Bank of America is one of the largest financial institutions in the world, serving small and middle-market business, large corporations and individuals. The bank has more than 56 million small business and consumer relationships

- Branch / ATM Locator

- Website: https://www.bankofamerica.com/

- Routing Number: 026009593

- Swift Code: See Details

- Telephone Number: 1-704-386-5000

- Mobile App: Android | iPhone

- Founded: 1998 (27 years ago)

- Bank's Rating:

If you have an account with Bank of America, you can sign up for internet banking services which enable you to pay your bills, check your transaction history, transfer money to one or several accounts, apply to loans etc. The internet banking services are free and all that customers need to do is visit the bank’s website. Continue reading this guide to learn more about how to enroll for the internet banking services, how to log in and how to change your password in case you forgot. We’ll start with how to log in.

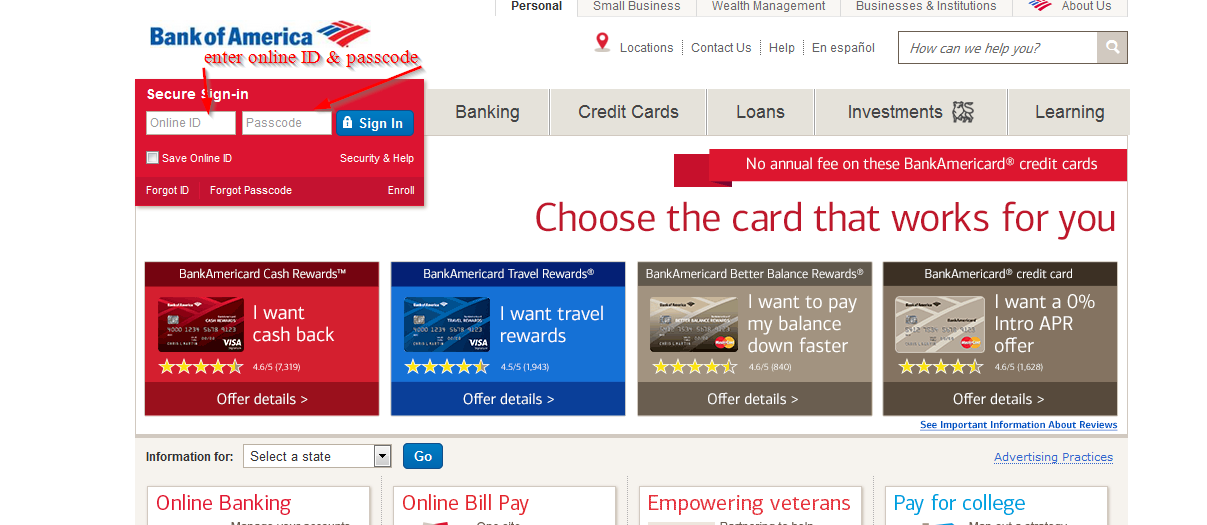

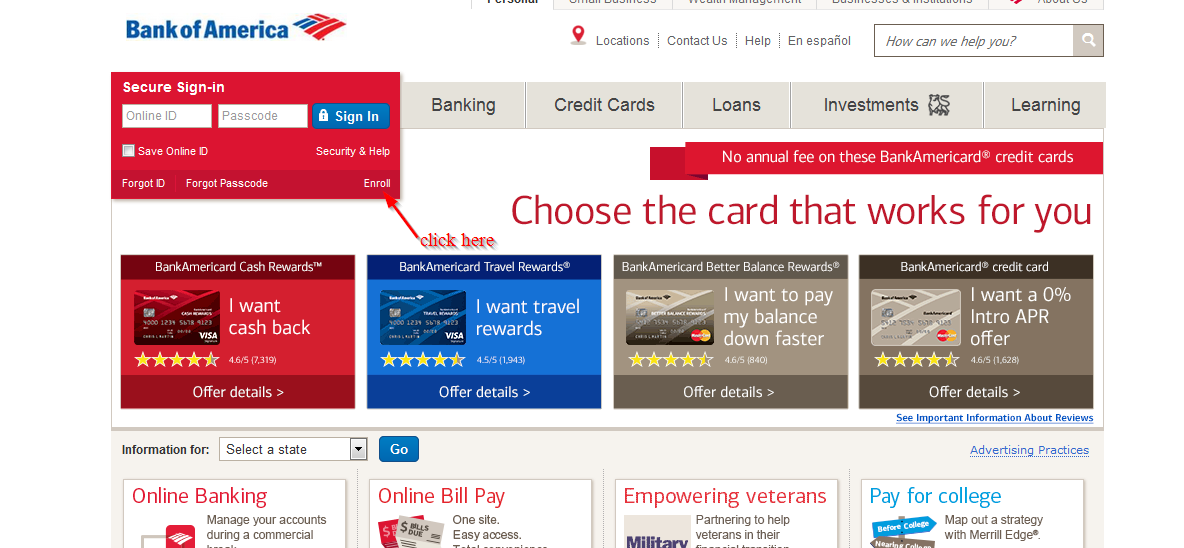

How to login

The website has a pretty easy to use interface, and just like Facebook, Twitter or any online account, you will need your login details. Here is a step by step guide:

Step 1-Start your computer, open your web browser and enter https://www.bankofamerica.com/ in the address bar

Step 2-Key in your online ID and passcode and click ‘sign’

If you use a valid passcode, you will be granted direct access to your dashboard

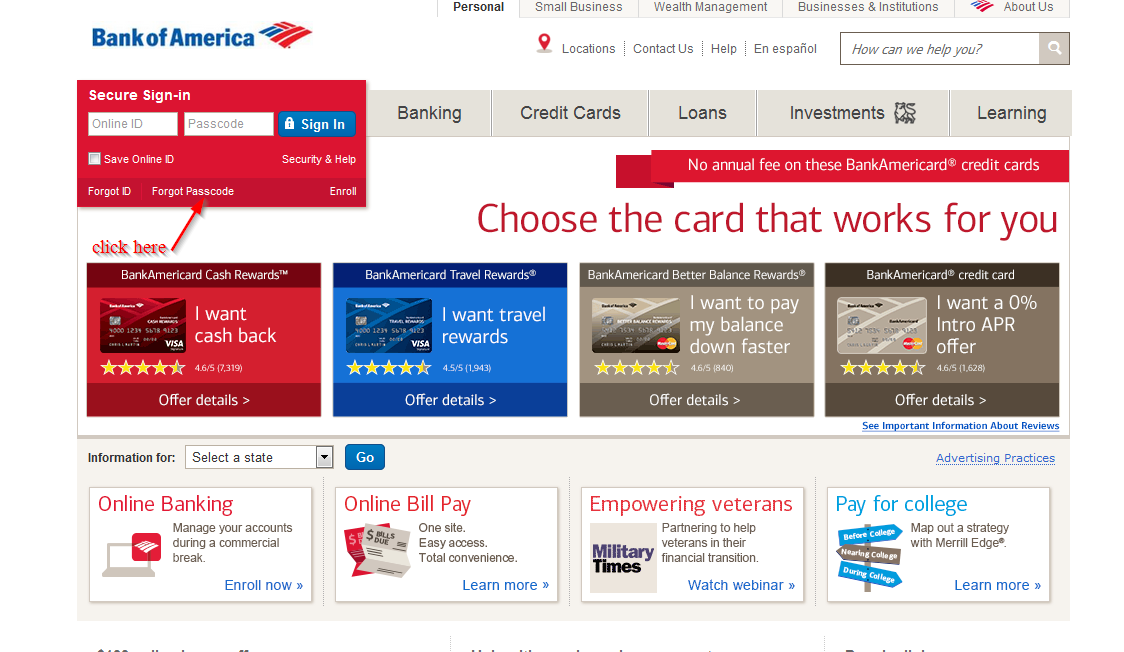

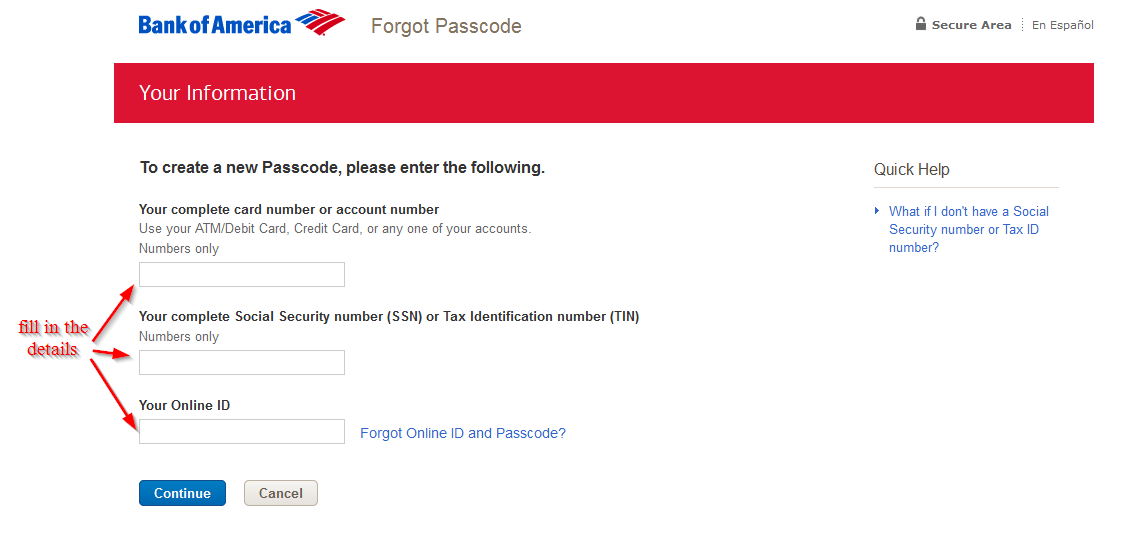

Forgot your password?

You will not be granted access to your Bank of America online account if your use an incorrect username or passcode. However, you can reset your password to regain access. Here are the steps you need to follow:

Step 1-Go back to the Homepage and click ‘forgot passcode’

Step 2-Use your credit card, Debt/ATM Card or any of your account numbers, enter your social security number and your online ID and click ‘continue’

A new temporary password will be sent to the email address associated with your account

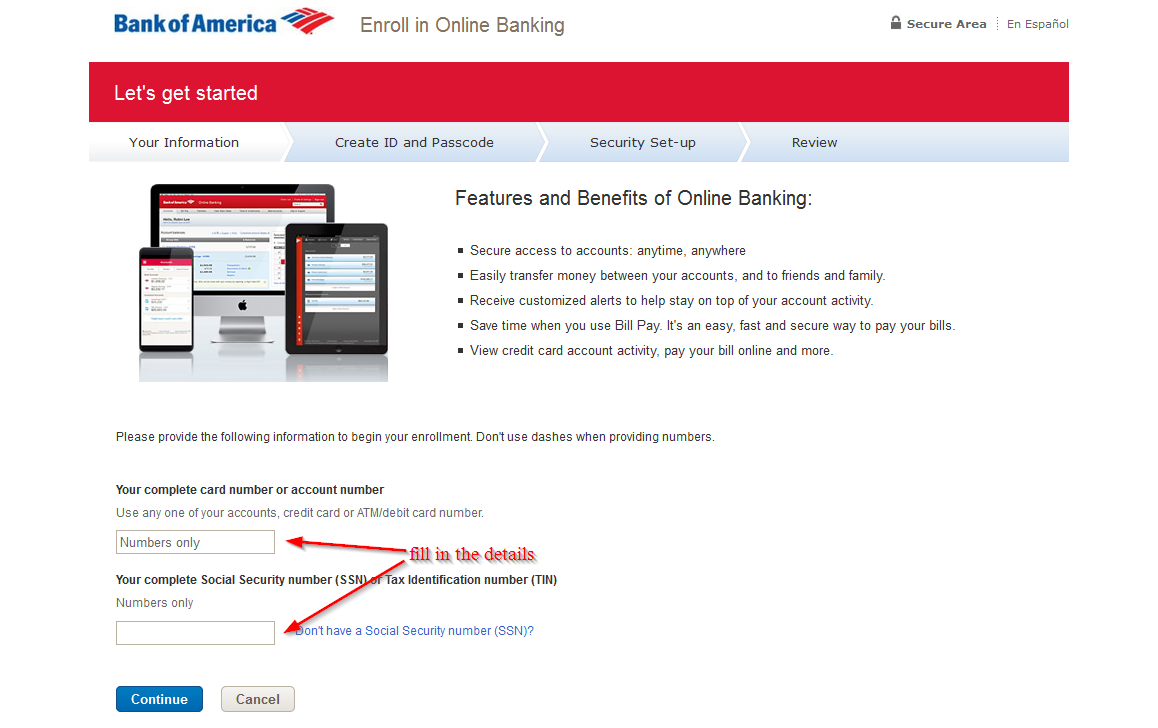

How to enroll

Registering for the internet banking services offered by Bank of America is easy. However, as mentioned earlier on, you must be a customer with a bank account. Follow these steps to enroll:

Step 1-Again, go back to the Homepage and click ‘enroll’

Step 2– Enter your account number and social security number or Tax Identification Number and click ‘continue’

Manage your Bank of America online account

The advantages of enrolling in the internet banking services with the bank include:

- Check account balance

- Pay your bills anytime, anywhere

- Transfer money from one account to another

- Access to an ATM locator

Bank of America Review

Bank of America is an international banking and financial services company based in Charlotte, North Carolina. It the second largest Bank in the United States, and one of world’s largest banks. The bank ranked No. 11 on Forbes Magazine Global 2000 list of the largest companies in the world.

As of 31st December 2016, the bank had $886.1B in Assets under Management (AUM) and held 10.73% of all bank deposits in the U.S. Bank of America provides its financial services and products through 4,600 retail financial centers, about 15,900 ATMs, call centers and online banking and mobile banking platforms.

Bank of America was founded in 1904, which means that it has a wide experienced in the banking industry. However, before you open an account with the bank, it is important that you consider the benefits and downside of the financial giant. The bank is everywhere, and offers many free and convenient account services.

Benefits

The benefits of banking with Bank of America include:

- Accessibility: This is basically one of the main advantages of Bank of America-it’s available everywhere. When you open an account with the bank, you can be sure that you will be able to find a branch that is near you, since Bank of America has locations in every state. And since the bank’s ATMs are legion, you are less likely to pay ATM fees.

- Ease of use: Another thing about Bank of America is that it offers branch banking, mobile banking, free online banking and text banking. Then again, most banks offer these services, excluding online banks which don’t offer branch banking

Security and safety of customers who bank with Bank of America

- Automatic savings: The “keep change program” is convenient as it rounds up every year debit card purchase to the nearest dollar and saves the rounded amount in your Bank of America savings account. It is however important to be aware that the bank charges a monthly fees for checking and savings accounts, which ranges from $5 to $25. You can avoid the fees with some conditions, but monthly fees will significantly decrease savings. Bank of America is currently offering low interest rates and has fees that other banks don’t charge.

- A range of checking accounts: The bank has two personal checking accounts: Interest checking and Core Checking. These accounts offer free online banking and mobile banking and free bill pay. Both accounts have debits cards and have Total Security Package which basically includes zero dollars Liability Guarantee and fraud monitoring. Aside from that, customers can add photos on their card to help find it whenever it is lost or stolen.

Downsides

Bank of America has its own downsides that anyone who wants to open an account with the bank should know. They include:

- Account fees: The bank created uproar a few years ago when it proposed a monthly fee of $5 on all debit card users who don’t have a mortgage, $20,000 in total balances or a Merrill Lynch brokerage account. The backlash from the public was so severe that the bank had to forego the idea.

- Slow service: Sometimes, the size of Bank of America can be a drawback. Many customers have registered complains that they have to wait for too long. Another complain that has been reported is long teller lines.

- Poor performance: Like many other big banks, Bank of America is under financial pressure. In a study that was conducted by Forbes to measure 100 banks in areas such as capital adequacy, profitability and asset quality. Forbes ranked the financial health of banks from the healthiest to the least healthy. Bank of America ranked No. 90 in 2017.

- Lack of responsiveness: Mortgage customers have complained that it is difficult for Bank of America to solve Mortgage problems through the bank and the bank usually doesn’t respond in time.

Conclusion

As you can see, Bank of America has its advantages and disadvantages inherent to its role as one of the largest banks in the United States. If more locations, online security, and convenience are your priority, then Bank of America is the right choice for you. On the other hand, if you are looking for free savings or checking and financial strength, then you will want to look for another bank.