Guaranty Bank is a fourth-generation family owned bank started in 1923. The bank was founded in Milwaukee. It has grown from a small personal banking business to a large bank that has survived the past’s financial crisis. It has more than $1.1 billion in assets and 120 branches in Wisconsin, Illinois, Minnesota, Michigan and Georgia.

- Branch / ATM Locator

- Website: https://www.guarantybank.com

- Routing Number: 275071288

- Swift Code: See Details

- Telephone Number: (800) 235-4636

- Mobile App: Android | iPhone

- Founded: 1923 (102 years ago)

- Bank's Rating:

Guaranty Bank is a $1.1 billion in assets family owned bank with branches in Wisconsin, Illinois, Minnesota, Michigan and Georgia.

The bank serves its customers in more than 120 branches. It also has mobile applications and a website that customers can access anywhere and any time.

HOW TO LOGIN

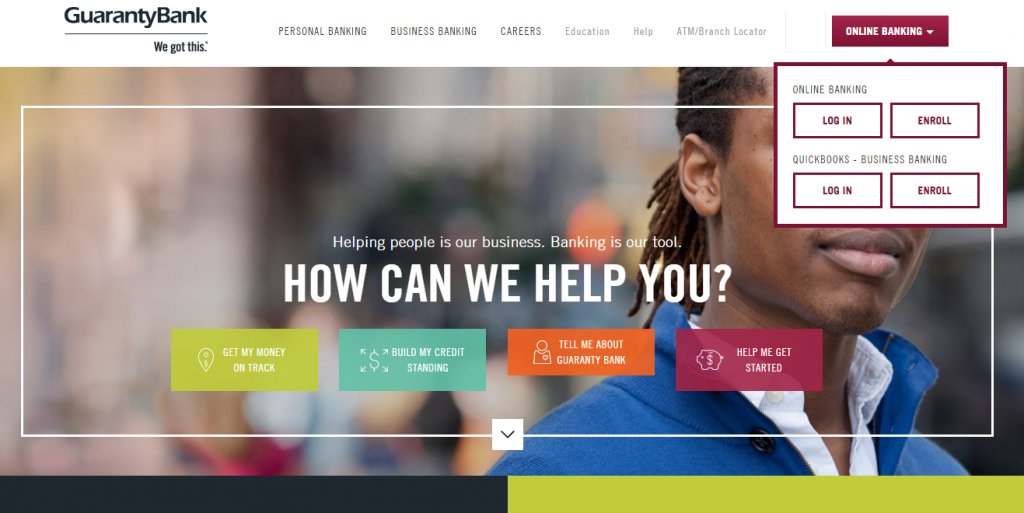

Step 1. The first step to login to the website is to go to the bank’s website: https://www.guarantybank.com

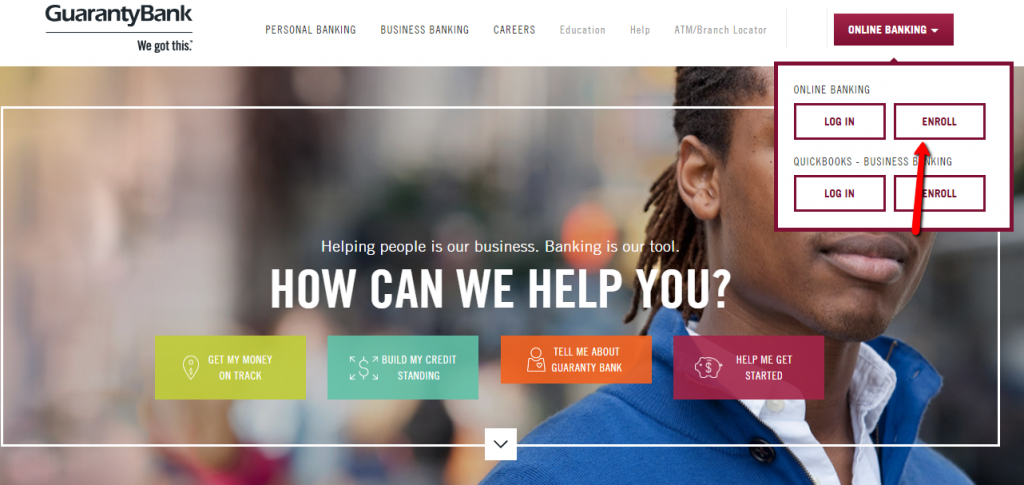

Step 2. In the homepage, you should go to the right side and click the Online Banking button. This will reveal four other buttons: Online Banking (Login and Enroll), and Quickbooks ( Login and Enroll. Click the Login button.

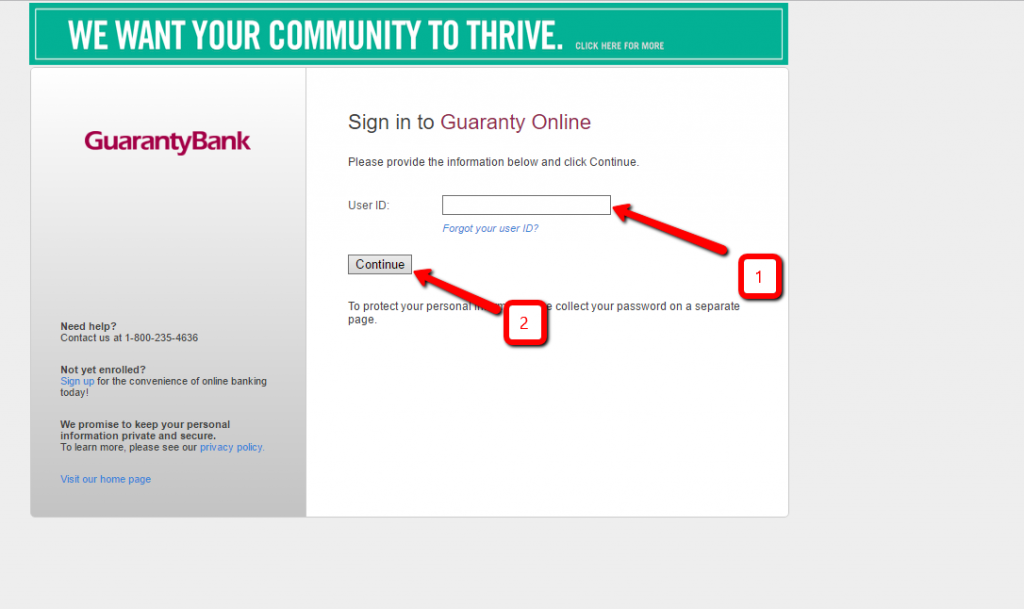

Step 3. After entering the login button, you will be taken to another page where you should enter your User ID and continue as shown below.

Step 4. In the next step, you should now enter your password. For your safety, the bank collects your password in another page.

HOW TO RECOVER YOUR PASSWORD

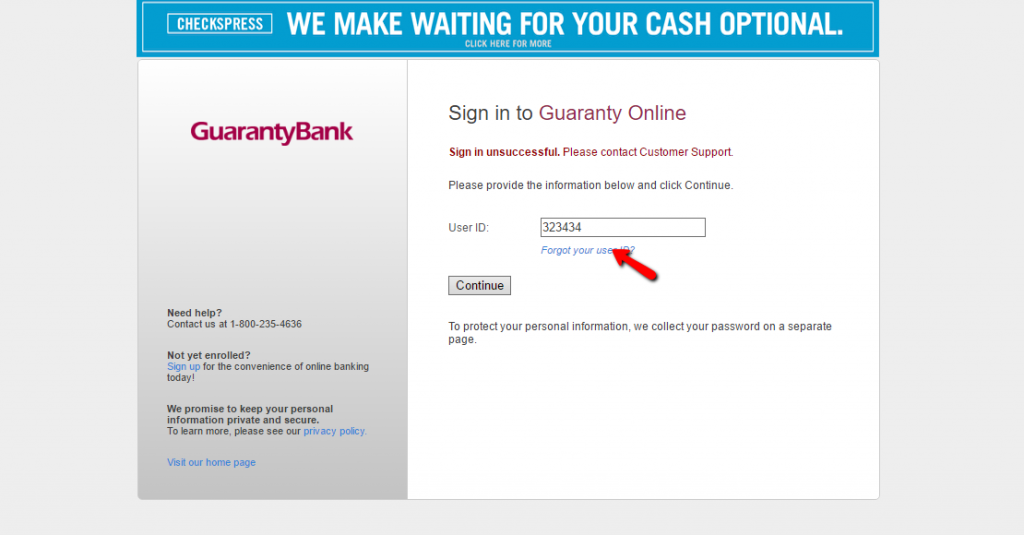

Step 1. To recover your password, you should follow the steps above. In the last stage, you should click the Forgotten Password link above.

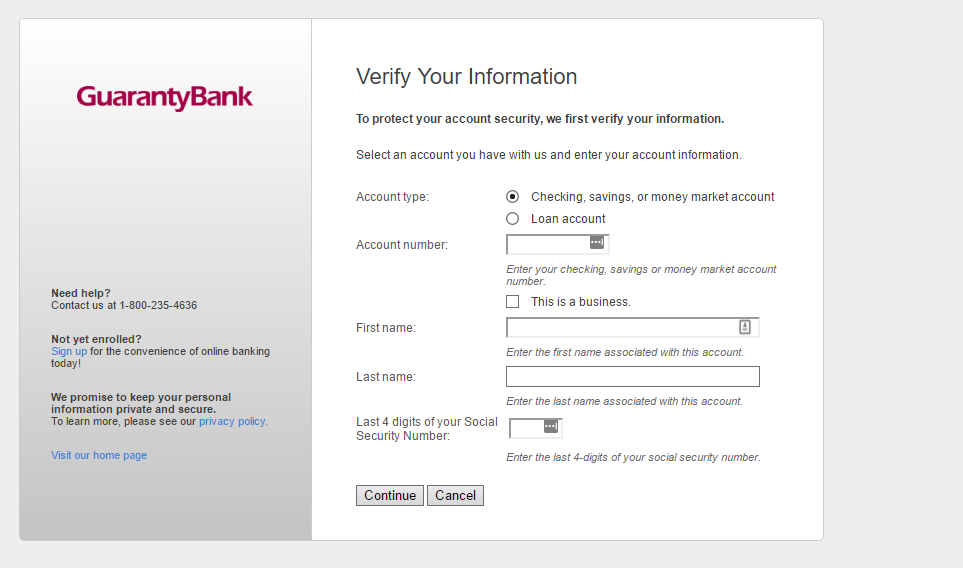

Step 2. In the next stage, you will be required to enter a number of information as shown below. After entering the information, you should click Continue.

Step 3. In the next stage, you should check your email address and recover your password.

HOW TO ENROLL

Step 1. The first step is to go to the site’s homepage as shown below. You should then click Enroll.

Step 2. Enrolling will take you to another page where you are supposed to start your online account registration. The page also contains the steps you will follow. You will first select the account type, read the disclosures, and enter your account for verification purposes. The disclosure document can be found at their website.

Step 3. In the next page, you should enter your correct information and complete the registration.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

The online account will enable you do most of the things you can do in a local bank. Some of the services you can find in the online account are: check your bank balance, view transactions, send money, and transfer funds among others.