Frost bank provides personal and business banking, investment, and insurance products and services in Texas. The bank operates as a subsidiary of Cullen/Frost Bankers, Inc.

- Branch / ATM Locator

- Website: https://www.frostbank.com/

- Routing Number: 114000093

- Swift Code: See Details

- Telephone Number: +1 800-513-7678

- Mobile App: Android | iPhone

- Founded: 1868 (157 years ago)

- Bank's Rating:

With your Frost Bank online account, you can pay your utility bills, transfer money to other bank accounts, check your transaction history etc. The bank has made it easy for their customers to manage their bank accounts from anywhere provided they have a computer and internet connection. In this guide, we will guide you through the process of logging into your online account, changing your password and registering for the internet banking services.

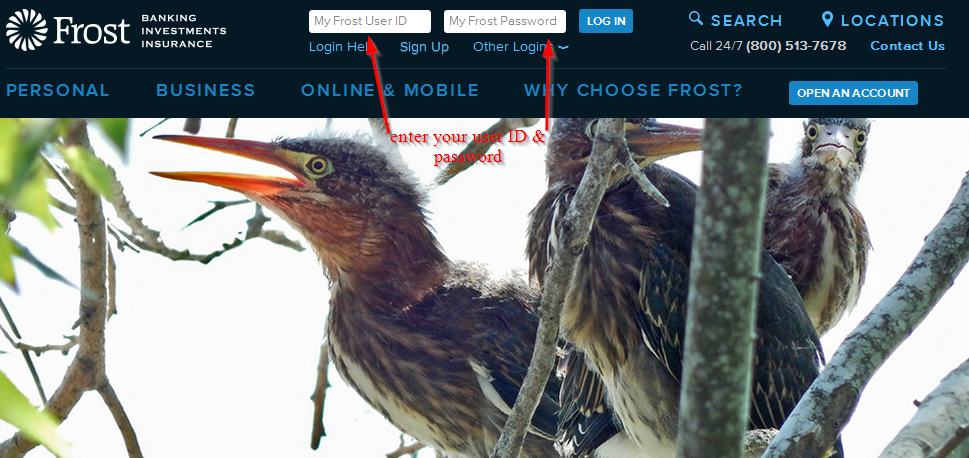

How to login

If you have registered an online account with Frost Bank, you can login anytime. Just like your Twitter and Facebook account, you will need your login details to login. Here are the steps to follow to login:

Step 1-Open your web browser and go to https://www.frostbank.com/

Step 2-Enter your username and password and click “login”

Provided you have used the correct logins, you will be able to access your online account

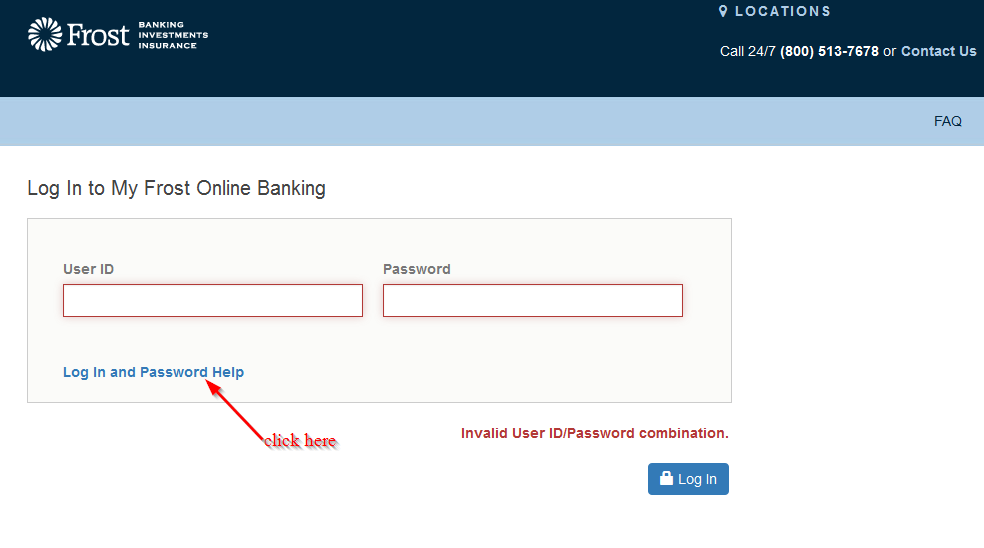

How to reset your password

Getting a login error? You don’t need to worry. You can reset your password to regain access to your online account in no time. Follow this simple step-by-step guide to reset your password:

Step 1-Enter your username and password

Step 2– If the details are wrong, you will navigate a new page where you will click “login and password help”

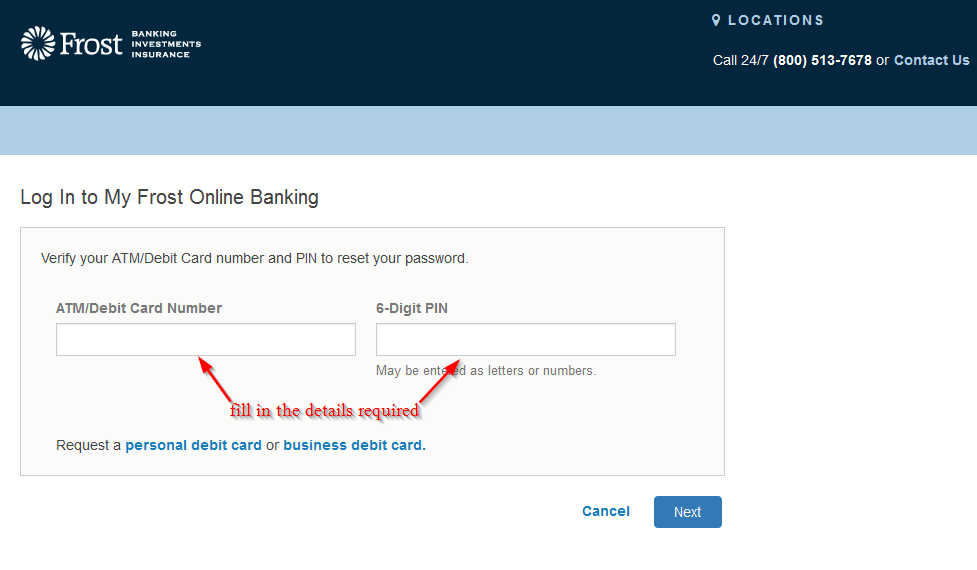

Step 3-Enter your ATM or Debit card number and 6-Digit PIN and click “next”

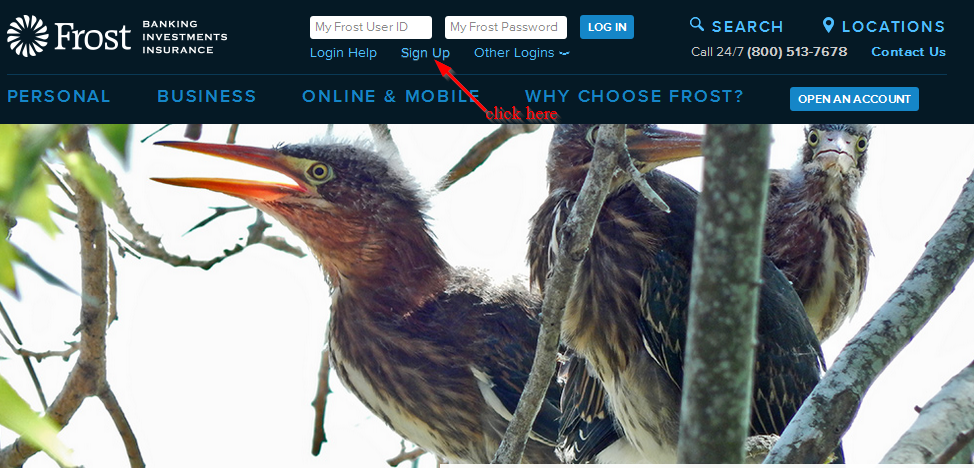

How to enroll

If you are interested in these internet banking services, you can enroll anytime because it’s free. You will be required to provide some details about your bank accounts. With these simple steps, you will be able to enroll with the online banking services:

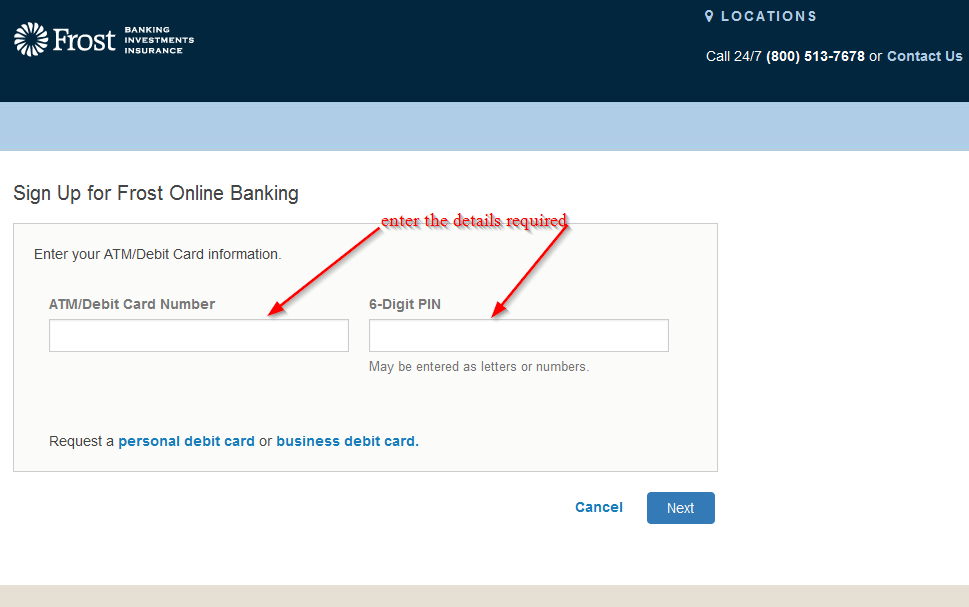

Step 1-Click “sign up” on the homepage. See the image below.

Step 2– Enter your ATM or Debit card number and 6 digit PIN and click “Next”

You may be required to provide more information about your bank account to complete your registration

Manage your Frost Bank online account

Here are a few advantages of having an online account with the Bank:

- Pay bills

- See your account balance

- Send money to your friends and family

- Access your eStatement

- Report a stolen or lost card

- Check your account balance

- Get transaction alerts

Frost Bank Review

Frost Bank is a bank founded in 1868 and is headquartered in San Antonio, with 126 locations across the United States. The bank is one of the largest banks based Texas.

The bank offers a full range of consumer and commercial banking products, brokerage and investment services and insurance products to its customers throughout Texas. The bank is a subsidiary of Frost Bankers, Inc.

The bank acquired Cullen Bankers, Inc of Houston in 1977, forming the holding company Cullen/Frost Bankers, Inc.

In 1982, the holding company merged with United States National Bancshares, Inc. of Galveston, Texas, but the bank operated USNVB separate for about two decades.

The community oriented financial institution works to provide the best banking services to its customers. The bank has more than 1,000 ATMs throughout the United States.

The bank prides itself in being the only Texas-based bank to have weathered the Great Depression and the more recent economic recession

Frost Bank Review

In this Frost Bank review, we will be looking at the account that are available and then the bank’s reliability and customer service. The bank is a full-service bank that offers individual and business banking accounts and online banking.

Being a local bank, the bank boasts a remarkable track record in supporting community nonprofits, giving back to the community and volunteering.

With that said, the bank has locations throughout the United States, and its customers can be sure that they are banking with a bank that is insured by the FDIC.

Bank account options

Checking account-The bank allows its customers to set up their own checking account, and choose only features that they need and hence reducing your service fee. The bank’s basic checking account has a fee of $5 and offers online banking, remote deposits and waived ATM fees with scanned checks.

For those who want to pay their bills online or get a paper statement, they will need to pay another $2 per feature per month.

Savings Account-You can open a money market or savings account through the bank. For those who want to avoid the monthly fee, you will be required to maintain a $500 minimum balance and $15,000 in their money market account. To open this account, you will need to deposit $50.

Loan products

Frost Bank offers a number of loan products for its customers:

You can apply for an auto loan for a used or new car. You can take advantage of pre-approved financing, an interest rate reduction of 0.25% if you register for automatic payments and a loan of up to 100% of the price of the car.

Credit cards are also available to local businesses. These credit cards allow you to take advantage of zero annual fee and range of card benefits such as airline miles or cash back. Credit cards are currently not offered to individual customers.

Mortgage rates have not been listed on the bank’s website. To apply for a mortgage, you will need to go through the bank’s business partner where you will find customer support representative who will take you through the process

Benefits

Frost Bank is one of the best banks in the United States. There are many benefits that you enjoy when you bank with Frost Bank. The benefits include:

- Online banking and Bill pay available

- The account fee of $5 is relatively low

- The initial deposit for opening an account is low

- Higher availability of locations

Downsides

Frost Bank also has its own downsides which you need to know. This will help you to make an informed decision. The disadvantages include:

- Overdraft fee s usually higher than the average

- The average minimum balance is $1,000

- Fee for insufficient funds is higher than the average

Conclusion

When choosing a bank, you want an organization that not only provides the accounts that you need but also has your good will. Frost Bank customer support service receives good feedback from customers. Complaints are few and many clients have expressed their surprise at how personable the customer support is.

The banks hours match up with the normal banking hours, although the call center is usually open until 9:00pm. Customers can also bank online, but the recommended method for opening an account is visiting the nearest branch.