First Bank offers personal and business banking services. Founded in 1906, the bank operates a subsidiary of First Banks, Inc.

- Branch / ATM Locator

- Website: https://www.firstbanks.com/

- Routing Number: 107005047

- Swift Code: See Details

- Telephone Number: 314-854-4600

- Mobile App: Android | iPhone

- Founded: 1906 (119 years ago)

- Bank's Rating:

First Bank offers internet banking services to enable its customers to access their bank accounts via the internet. With mobile apps now available on itunes and playstore, customers can download an app on their mobile phones and download the app on their phone and login. In this guide, we will take you through the process of logging into your online account, resetting your password and enrolling into your online account.

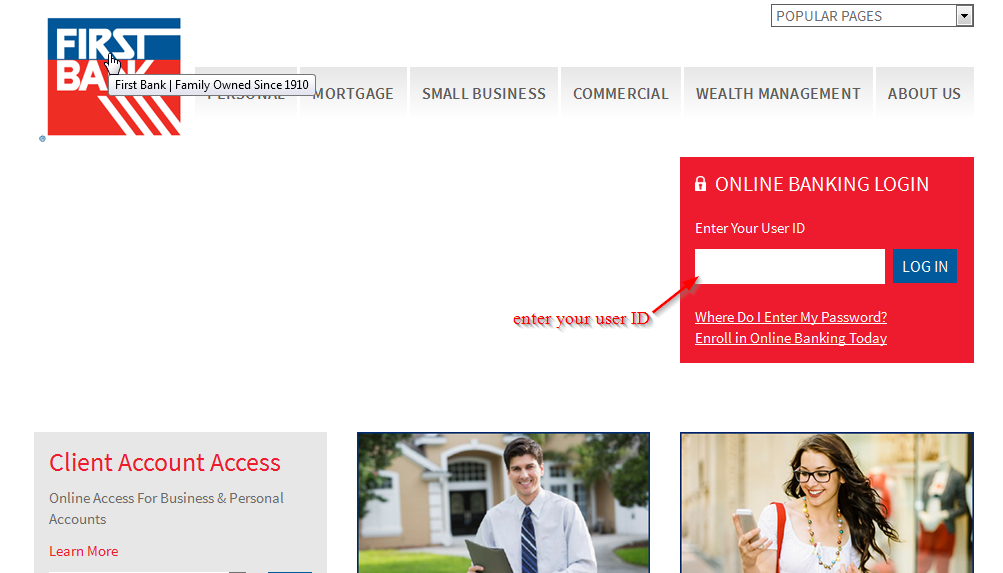

How to login

First Bank has an easy to use platform that enables customers to convenient login into their online accounts anytime. As mentioned above, you can also login using your mobile phone to login. Follow these simple steps:

Step 1-Open https://www.firstbanks.com/ in your web browser

Step 2-Enter your user ID

Step 3-Enter your password

Provided the login ID and password you have used are correct, you will be able to navigate to your online account

How to reset your password

To reset your password, you will need to use a valid user ID. This is the only way you will be granted access to your password page. And once you are there, you can click the password reset link and provide the details required to reset your password. Unfortunately, we couldn’t get screenshots for this section.

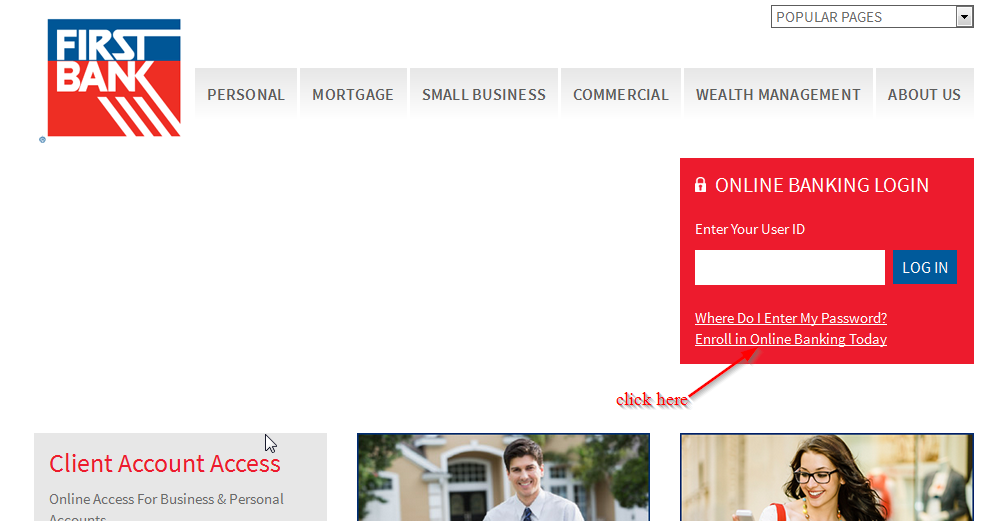

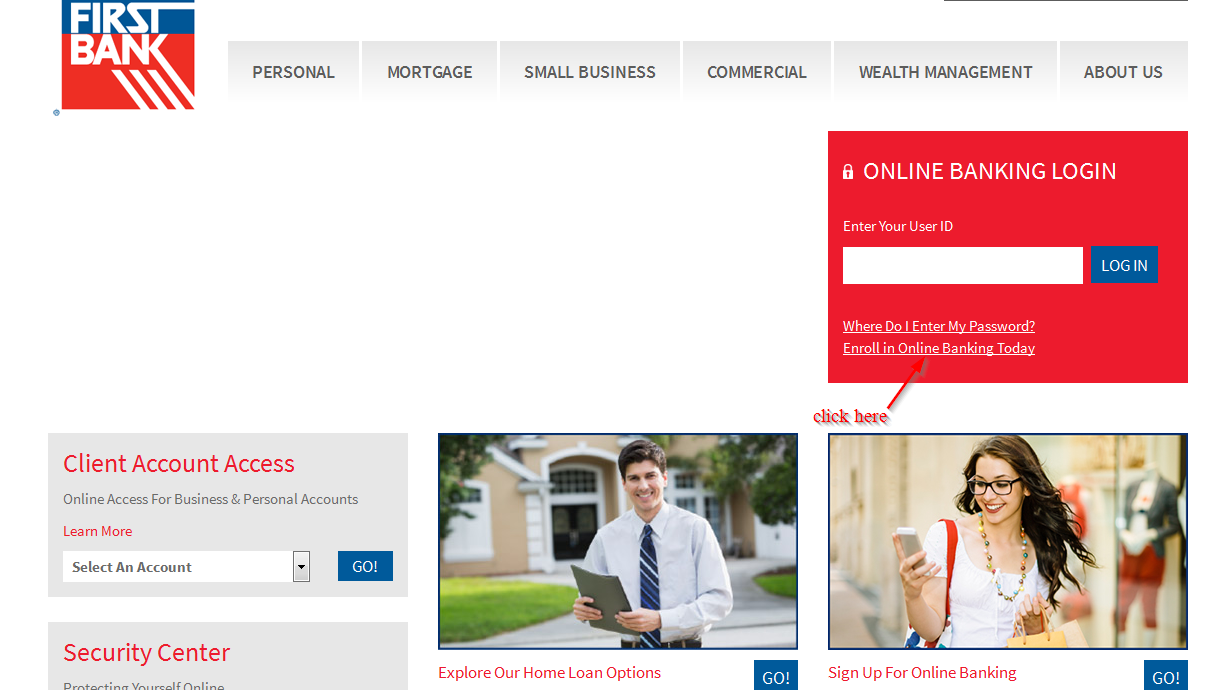

How to enroll

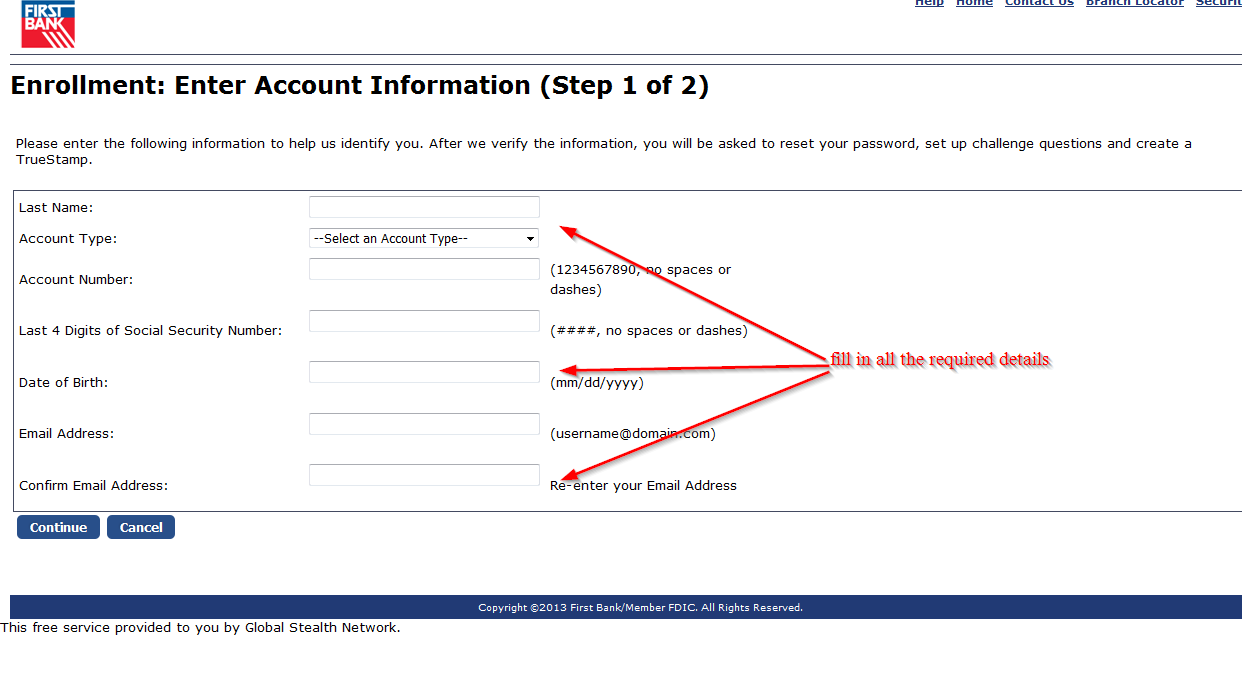

Registering an online account with First Bank is easy. Since you will be required to provide details about your bank account, you must be a customer with a bank account with First Bank to enroll. Here are the steps you will need to follow:

Step 1-Go to the homepage and click “enroll in online banking today”

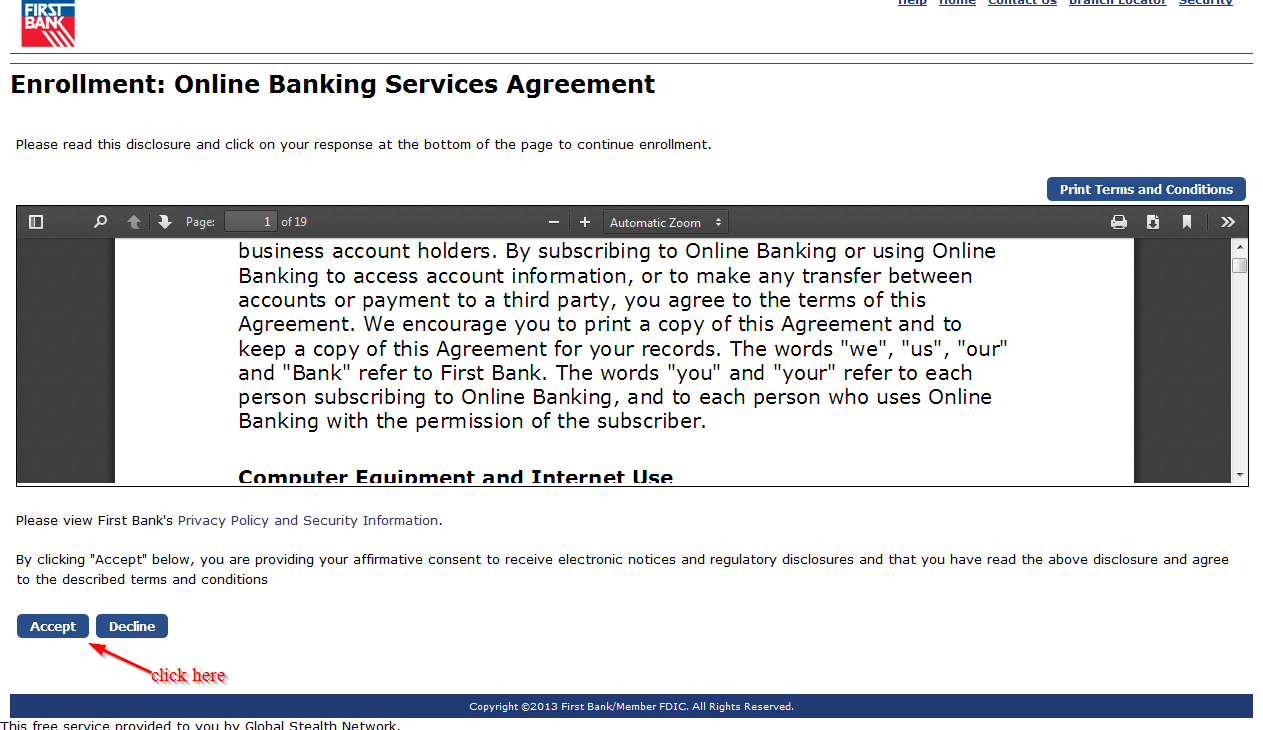

Step 2– Read all the terms and conditions in the PDF file. You can even download the file. And then click “accept” to proceed with registration.

Step 3-Fill in all the required details

Manage your First Bank online account’

It’s easy to enroll for the internet banking services offered by First Bank. Here are the advantages of enrolling:

- Full time access to your bank account

- Online customer support

- Safe and secure online platform

- Track transaction history

- Get transaction alerts

- Report stolen or lost card

- Find the nearest ATM/branch

First Bank Review

First Bank is also known as 1ST Bank. The bank is a privately held financial services company with 115 branch locations in California, Arizona and Colorado. It is headquartered in Lakewood, Colorado and it is the second largest bank in Colorado by total assets behind Wells Fargo.

First Bank is a member of FDIC and Equal Housing Lender. Founded in 1963 by Roger Reisher, the bank expanded beyond the Denver Metro Area to one of the most trusted and privately held banks in the United States. The bank had assets of $17 billion and over $14 billion in deposits as on December 2016.

In 2010, the bank partnered with Community First Foundation to start Colorado Gives Day, a 24-hour online drive aimed at raising funds for non-profit organizations in Colorado. In 2013, this initiative was expanded outside Colorado, with the implementation of the Arizona Gives Day, collaboration between Arizona Grantmakers Forum and Alliance of Arizona Nonprofits.

Very little distinguishes this bank from other banks, and that’s good and bad at the same time. The bank’s fees are not particularly high; the same can be said for savings rates. The bank’s website has all the basics that you need to get started.

Savings accounts

First Bank offers a number of savings account options. These accounts include:

- Regular savings-This is the right personal savings account with low minimum balance and competitive interest rates. Customers are required to maintain a minimum balance of $100. There is also a $5 quarterly service charge for customers who don’t maintain the daily minimum balance

- Anywhere account with eSave-This account offers the ultimate way to save money. Savings and eSave account with automatic transfer. This account does not require a minimum balance and has no monthly service charged.

- Money market savings-This is an interest-earning account provided you have money in your account. The account earns interest even with low minimum balance. Customers are required to maintain a minimum balance of $1,000 and a monthly service fee of $10 applies to those that don’t maintain the minimum daily balance

- Liquid asset savings-This account earns higher interest rates on your savings while enjoying liquidity. Customers are required to maintain a minimum balance of $20,000. A monthly service charge of $20 applies id you don’t maintain the minimum balance

- Individual retirement accounts (IRAs)-The bank offers IRAs with very competitive rates and a range of minimum balance requirement that must be met

Personal checking

First Bank also offers a range of checking accounts that you need to know before choosing the bank:

- Anywhere account-This is the perfect account for anyone. It has a no minimum balance requirement and no monthly service charges

- Anywhere account with eSave-This is the ultimate way to save money. Savings and eSave checking accounts with automatic transfer. They have no monthly service charge and no minimum balance.

- Money Market Checking-This is the perfect checking account with competitive rates with low minimum daily balance. The account has a monthly service charge $7 if you maintain the monthly balance

- Premier Checking-This is the hardest working checking account that comes with amazing interest rates. The account has a minimum balance requirement of $2,500 and a monthly service fee of $15 if the minimum daily balance is not maintained

- 55-Plus Checking-This is an interest-earning account for people who are 55+ years. The account has no minimum balance and no monthly service charges

Benefits

First Bank is one of the best banks in the United States. It has many benefits that customers enjoy. These benefits include:

- Free online banking with electronic statements

- Mobile banking

- Account alerts

- Some accounts don’t require minimum balance or monthly service charge

- It is also easy to open a savings or checking account online

- Around the clock live chat support

Downsides

First Bank also has its own downsides, which you need to know:

- The liquid assets savings account requires a minimum balance of $20,000 and a monthly service fee or $20

- Limited location of only 115 branches

Conclusion

First Bank is one of the best banks in the United States with an online presence. The bank offers live chat support and most of its accounts don’t require a minimum balance and no monthly service charge. But they have limited locations.