First citizen bank offers business and personal banking services and products to communities in Kentucky. The company operates as a subsidiary of Farmers Capital Bank Corporation.

- Branch / ATM Locator

- Website: https://www.firstcitizens.com/

- Routing Number: 061191848

- Swift Code: See Details

- Telephone Number: +1 888-323-4732

- Mobile App: Android | iPhone

- Founded: 1964 (61 years ago)

- Bank's Rating:

Customers who have an account with First Citizens Bank can register for the free internet banking services so that they can easily manage their bank accounts from the comfort of their homes or anywhere around the globe. Customers can use a computer, tablet, iPad or mobile phone to access their bank accounts. In this post, we will guide you through the process of logging into your online account, reset your password and register for the internet banking services.

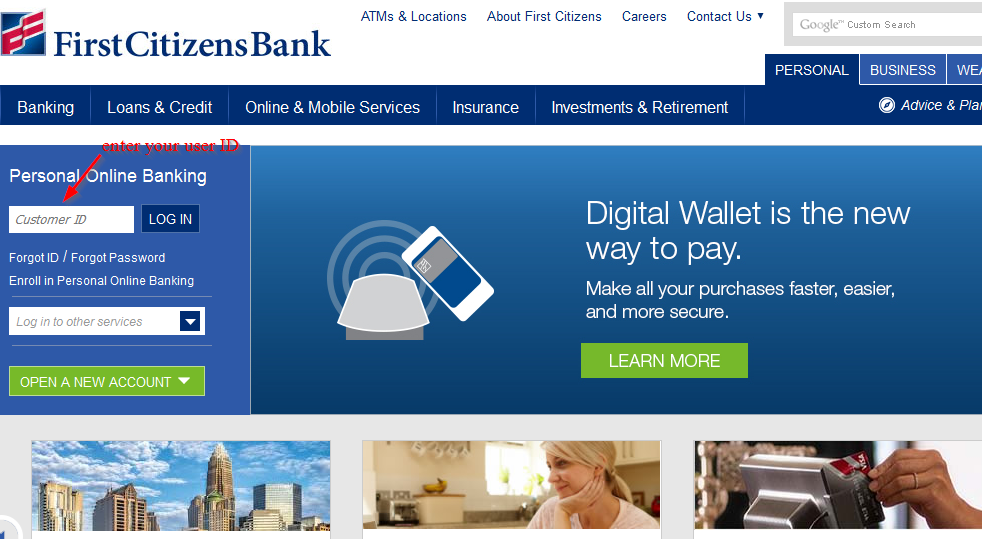

How to login

As mentioned above, the internet banking services offered by the bank are free and customers can login anytime to manage their bank accounts. Here are steps to help you access your online account:

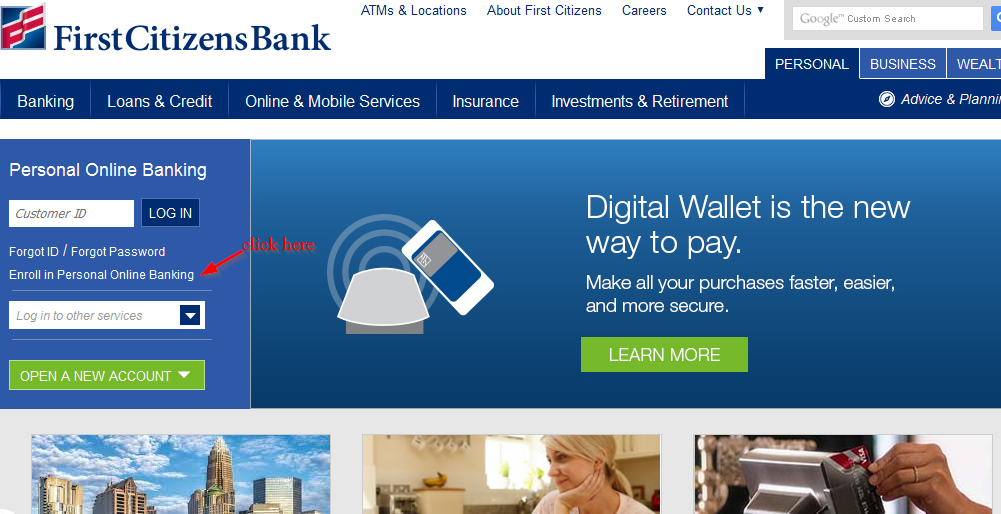

Step 1-Open https://www.firstcitizens.com/ in your web browser

Step 2-Enter your customer ID and click “login”

Step 3-Enter your password

First Citizens Bank ensures that tight security is maintained and that means that you won’t be granted access to your online account if you don’t use the correct password

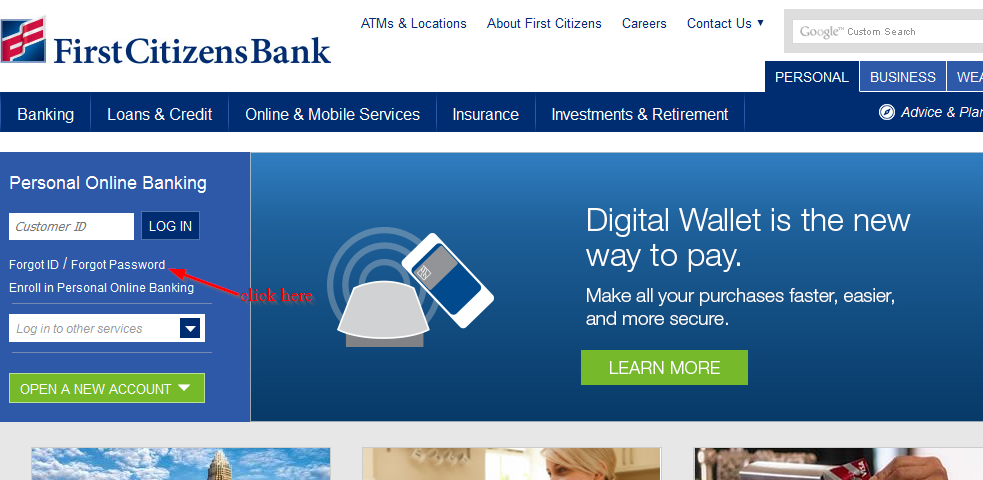

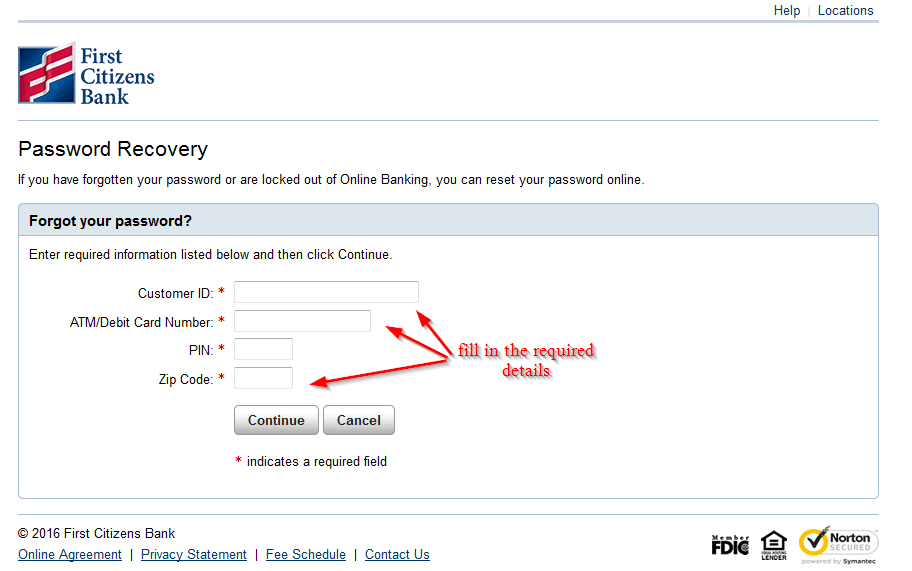

How to reset your password

You can reset your password anytime provided you have a valid login ID. This is a requirement for anyone who wants to reset their password. Follow these easy steps to reset your First Citizens Bank online account:

Step 1-Click “forgot password” as shown in the below image

Step 2-Enter your customer ID, debit card/ATM number, PIN and zip code and click “continue”

How to enroll

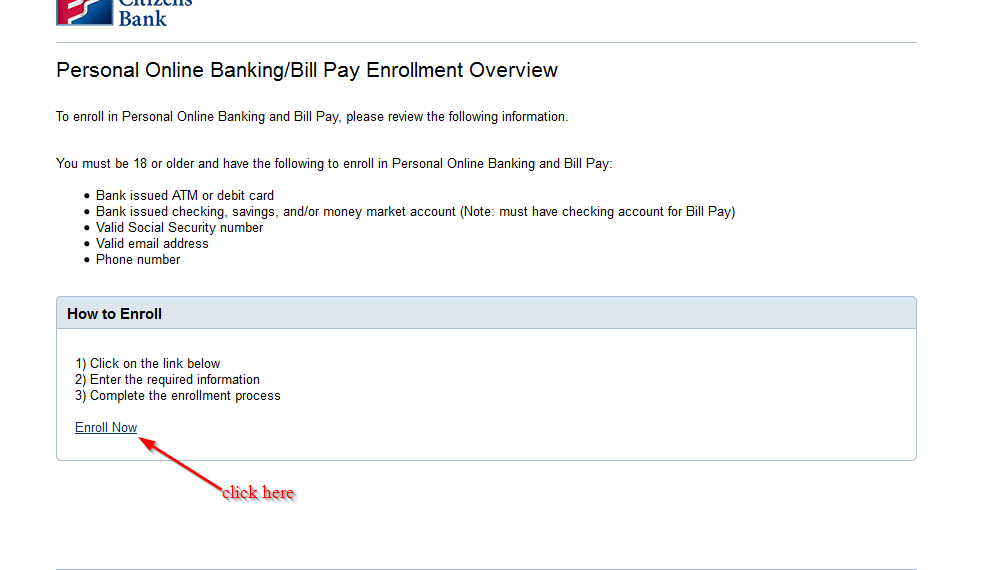

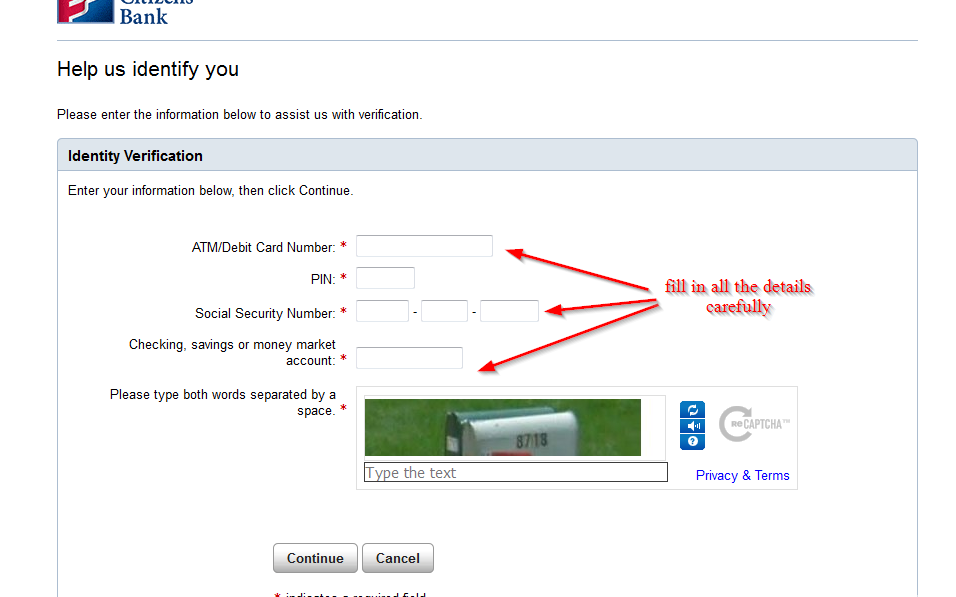

Registering for the internet banking services offered by the bank is free. However, the services are only available to people who have an account with the bank. You will need your bank details to complete your registration. Here are the steps you will follow:

Step 1-Click “enroll in personal online banking”

Step 2-Click “enroll now”

Step 3-Enter your Debit Card number, PIN, Social security number, account number, and click “continue”

Manage your First Citizens Bank online account

Here are the benefits of having an online account with First Citizens Bank:

- You can make payments

- Gives you access to your eStatements

- Access to the nearest ATM

- Download your check images

First Citizens Bank Review

First Citizens Bank is a financial institution headquartered in Raleigh, North Carolina. The bank is a subsidiary of First Citizens Bancshares, Inc. Another subsidiary is IronStone Bank. The bank 575 branches in 18 states in the United States and the District of Columbia. In the year 2010, the bank employed about 4,400 employees.

The bank serves customers in over 200 locations in 571 branches in West Virginia, Arizona, Pennsylvania, California, Washington, Colorado, Virginia, District of Columbia, Texas, Florida, Tennessee, Georgia, South Carolina, Kansas, Oregon, Maryland, Oklahoma, Minnesota, North Carolina, Missouri and New Mexico.

Benefits

In our First Citizens Bank review, we have learnt many pros. In this post, we have created list of pros that you should definitely know before opening a banking account with First Citizens Bank:

- Great products and services

The bank provides banking, insurance, lending and investment services to businesses and individuals. Customers can choose from a range of accounts and take advantage of the benefits that come when they sign up. In addition, the bank customers can get credit cards and plan for retirement.

- Checking accounts

For individual customers, there is a wide range of checking accounts offered by the company. All the accounts include free online banking with Bill Pay, free visa debit card, free mobile banking and access to more than 475 ATMs. The checking accounts offered by the bank include:

Free checking-This is a full-service checking account with zero minimum balance, optional overdraft protection, online and mobile banking and Together Card account for $3 a month.

Select checking-This is an account that’s flexible and convenient with no monthly service fee with low balance or deposit requirement, free estatements, Together Car account with a $3 every month and optional overdraft protect.

Premier checking-This account allows customers to earn more based on their banking relationship. The account also includes free cashier’s checks, preferred rates on select CDs and EquityLines, traveler’s checks and money order, interest on the account and option to sign up in complimentary financial programs.

Prestige Checking-This type of account includes exclusive benefits and rates with all the benefits of a premier checking and more. Some other benefits include zero overdraft transfer fees, unlimited access to non-First Citizens ATMs, ATM limits on Visa Debit Card and higher purchase.

- Loan options

The lending offers by First Citizens Bank include several financing options. Although the bank offers credit cards, the loan capability of the bank is pretty impressive. Here are the loans that are offered by First Citizens Bank: home ownership loans, lines of credit, personal loans, auto loans and home equity loans.

Downsides

It goes without saying that we would not be doing a good job if our First Citizens Bank Review doesn’t list the downsides. We have listed a few cons of banking with First Citizens Bank that you should know before opening an account with the bank:

- Not available in all states

One of the main disadvantages of First Citizens Bank is the fact that they are not available nationwide. This has a dramatic impact to those that don’t live in one of the states in which they have branches. Although they have more than 500 branches, that doesn’t change the fact that their banking services cannot be accessed in many states.

- Limited options

Although First Citizens Bank offers credit cards to its customers, only four options are available to choose from. They don’t need a rewards program fee or an annual fee (except for Optimum Rewards Card) and they are also secure. The credit types available include: First Citizens Cash Bank Rewards Visa Card, First Citizens Smart Option Visa Card, First Citizens Cash Bank Rewards Visa Card and First Citizens Option Rewards Visa

Conclusion

First Citizens Bank has been providing its customers with a range of banking and financial services for years. The bank’s knowledgeable and dedicated employees help customers to set clear their financial standards as well as their financial dreams. People who choose to open an account with First Citizens Bank should expect the following:

- Limited service area

- Student, senior and military solutions

- A range of savings and checking accounts

- Customized opportunities

- Small credit card sample size

All in all, this is a great bank to bank with as it has shown that it is committed to providing customers with quality banking services.