City bank is a bank committed to building long lasting relationships by providing financial solutions. The bank has successfully created an engaging, innovative, exceptional and genuine experience that is only unique to the bank. This explains why it has managed to grow its assets to more than $250 million. Deposits have grown to $270 million and investments to over $270. This is not to mention the $75 million worth auto loans.

It was the first bank in Texas t offer crop insurance, a service that has now spread to 15 states. Over the past 40 years, City bank has grown from $40 to more than $2.5 billion with over 600 employees.

- Branch / ATM Locator

- Website: https://www.citybankonline.com/

- Routing Number: 111301737

- Swift Code: None

- Telephone Number: (800) 687-2265

- Mobile App: Android | iPhone

- Founded: 1941 (84 years ago)

- Bank's Rating:

City bank has its roots in West Texas. This is where it was first established in 1941 as State Bank of Morton. It kicked off its operations and growth immediately and by 1942 its assets were estimated at just over $ 1 million. This is from an initial capitalization of $ 129,335.48.

Its beginning wasn’t without some misfortunes as it experienced a major fire outbreak and an armed robbery in its first five years. This didn’t dull the bank’s star as in 1946 it recorded $ 2 million in deposits. There was no turning back as growth was all that was recorded. In 1957, the bank moved to its current location Morton Texas.

City bank has gone through several acquisitions and shouldn’t surprise you to learn that its headquarter is in Lubbock, Texas. It currently as assets worth over $2.5 billion, 24 branches and 16 mortgage locations. In addition to the land-based banks, it has a friendly website that enables its customers to bank online. Here is a guide on how to use the online platform.

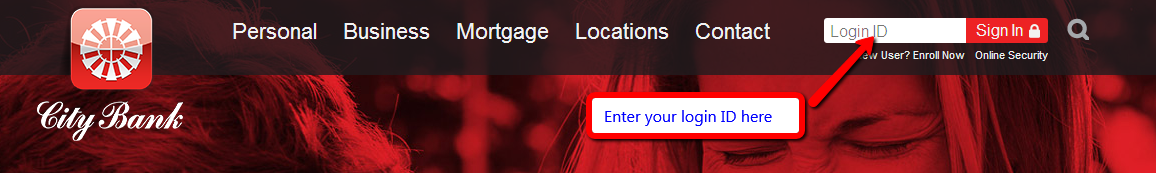

How to login

Step 1

Visit the bank’s website to access your online account. Follow this link. To the right hand corner, you will find a section labeled ‘login ID’. Enter you login ID here. Click ‘sign in’.

If details are okay you will be signed in. If not, you can reset the password.

How to reset password

To login into your account, you will only need the login ID. This means that you do not need to have a password. This being the case, the issue of lost passwords doesn’t arise. As such, there is no option or resetting the password.

If you need any help, call the bank on (800) 687-2265 .

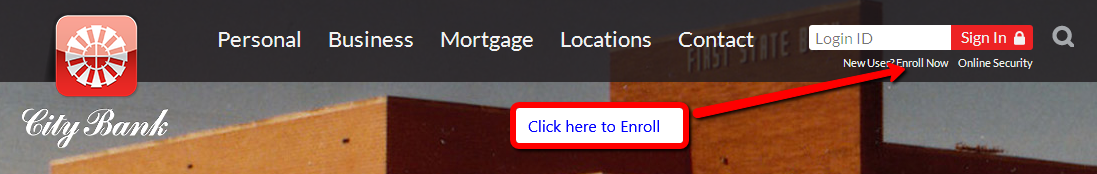

How to enroll

Enrolling is a new online user is easy. Visit the bank’s website.

Step 1

Below the login dialog box, you will see the ‘new user? Enroll now’ option. Click on the link.

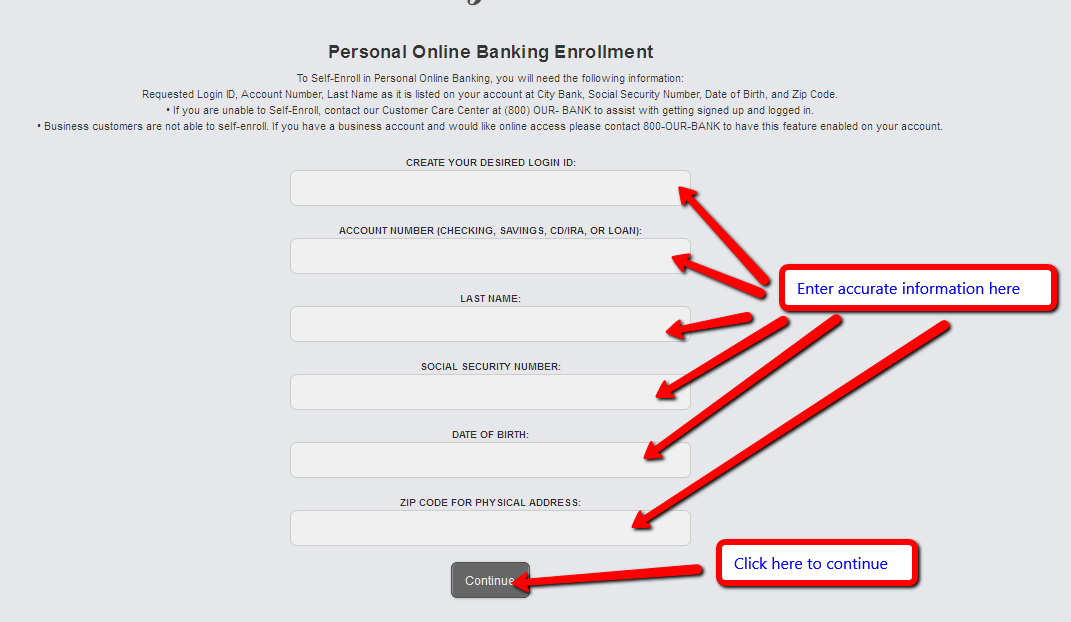

Step 2

Fill in all the fields and click continue.

Step 3

Enter your personal information. Click submit.

What will be in your online account?

You will be in full control of your bank account with this online account. Here you will be able to:

- Deposit checks

- View balances

- Re-order checks

- Manage your debit card

- Picture pay

- Find locations

- Transfer money

- Among others

Your bank account’s control will truly be in your hands. Enjoy the easy modern way of banking.