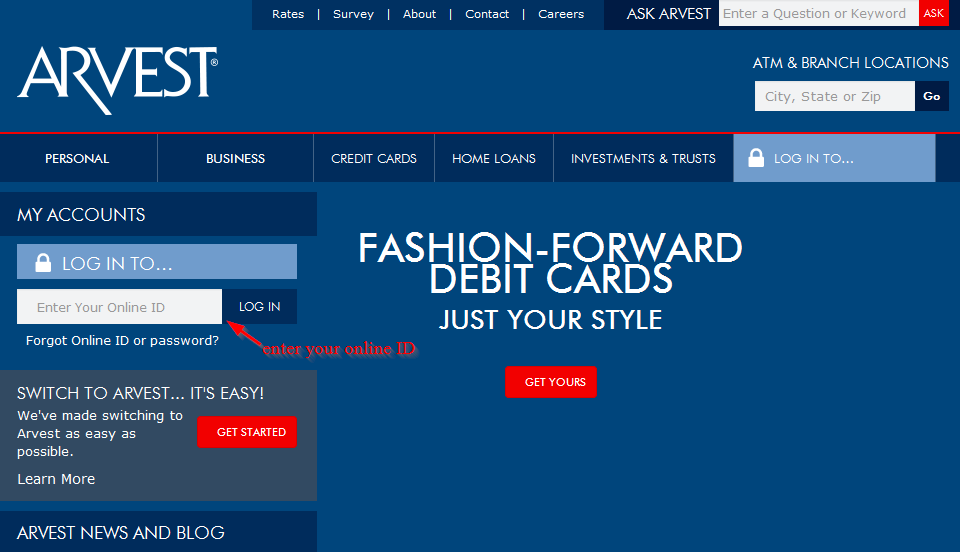

How to login

As mentioned above, you can login using your computer or download and app and login using your Smartphone. Here are a few steps that you need to follow to login into your online account:

Step 1-Open https://www.arvest.com/ in your web browser

Step 2-Enter your online ID and click “login”

Step 3-Enter your password

You will be able to login into your online account as long as you have use the correct logins

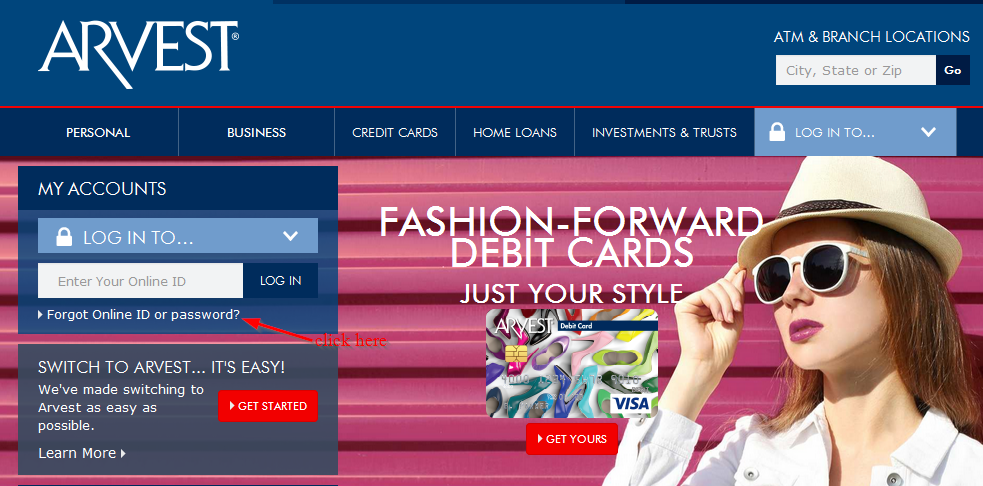

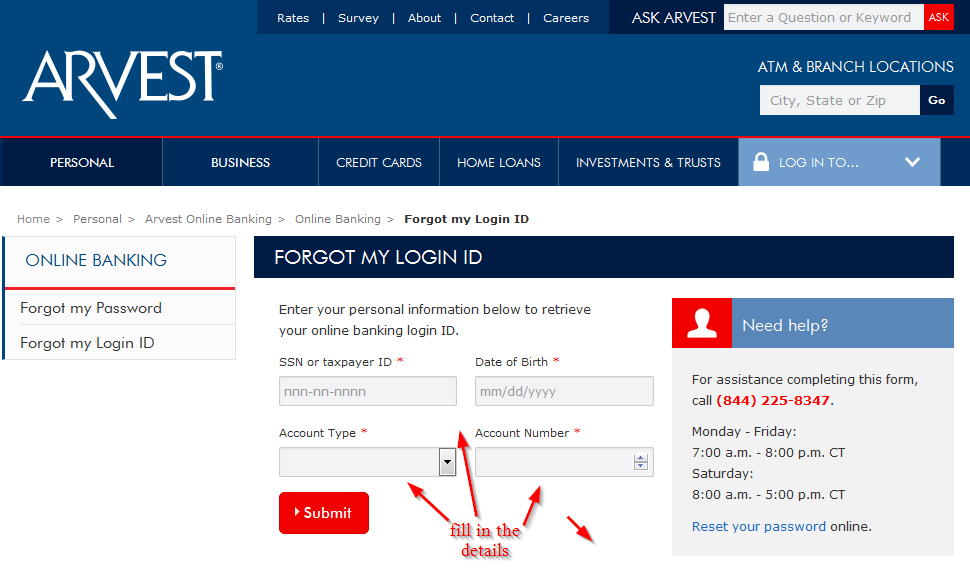

How to reset your password

It only takes a few minutes to change your password and access your online account again. Provided you have an online account with the bank, you can reset your password anytime. Here are steps to help you reset your password

Step 1-Click “forgot user ID or password?”

Step 2-Enter your SSN or taxpayer ID, date of birth, account type and account number and click “submit”

How to enroll

You can enroll to the internet banking services offered by Arvest Bank in only a few minutes. The process is pretty simple and straightforward. In this case, you will need to visit the nearest branch in your area so that you can enroll for the internet banking services.

This is because there is no link on the website to enroll. The bank will provide you with a login ID and password.

Manage your Arvest Bank online account

You will be able to do the following with your Arvest Bank online account:

- Access to your bank account

- Access to the nearest ATM and branch location

- Login anytime anywhere

- Online security

- Get transaction alerts

- Report a stolen or lost card

- Online customer support

Arvest Bank Review

Arvest Bank was founded in 1961 and was initially known as The Bank of Bentonville. The bank has expanded over the years and it now has more than 200 branches. The bank had $3.5 million in deposits when it was initially purchased. Today, Arvest Bank has assets that exceed $16B. The bank’s service can be found in more than 120 communities and it is the largest bank in Arkansas in terms of deposit market share

Benefits

In our review, we realized that Arvest Bank has a few benefits that you should know if you want to bank with them:

- Products and services

Arvest Bank offers a few banking, insurance, investment and lending products to their customers. Customers range from people who need personal banking services to small business owners. Whatever the financial background or situation, the bank provides dedicated advisors to help customers navigate the complex financial world.

- Great features

There are a few features and services that are available through Arvest Bank. Customers can open an account with the bank online and get individual help with the bank’s professionals. The personal banking services can be divided into:

Checking accounts-The bank offers a number of personal checking accounts that will help customers to bank in the most comfortable way possible.

Free Blue: This is a basic account with free debit card, unlimited check writing and as much as $400 in overdraft protection. Free debit card, no monthly fee, and enrollment in e-Statements is needed to avoid a fee

Basic Blue: For customers who need paper statement, this account provides that option which also comes with nominal monthly fee. There is also free debit card and also includes paper account statement with images

myBlue: The bank’s myBlue checking offers one of the most affordable checking with extras and valuable benefits. This account includes a monthly fee of $12 and unlimited online BillPay, Family AD&D insurance and Family IDProtect.

Arvest Club: You can enjoy club discounts together with higher overdraft protection, valuable accidental death policy, and free printed checks

Preferred Club: This account earns interest on balance

Savings-The bank offers a number of savings account options that will help you earn interest as you save money. The accounts include Cool Blue Savings, Savings, Money Market, Health Savings Account, Certificate of Deposit and Individual Retirement Account.

Online and mobile banking-The bank’s online banking is secure and offers an easy way for customers to manage and access their accounts anytime. Online BillPay is a convenient and fast way to pay your bills. This service is also included with a number of the bank’s checking accounts. The bank’s mobile banking allows customers to bank even when they are on the go. You can pay bills, transfer funds and check balances and more

Debit Cards-The Arvest Bank chip enabled debit card is convenient, safe and fast way to many purchases at any place that Visa debit is accepted

Arvest Flex Rewards-When you sign up, you will see your point balance and activity. The points can be redeemed online for statement credits, gift cards, cash back and more

Prepaid Cards-Arvest Visa Gift Card can be used anywhere that a Visa is accepted. Spending on this card is limited to the amount that is on the card. If you have not known, spending cards are amazing for internet purchases, providing money to teens, budgeting and traveling.

Downsides

The disadvantages of banking with Arvest Bank include:

- Limited loans

Although Arvest Bank offers loan services, they only specialize on mortgages. This is the only loan that customers can obtain from the bank. The bank offers one of these loan options to their customers: student loans, auto loans and home equity loans.

- Monthly maintenance fee

Aside from the limited lending abilities, the bank also charges monthly maintenance fee on a number of savings and checking accounts.

Conclusion

Arvest Bank offers several traditional banking solutions to small businesses and personal clients. Some of these solutions include basic banking features with some bonus services that are included.

People who are interested in the bank as their bank can expect these from the platform: fees charged on accounts, debit and credit cards, a number of savings and checking accounts available, online and mobile banking and limited lending solutions.