First National Bank offers financial and credit services. The company is based in Johannesburg, South Africa and operates as a subsidiary of FirstRand EMA Holdings Limied.

- Branch / ATM Locator

- Website: https://www.firstnational.com/

- Routing Number: 104000016

- Swift Code: See Details

- Telephone Number: +1 800-642-0014

- Mobile App: Android | iPhone

- Founded: 1857 (168 years ago)

- Bank's Rating:

The internet has become safe for people to do many things that were not possible to do before. The bank offers internet banking services which enable customers to conveniently bank and manage their bank accounts. If you are interested, we will walk you through steps involved in logging into your account, changing your password and enrolling for the internet banking services

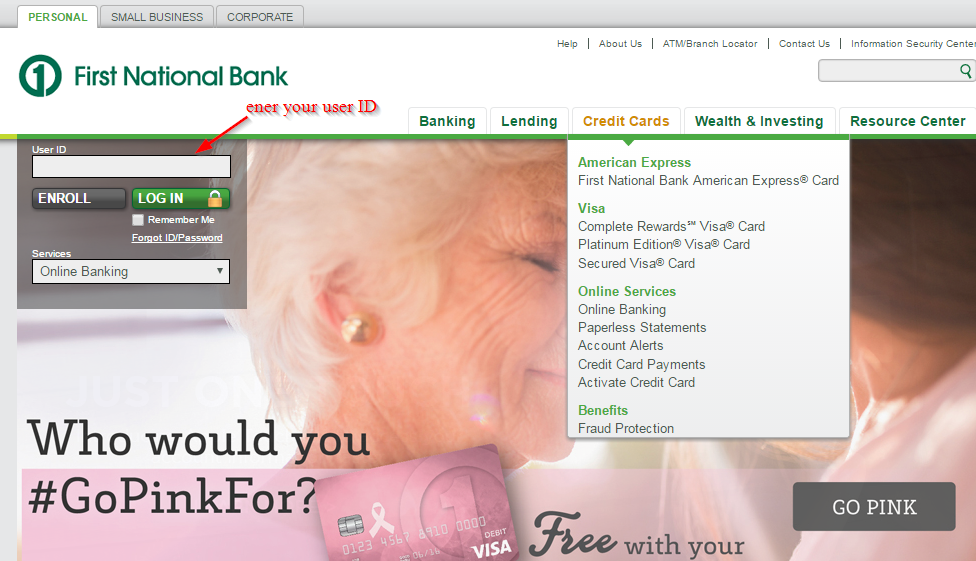

How to login

First National Bank has an easy to use platform that makes it easy for customers to login anytime and manage their bank accounts. If you have a mobile app on your phone, you can login. Follow these steps to access your bank account:

Step 1-Open https://www.firstnational.com/ in your web browser

Step 2-Enter your user ID and click “login”

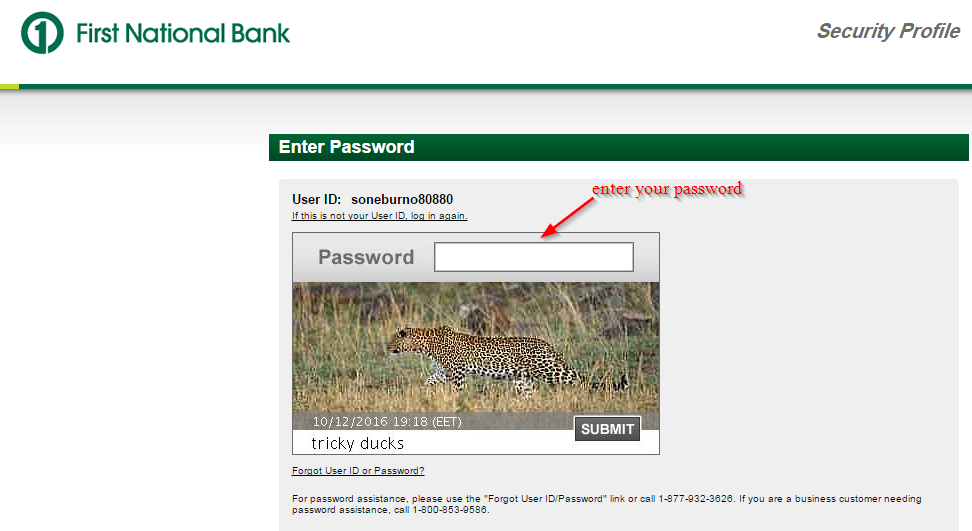

Step 3-Enter your password and click “submit”

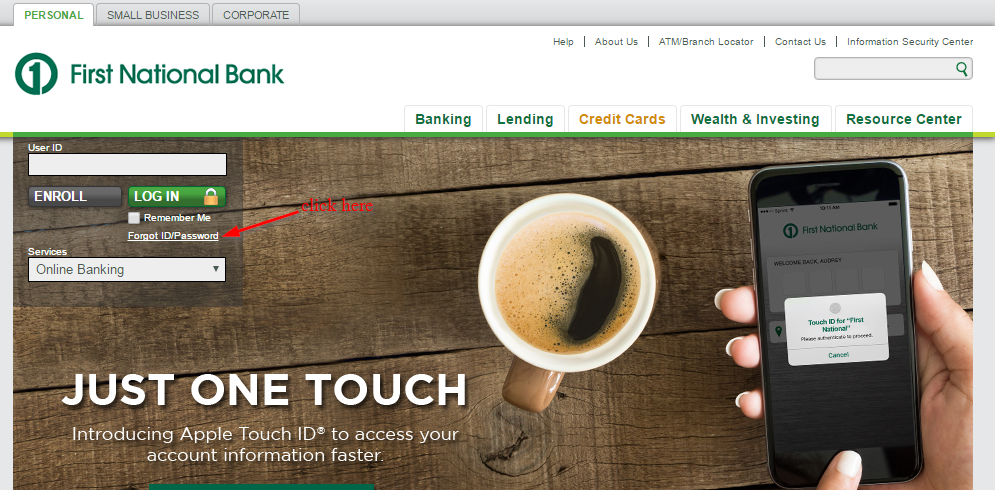

Forgot your password?

Can’t remember your password? Don’t worry! The process of resetting your password is pretty simple and straight forward. In fact, it only takes a few minutes to reset your password. Follow these simple steps:

Step 1-On the homepage, click “forgot ID/password”

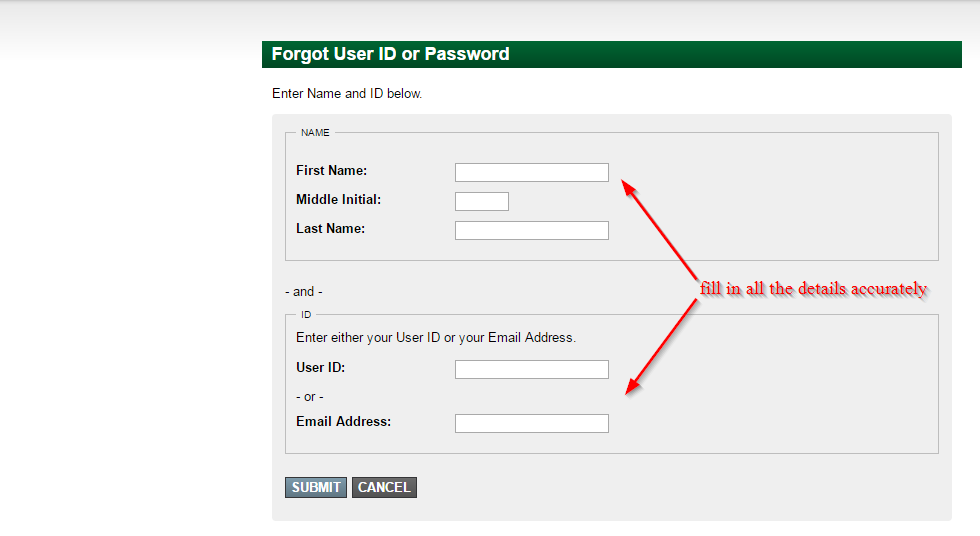

Step 2-Fill in all the details required on the page and click “submit”

You can then reset your password

How to enroll

If you have an account with First National Bank of Omaha, you can enroll for the online banking services in less than five minutes. It’s pretty straight forward-just like setting up any online account. Here are the steps you need to follow to enroll:

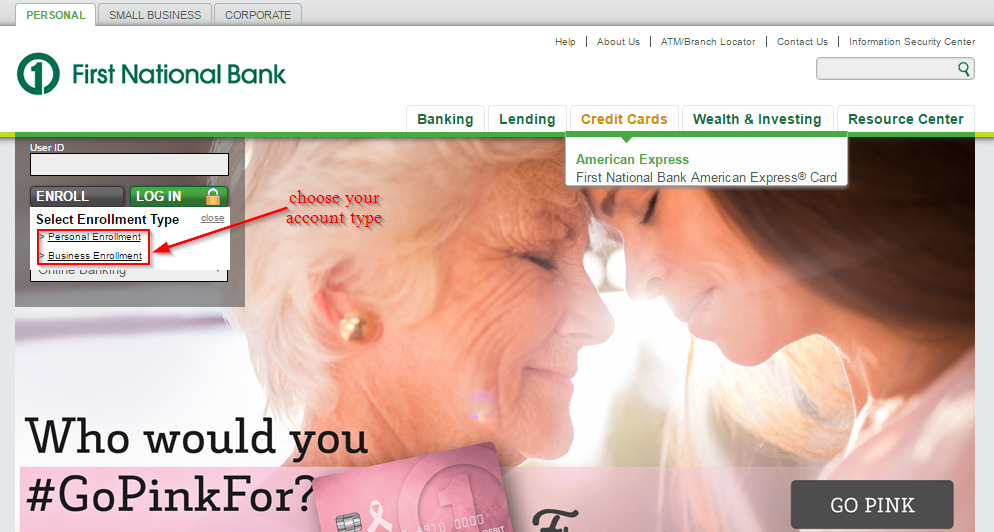

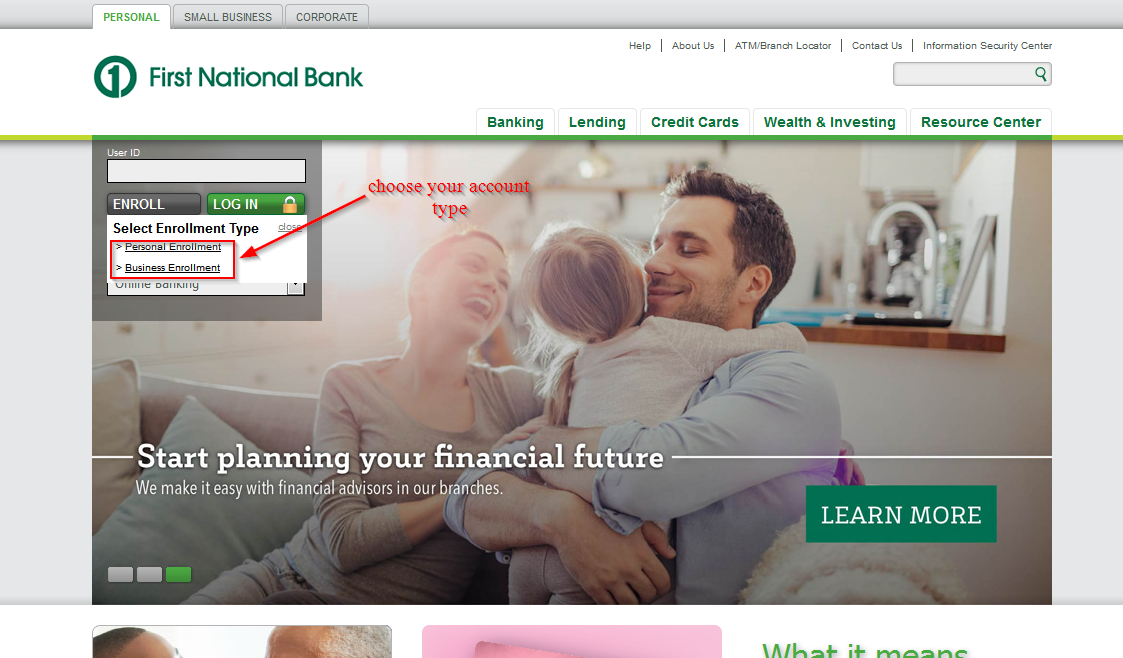

Step 1-Click “enroll now”

Step 2-If you have a personal bank account with the bank, click “personal enrollment” and if you have a business bank account with the bank, click business enrollment.” In this case, we will choose “personal enrollment.”

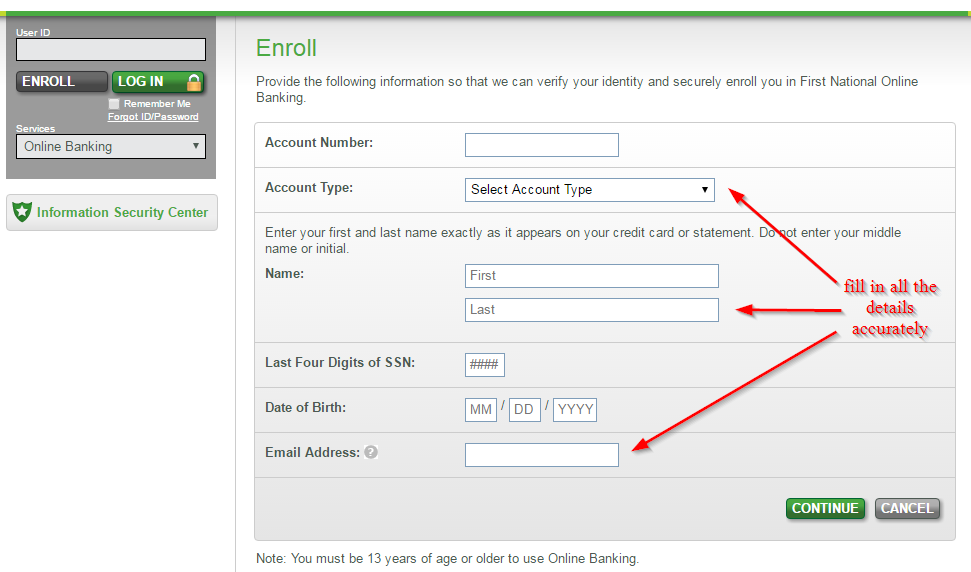

Step 3-Fill in all the required details, which include account number, account type, name, last four digits of SSN, date or birth and email address and click “continue”

Manage your First National Bank of Omaha online account

Among the many advantages of having an online account with First National Bank of Omaha includes:

- Pay your bills conveniently

- Transfer funds

- Access your eStatements

- Check your transaction history

- Track your checks, purchases and deposits

- Get alerts about your transactions

First National Bank of Omaha Review

First National Bank operates as a subsidiary of First Nation of Nebraska. It is known to be the largest privately held bank in the U.S. with assets over $17 billion and 5,000 employees.

Chartered and based in Omaha, Nebraska, United States, the bank provides corporate banking, consumer lending, investment banking, wealth management and retail banking services is locations in Illinois, Nebraska, Kansas, Iowa, Texas and Colorado. First National Bank has 101 branches in the Midwest.

In Texas, the bank has four branches and it operates under the name First National Bank Southwest. The First National Bank acquired First State Bank in Frisco on 15th December 2000.

Very little distinguishes this bank from other banks, and that’s both bad and good. The bank’s fees aren’t high, but neither are the bank’s savings rates. First National Bank website has also the basics, but somehow little else.

This is the best bank for people who live near one of its branches and are looking for in-person help once in a while.

Checking account

First National Bank checking account is not an interest earning account. However, it does not charge a monthly fee. The account should you serve you perfectly if you are only looking for a place to keep your money. The bank’s premier account which offers minimal interest; however, it is not factored into this ratings. The rates may vary from one state to another.

Benefits

- No fee when First National Bank customers use another bank’s ATM, however the each of the ach machine might

- No monthly service fee

- No minimum balance required or minimum deposit to open the account

- Free checks

- Return Item fee or one overdraft fee Forgiveness every year

- Free statements-paper or online

- Free cashier’s check, stop payments and incoming wires

- Free monitoring for debit card fraud

- Free mobile banking with bill pay, money transfer and check deposits

- Free online bank and account alerts

- Relationship rates on Money market, Certificate of deposit, IRA and savings accounts

- Safe deposit box discount of $25

- A 0.25% discount on personal loans, home equity and auto loans

Downsides

- Only 275 free ATMs are accessible to customers

Savings account

Rates on First National Bank basic saving is pretty low; therefore if you money grow faster, you may want to consider other financial institutions. However, if you want to save money for home improvement, your children’s education, or just a rainy day, the bank’s savings plan have the right financial combination with competitive interest rates and quick access to your money.

Benefits

- No monthly fee

- No minimum balance requirements

Downsides

- Basic savings account comes with a 0.05% APY

Certificate of deposit

Customers have access to certificate of deposit with term lengths ranging for between 91 days to 5 years. While the rates are higher at First Nation Bank that at most national banks, they are not as strong as those that are offered by online bank and some credit unions. Customers who have checking account at the bank can qualify for somewhat higher savings rates that those that are shown below. Clients who reside outside of Nebraska and Omaha may get slightly different rates.

Benefits

- Base rates vary from between APY of 0.22% and 1.54%, with longer term lengths that earn higher the highest rates

Downsides

- Requires $500 to open a certificate of deposit account

Customer experience

First National Bank also provides mobile banking apps for Android and Apple devices. These apps can be used to monitor, deposit checks and transfer money between accounts.

The bank’s online portal makes it easy to find details about rates and fees, but it doesn’t have a live chat support. In addition, the bank’s branches are limited to seven states only.

Overdraft fees

The bank charges an overdraft fee of $33 up to 4 times a day, which is slight below the $34 national median. But the bank doesn’t charge customers if the balance is $20 r less.

Conclusion

First National Bank doesn’t charge a monthly service fee on savings and checking account. APYs are generally low, especially for basic savings account. However, you should be aware that there is an overdraft fee.