Byline bank offers business and personal banking services and products. The bank was founded in 1972 and is based in Chicago and Illinois. Byline bank operates as a subsidiary of Byline Bancorp, Inc.

- Branch / ATM Locator

- Website: https://www.bylinebank.com/

- Routing Number: 071001533

- Swift Code: See Details

- Telephone Number: + 1 773-244-7000

- Mobile App: Android | iPhone

- Founded: 1972 (53 years ago)

- Bank's Rating:

Byline Bank offers internet banking services to enable their customers to conveniently access their bank accounts from anywhere around the globe. These internet banking services are available to all customers who have personal and business accounts. Here is a guide on how you can login into your online account, reset your password and register a free online account with the bank.

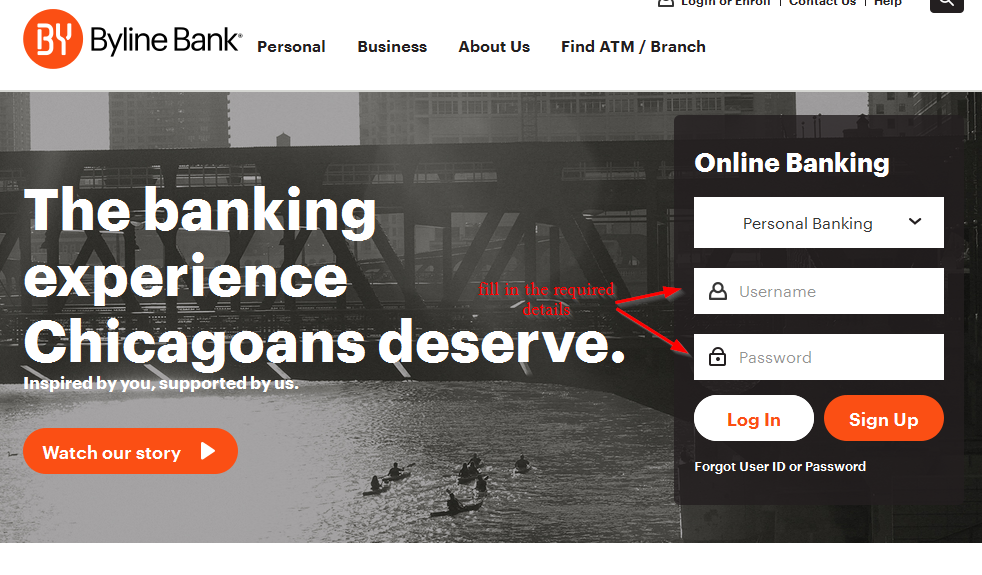

How to login

If you have created an online account with the bank, it is easy to login and manage your bank account. However, to access the online account, you will be required to use valid login details. Follow these simple steps to login:

Step 1-Open https://www.bylinebank.com/ in your web browser

Step 2-Enter your username and password and click “login”

If the logins you have used are correct, you will be directed to your online account

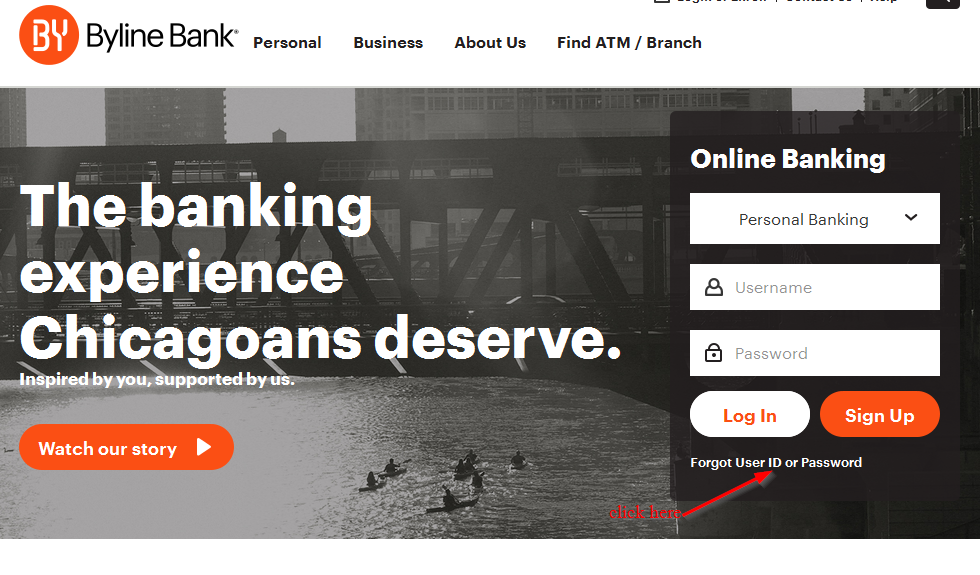

Forgot your password?

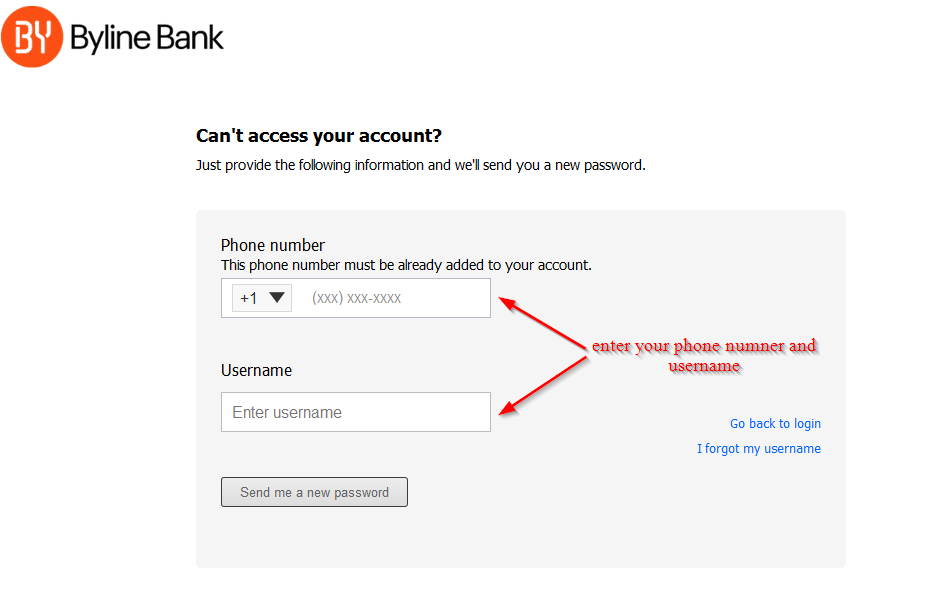

You can reset your password anytime and regain access to your online account. All you will need is a valid user ID to get started. Follow this step by step guide to reset your password:

Step 1-Start on the Homepage and click “forgot user ID or password”

Step 2-Enter your phone number and username and click “send me a new password”

The bank will send you a new password in your email address

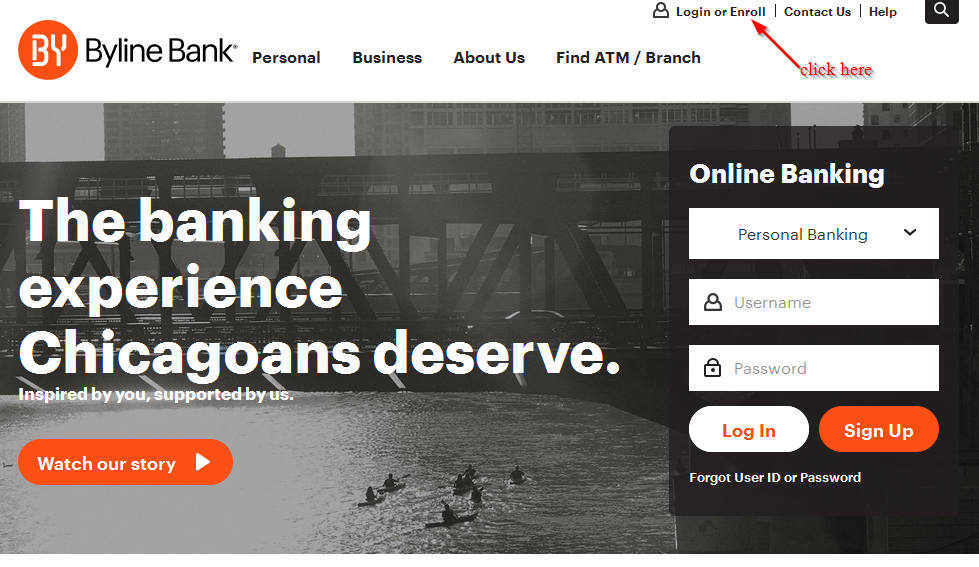

How to enroll

If you have an account with Byline Bank, you can register for internet banking services so that you can manage your bank account. You will be required to provide certain details about your bank account. Here are the steps you need to follow:

Step 1-Again, go to the homepage and click “login or enroll”

NOTE: The website is still under maintenance and we were unable to get you screenshots for enrolling. However, the process if pretty straight forward and it’s also free to create an online account.

Manage your Byline Bank online account

Here are a few advantages of creating a free online account with Byline Bank:

- Check your account balance

- Pay your bills

- Transfer money from one account to another

- Check your transaction history

Byline Bank Review

Byline Bank is an American Bank headquartered in Chicago. The bank operates more than 50 branches in the Chicago metropolitan. Byline Bank almost collapsed in 2013 before it obtained new investment from the BXM Holdings.

The bank was founded in 1972 and operates a subsidiary of Byline Bancorp, Inc. The bank provides commercial and individual banking services. It offers savings, checking accounts, money market and individual accounts; mortgages and personal loans.

The bank also provides loans in sector such as equipment leasing, online banking, and investment service and cash management.

The bank was initially known as North Community Bank, but changed to Byline Bank in 2015.

Savings account

If you are looking for an account that will put your money to work then you will want to go with this account. Byline Bank offers a range of savings accounts that you will want to explore.

Statement savings-This is the right account if you are looking to start a rainy day fun. Some of the features included in this account are free mobile and online banking; earn interest even with a low minimum balance, free MasterCard debit card when it’s linked to a checking account.

- Golden Statement Savings

If you are looking for an account that will earn you more interest on large balances then this is the right account for you. This account features free online and mobile banking, you get to earn more interest when you maintain a higher balance and free mastercard debit card when its linked to a checking account

- Passbook savings

This account makes it easy for you to track and post your transactions in a passbook. You can bank free of charge online and through your mobile phone. It also enables you to track your balance with ledger.

- Golden passbook savings

With this account, you can earn more interest and track your transactions from a traditional passbook. The account features free online and mobile banking, earn more interest with higher balance, and track your balance using passbook ledger.

- Money market

The money market account helps you to keep your savings in your reach. The features of this account includes free online and mobile banking, e-statements make the process of record keeping easy, you can access money market by debit card, check and transfer and get some interest based on balances

- Individual retirement accounts

If you are looking to plan retirement then you are at the right place. The bank insures its IRAs up to $250,000 by the federal government.

Checking account

Checking accounts are secure, easy and fast. You just get your funds and go. The various types of checking accounts offered by the bank include:

- Freedom account

This account has no silly restrictions. The account has no monthly fee, free online and mobile banking, unlimited check writing, no minimum balance, and free MasterCard debit card, free first order of standards checks, 3 free ATM transactions every month at non-bank affiliated ATM

- High interest checking

This account earns you some interest. Your money will be working for you here. The features include: free online and mobile banking, free MasterCard debit card, free online banking and bill pay, higher interest rate and free online check images. Those who want to open a High Interest checking account will be required to visit one of the bank’s branches in Milwaukee and Chicagoland area.

Prime life checking

This account gives you the banking benefits that you have earned. The features include: access to customers who are 55+ and free online banking, mobile banking, and MasterCard debit card, ATM transactions at more than 1,000 ATM in Chicagoland, cashier checks, travels check, money orders and check for life.

Benefits

- No monthly fees

- Free online check images

- Free online and mobile banking

- Unlimited check writing

- Three free ATM transaction per month at non-bank affiliate ATMs

- Free MasterCard Debit Card

- No minimum balance

Downsides

- Lack of commitment to improve IT capability

- Unprofessional and unfriendly stuff

Conclusion

Thos who reside in qualifying states could be eligible for $100 bonus when you refer a family or friend. The bank has received many positive reviews on mobile deposit and mobile banking. In addition, customer get free MasterCard debit card