First Merit Bank is a leading banking corporation established in 1866. The bank offers banking services to private clients and corporate clients. It offers services such as cash deposit, credit services, and real estate financing services. The bank was recently acquired by Huntington Bancshares Corporation.

- Branch / ATM Locator

- Website: https://www.firstmerit.com

- Routing Number: 041200555

- Swift Code: See Details

- Telephone Number: 888-554-4362

- Mobile App: Android | iPhone

- Founded: 1866 (159 years ago)

- Bank's Rating:

First Merit Bank is a leading banking services company established in 1866. The bank which is in the process of merging with Huntington Bancshares to create a large corporation with a combined experience of more than 300 years. The bank offers services in their branches and in their internet platforms.

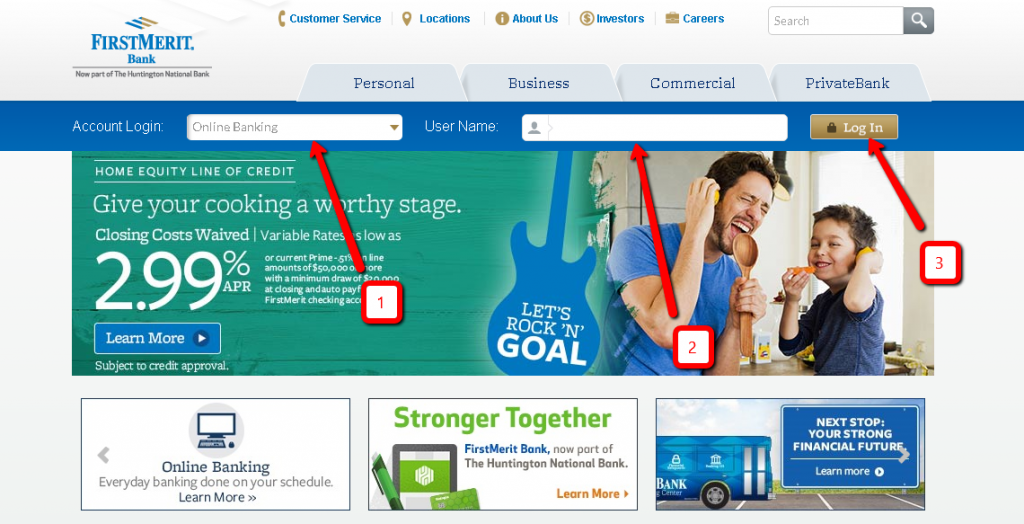

HOW TO LOGIN

To login to your First Merit bank online account, follow the following steps:

Step 1. The first step is to go to the bank’s website. The website is found at www.firstmerit.com.

Step 2. The next step is to select Online Banking and entering your account number as shown in 1 and 2 respectively. After doing this, you should click login.

Step 3. After entering this information, it will take you to another page which will ask for your password. Enter your password and click Enter. This will take you to your account.

HOW TO RECOVER A LOST PASSWORD

To recover the password if you misplaced it, you should follow the steps shown below.

Step 1. First, enter into the website as described in the first step above.

Step 2. Select the Online Account and enter your account number or username and click enter.

Step 3. In the next page, you will be asked to enter your password. Below that, you will see a link written forgotten password.

Step 4. Follow that link and follow the steps to recover your password.

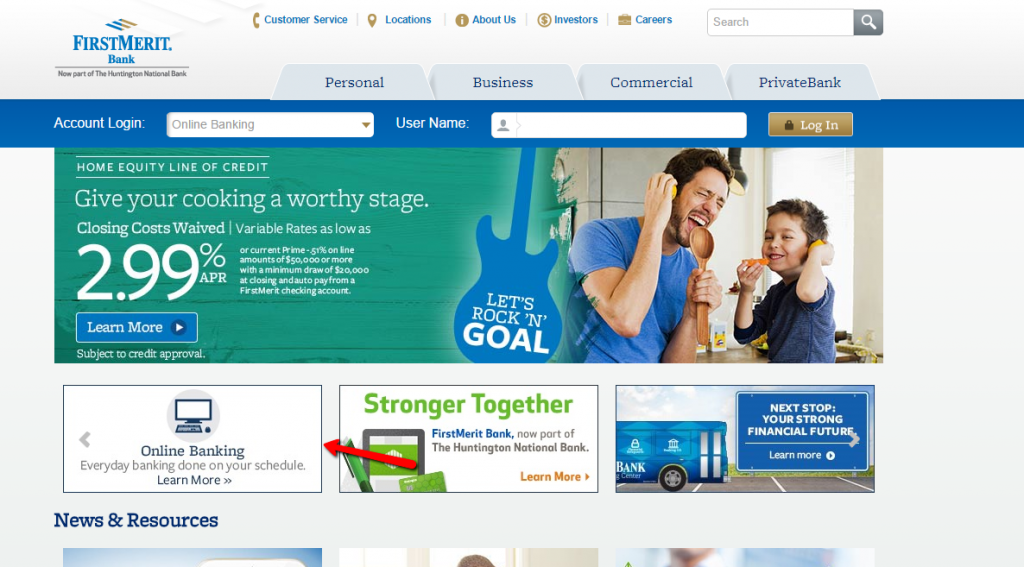

HOW TO CREATE AN ONLINE ACCOUNT

Step 1. The first step is to go to the website. In the homepage, click the online banking banner.

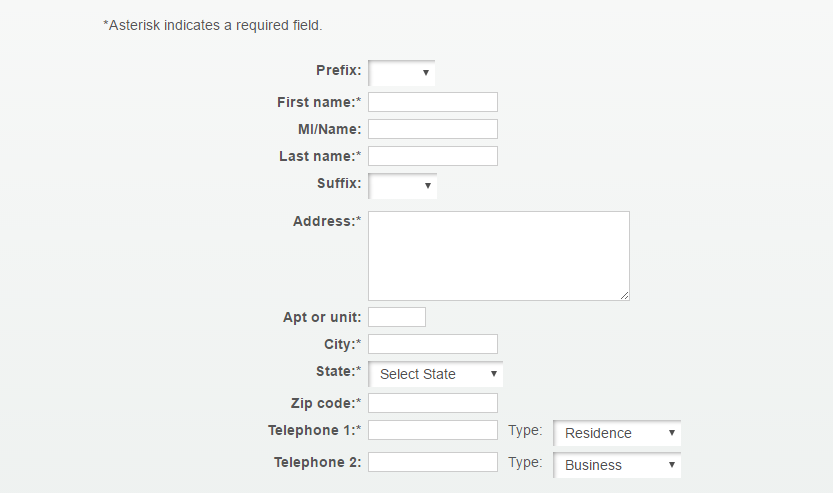

Step 2. On the next page, select Enroll today.

Step 3. On the next page, enter the required information accurately. For other details, check this page for more information.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

The online account can be accessed using your mobile devices or computers. You enter the account using your account number and password. Inside the account, you will find a number of features such as:

- Viewing your account transaction history

- Viewing your cancelled checks

- Viewing your account statement

- Transferring money between accounts

- Making loan payments

- Stopping payment on checks

- Ordering checks

- Changing your mailing address

These features are very important because they are convenient and relatively faster than going to your local branch.

First Merit Bank Review

First Merit Bank is the oldest branch that started as Old Phoenix National Bank in Medina, Ohio. The bank was founded in 1845.

Over the period that the bank has been in service, it has merged with other banks, finally being named FirstMerit Corporation in 1996 after uniting 6 subsidiaries Ohio banks, forming what is today known as FirstMerit Bank.

In terms of asset, First Merit Bank is the 28th largest commercial bank in the U.S. Based in Akron, Ohio; First Merit Corporation is a $25.1B multi-financial services company with 384 locations and 412 ATMs in Michigan, Pennsylvania, Ohio, Illinois, and Wisconsin.

Benefits

The benefits of banking with First Merit Bank include:

- Features and benefits

The bank’s premier feature is its Reality brand personal accounts. The first one is the Reality Checking Account for people looking for low cost banking. This account has no monthly maintenance fee or minimum balance requirements.

Other features of this account include: free paperless statements; free online banking and bill pay; $50 minimum opening deposit; free mobile banking and alerts; and enroll in MeritRewards.

The second premier feature offered by the Bank is Statement Savings Account. It doesn’t cost much to open and maintain this account. This account is designed for people who are looking for a basic account that will help them reach their savings goals.

The features and benefits include: free paperless statements; free mobile banking and alerts; free online banking, easy access to funds using the FirstMerit Debit Card; earn interest when you maintain a minimum daily balance of $50 or more; monthly fee can be waived if certain requirements are met; and requires a minimum opening deposit of $50.

- Text banking

Customers can take advantage of the Text Banking service by sending a text message to the bank’s designated number that has been listed on their website.

Through texting, customer will be able to request and receive information about their accounts and also stay informed about important activities involving their accounts.

Text alerts allow customers to choose to receive: security alerts, low balance alert with transfer option, payment alerts, balance alerts, scheduled alerts and transaction alerts.

Downsides

Despite being one of the largest banks in the United States, First Merit Bank has its own downsides, which you should be aware of being banking with them.

- Closing fees

One penalty that looks questionable is the 25 dollars closing fee when closing an account in the first year.

This is not fair on the part of the consumer because even major banks don’t charge this fee to close a checking or savings account. The bank also charges fees for services that are provided as complimentary at other banks.

Other fee charges by the bank include:

- Replacement of ATM/Debit card-$3 per card

- ATM card is charged a monthly fee of $1

- Initial Debit Card Design Change is free, but thereafter, you will have to pay $5

- Debit Card special handling or processing cost $25

- Foreign transaction fee is $3

- Non-FirstMerit ATM fees is $2.5 for every transaction

- Account closure within 3 months of opening costs $25

- Charge-off fee is $35

- Check image enclosure fee is $3 per month

- Foreign collection fee is $50

- Foreign check deposit is $5 per item

- Inactive checking account fee is $25

- Interim statement is $5

- Closure fee of savings club is $10

- Withdrawal fee for savings club is $5

- Mobile deposit fee is $5 per deposit

- Paper statement fee is $3

- Re-deposit item fee is $5

- Returned check deposited is $10

- To stop payment when your credit card has been stolen, you will have to pay $33

These are not the only fees that are charged by the bank. There is also overdraft/insufficient funds.

If you have an everyday personal banking account and even for small business customers, you should know that these fees will pop up and add up very quickly. You may find that there is a lot of money that you owe the bank.

Conclusion

When closing an account, it makes no sense that there should be a fee to pay. However, the flagship savings and checking account is worth considering since they are low cost and doesn’t need any monthly fees. Another great feature is text banking which you may not find with many banks.