Delta Community Credit Union operates as a state-chartered credit union for its members in Georgia. The company was founded in 1940 and is based in Atlanta, Georgia.

- Branch / ATM Locator

- Website: https://www.deltacommunitycu.com/

- Routing Number: 061092947

- Swift Code: See Details

- Telephone Number: 800-544-3328

- Mobile App: Android | iPhone

- Founded: 1940 (85 years ago)

- Bank's Rating:

People who have an account with Delta Community Credit Union bank, you can enroll for the internet banking services offered by the bank. The internet banking services offered by the bank are free and customers can access the bank’s website and login anytime to manage the bank account activities. If you are unsure or interested in these services, here is a guide on how you can login, change your password and register your password.

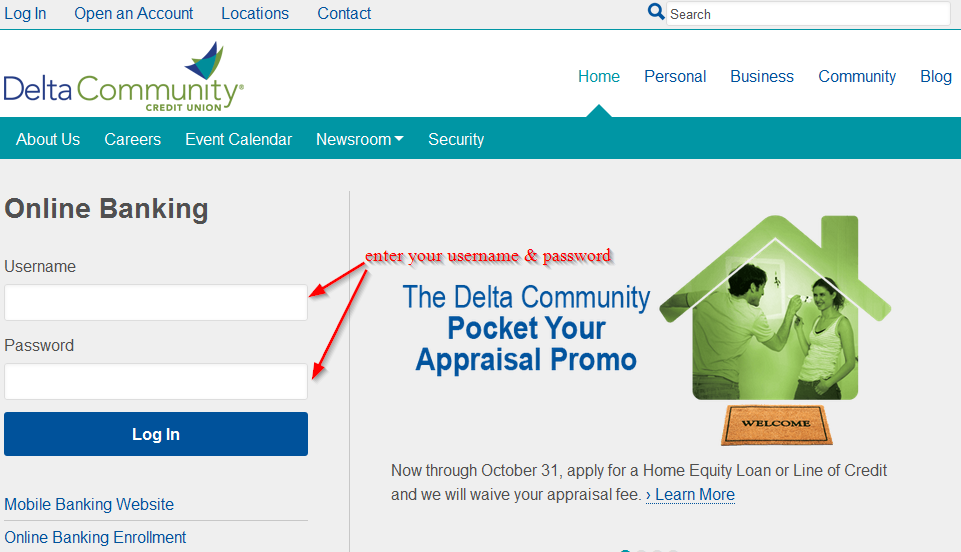

How to login

You can login into your online account anytime provide you have your login details. If you have a Smartphone, you can download an app from playstore or itunes and used it login into your online account. Follow these simple steps to login into your online account:

Step 1-Start your computer, open your web browser and type in https://www.deltacommunitycu.com/

Step 2-Enter your username and password and click “login”

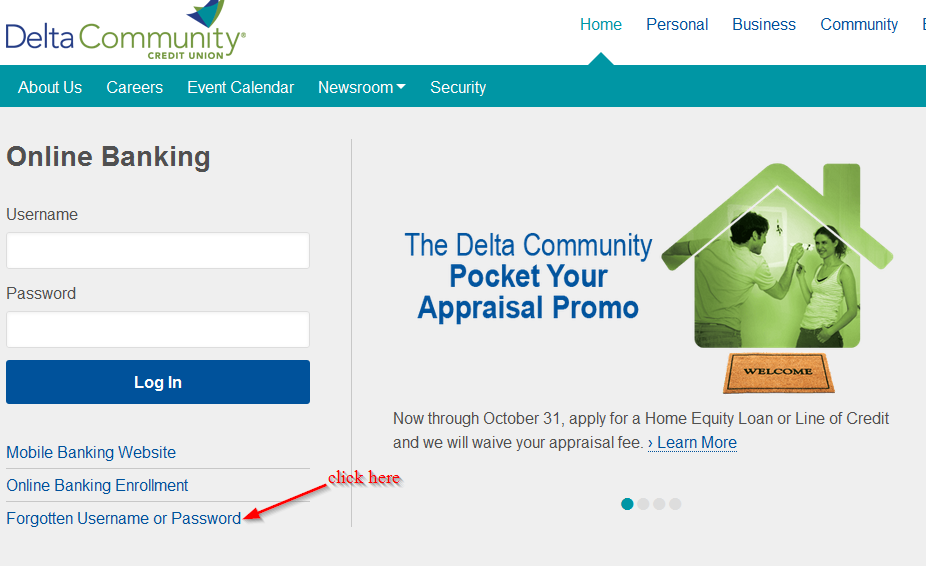

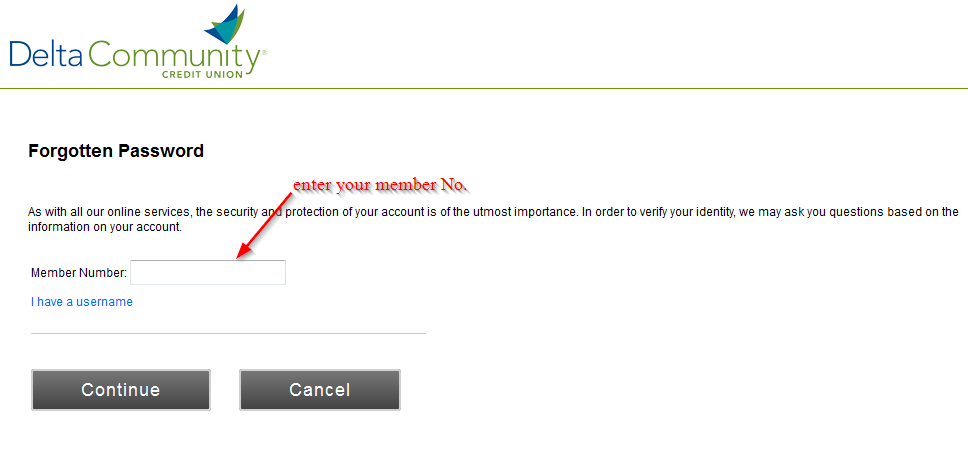

How to reset your password

You can reset your password if you don’t have access to the account. The process is pretty straight forward and customers can get a new password in as short as 5 minutes. To reset the password, you will need to use a valid username:

Step 1-Click “forgotten username or password” on the homepage

Step 2– Enter member number and click “continue”

You may be required to complete a few more steps to successfully reset your password

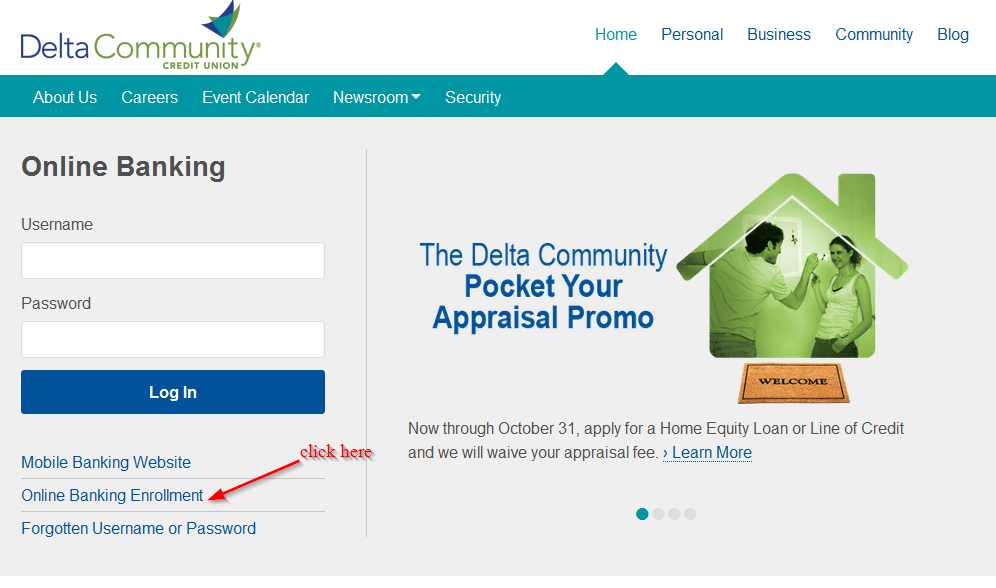

How to enroll

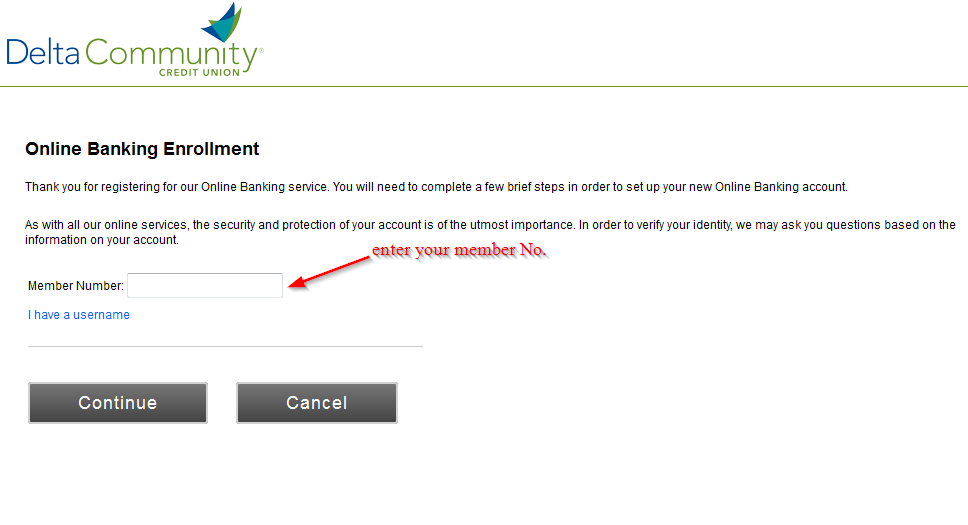

Registering an online account with Delta Community Bank is free as long as are a customer a bank account with the bank. You will be required to provide certain details about your bank account. Follow these steps to enroll:

Step 1-On the homepage, click “online banking enrollment”

Step 2-Enter your member number and click “continue”

You may be required to provide more information in a few more steps to complete your registration.

Manage your Delta Community Credit Union online account

Here are the advantages of having an online account with Delta Community Credit union

- Give you access to your bank account

- You can check your account balance

- You can transfer money between accounts

- You can pay your bills

Delta Community Credit Union Review

Delta Community Credit Union is a state-chartered credit union and the largest credit union based in Georgia in terms of membership and asset size. The credit union has over $5 billion in assets and over 350,000 members.

The credit union ranks among the 25 largest credit unions in the United States. To be eligible to join the credit union, you must work or live in 11 counties in the Atlanta metro area.

Delta Community Credit Union has 27 branch offices and is a member of the CO-OP previously known as CU Service Centers, a countrywide cooperative that allows people to bank are more than 3,500 credit union and more than 5,000 branches.

Delta Community Credit Union has several ATMs and members may use ATMs that are operated by other CO-OP credit unions. The credit union was founded in 1940 by 8 Delta Air Lines employees.

The credit union has branches in the states of Utah, Texas, Georgia and Kentucky. The newest branch that was opened on 24th May 2017 is in Alpharetta, Georgia.

The credit union provides a range of banking services and usually doesn’t charge monthly fee on deposit accounts.

Checking account

Delta Community Credit Union offers one personal checking account for its customers. Open a checking account with the credit union to enjoy many benefits offered by the credit union.

Benefits

- No minimum opening deposit, no monthly maintenance fee and no monthly balance requirement

- Customers have access to about 30,000 surcharge-free ATMs in the United States and 10 other counties, including the 50 ATMs that are owned by Delta Community Credit Union

Downsides

- If you have less than $5,000 in your account, you will not earn any interest. Even with balances above that, you can only earn interest that is very low 0.05%

Savings

Delta Community Credit Union has a single savings account. The credit union’s website has 10 calculators to help members reach their savings goals

Benefits

- Requires a minimum opening deposit of $5 and a monthly service balance that’s as low as $5

Downsides

- Has an APY of 0.15%. For a USD 1,000, that is a bit better than the national average rate of 0.13% for credit unions. However, other banks can offer over 1.00%

- If the total of all your balances is in loan accounts and deposit drops below $60 and you have not made any transaction for 6 months, your account will be considered inactive and you may be assessed a monthly fee of $5. For account owners who are under 18 years of age, the inactivity fee doesn’t apply to them

Certificate of deposit

Delta Community Credit Union has a standard range of certificate of deposit with terms from 6 months to 5 years.

Benefits

- Requires only a minimum balance of $1,000

Downsides

- Rates for certificates of deposit with 6 months to 5 year terms range from between 0.4% and 1.40%. That is a better rate than most that are offered by most banks, but you can find better certificate of deposits elsewhere.

Customer experience

Delta Community Credit Union operates full service branches in the United States. Its members have access to more than 5,000 shares branches across the nation through credit union CO-OP Network.

Customers can reach the credit union’s customer service by email and phone. The credit union offers around the clock live phone service, although it is provided by a third party after business hours.

Many customers seem to like its Android and iOS mobile apps, giving them average ratings of between 4.4 stars and 4.6 stars out of 5 stars. Delta Community Credit Union website is not loan with whistles and bells, but it is easy to use and navigate.

Overdraft fees

When you open a checking account, the credit union will set up a savings account as a source of overdraft protection at no cost. Delta Community Credit Union also doesn’t charge any fees for automatic transfers from savings account to cover overdrafts.

Conclusion

Delta Community Credit Union is one of the most trusted credit unions in the United States. Most accounts don’t require an opening deposit and customer support is always available. However, it has a low APY on its accounts