Key bank has new features and design that allows customers to easily deposit checks, open accounts, transfer funds and easily make payments. The bank allows you to take control of your finances and bank as you wish to.

- Branch / ATM Locator

- Website: https://www.key.com/

- Routing Number: 021300077

- Swift Code: See Details

- Telephone Number: +1 800-539-2968

- Mobile App: Android | iPhone

- Founded: 1825 (200 years ago)

- Bank's Rating:

Key Bank internet banking services allow their customers to access their bank accounts anytime. It’s easy to set up an online account with the bank as you a customer. Customers can access their bank accounts using their personal computers and web browsers on their mobile phone or android and iphone apps. In this guide, we will be taking you through the steps involved in logging into your online account, resetting your password and creating an online account.

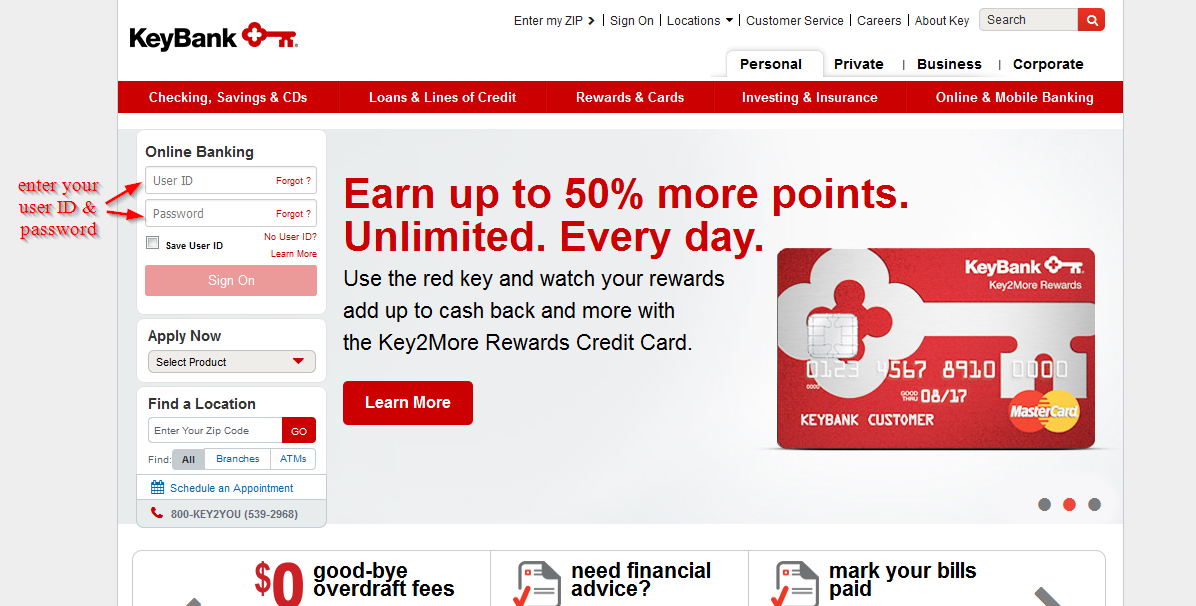

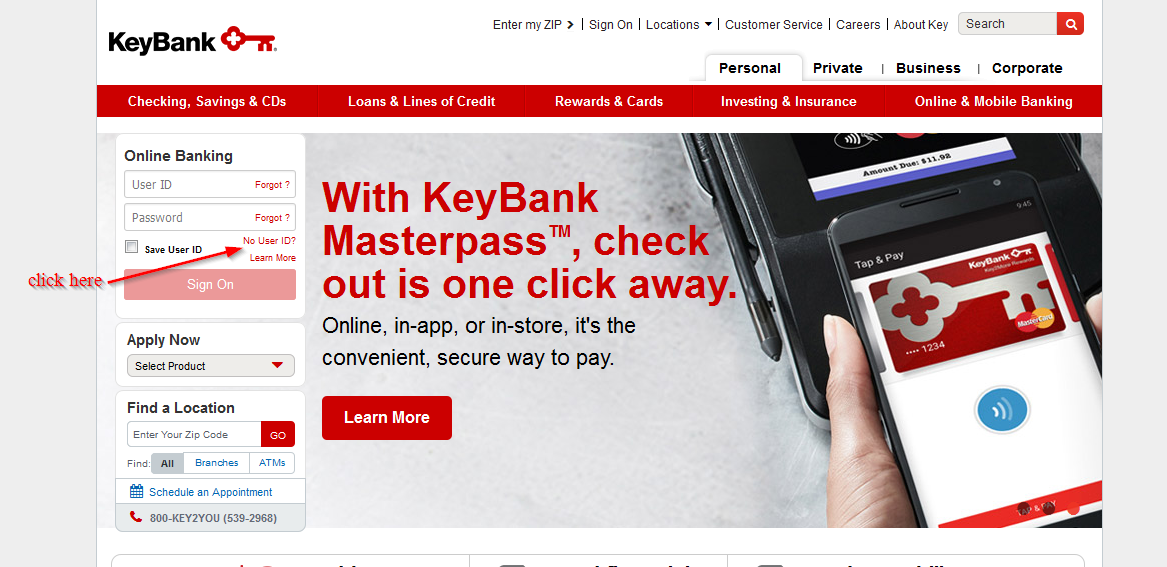

How to login

As mentioned above, it is easy to login into your online account and you can use your computer or mobile phone to do so. You will need your login details to access your online account. Here is the process you need to follow to successfully access your online account:

Step 1-Open https://www.key.com/ in your web browser

Step 2-Enter your online ID and password and click “sign on”

You will be directed to your online account. That’s if you have used the correct password

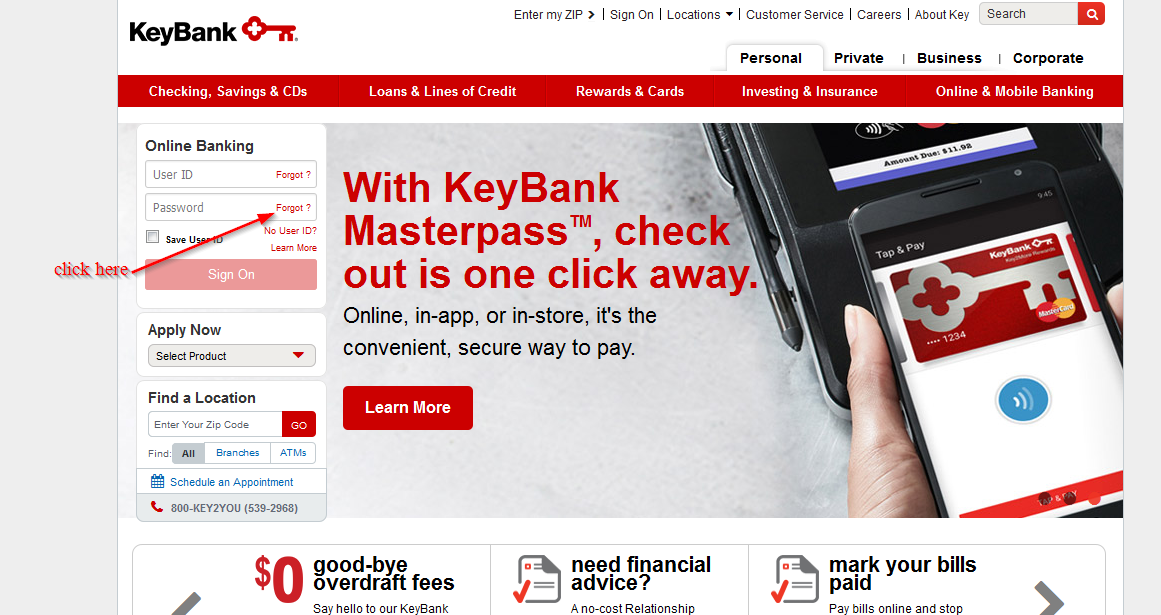

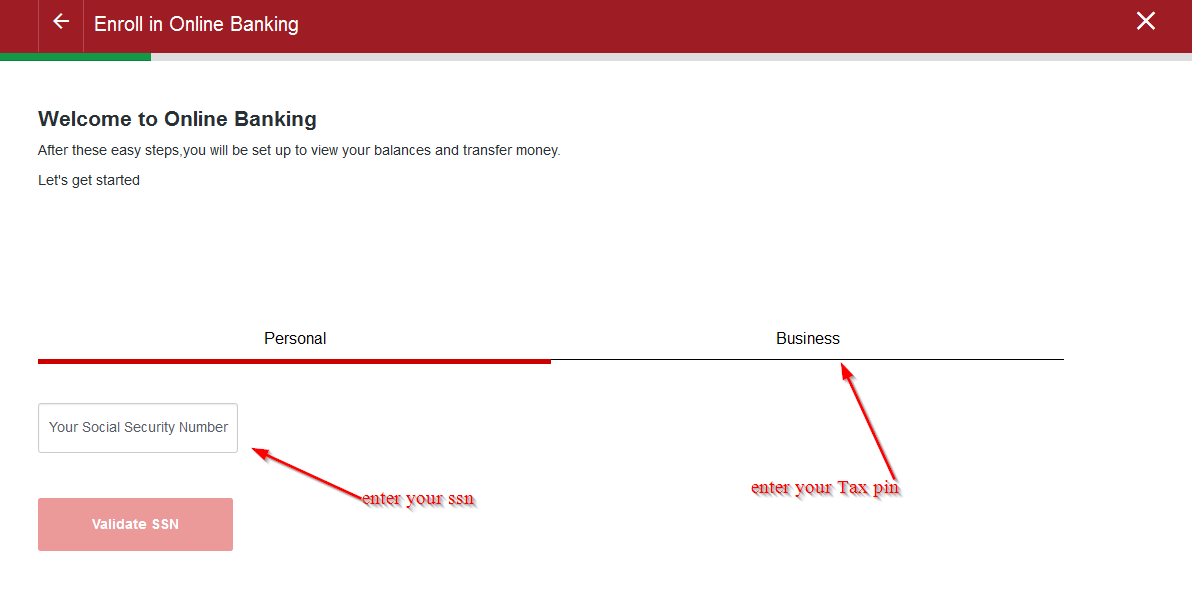

How to reset your password

You can reset your password anytime as long as you have a valid login ID. You will be required to use the ID in order to reset the password. Follow these steps to reset your password:

Step 1-Navigate back to the homepage and click “forgot?”

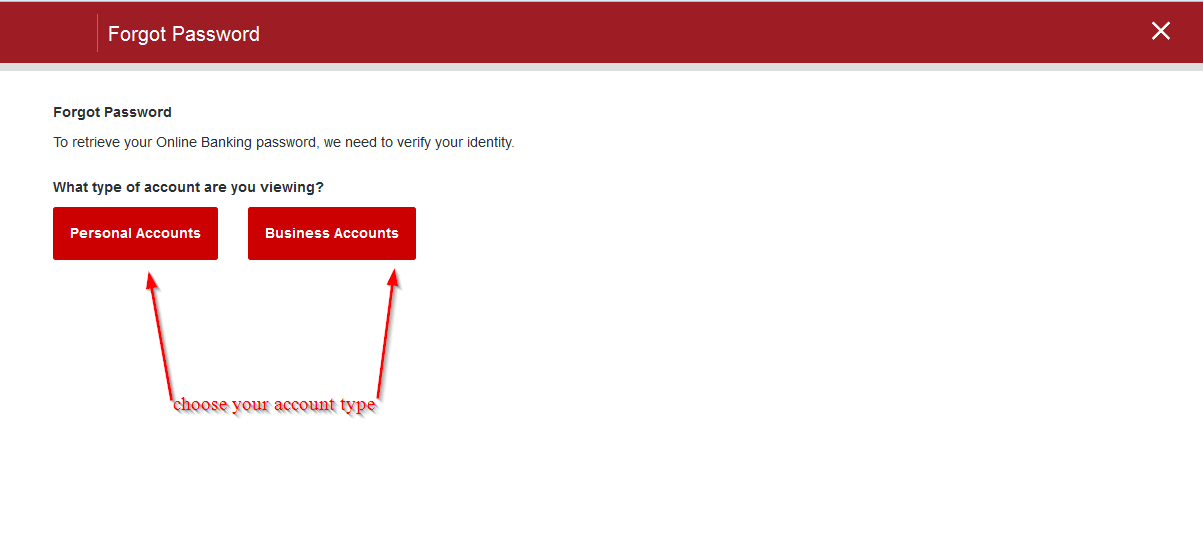

Step 2-Choose your account type (whether personal or business)

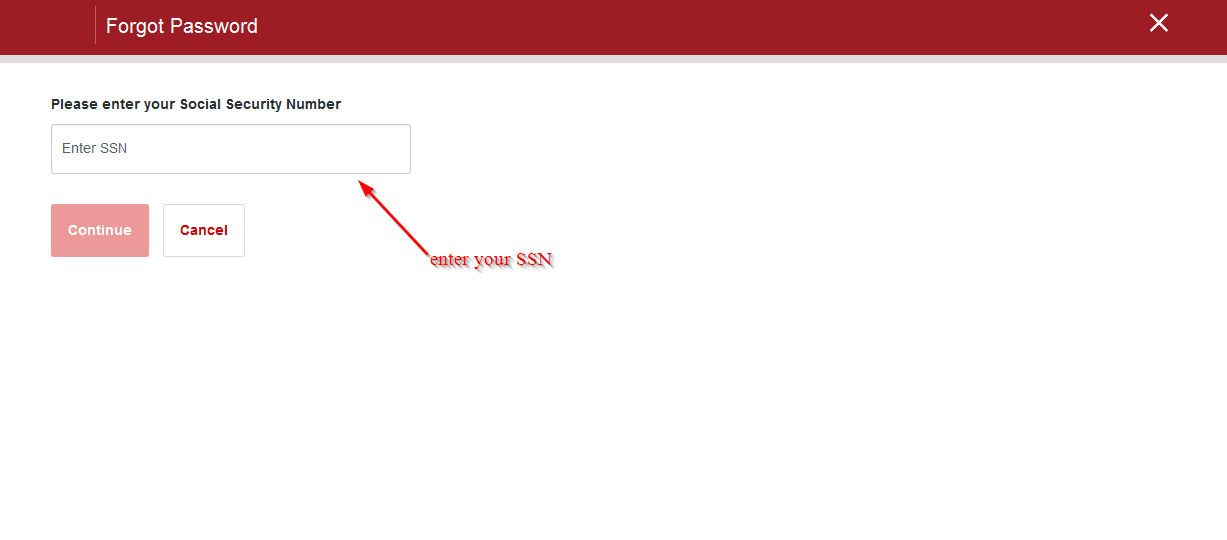

Step 3-Enter your SSN number

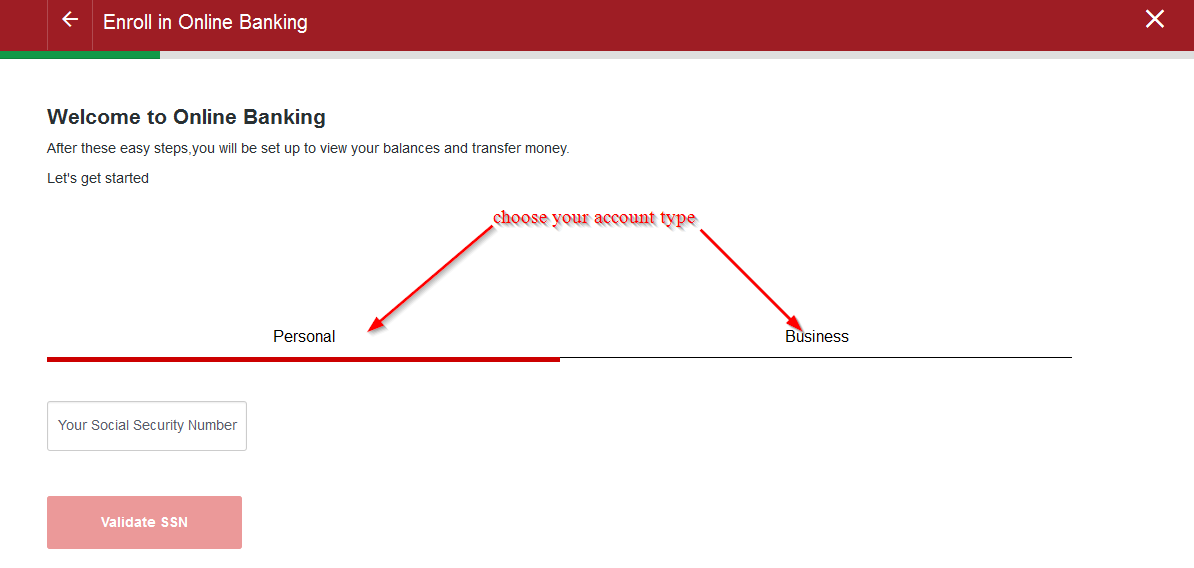

How to enroll

Enrolling for the online banking services is easy as long as you are customer with an account with the bank. It’s easy to create an online account with the bank. Follow these simple steps to register:

Step 1-Go to the homepage and click “no user ID”

Step 2– Choose either personal or business depending on the type of account you have with the bank.

Step 3-Enter your social security number for personal banking and tax ID number for business banking.

Manage your Key Bank online account

The advantages of having an online account with Key Bank include:

- You can deposit money

- You can pay your bills anytime

- You can transfer funds between accounts

- Access to online customer support

- Access to a nearby ATM

Key Bank Review

Key Bank is the subsidiary of KeyCorp and is headquartered in Cleveland, Ohio. It is one of the largest banks in the U.S. The bank was founded in 1994 through a merger between KeyCorp of Albany, New York and Society Corporation of Cleveland.

Key Bank offers a range of financial products that appeal to many customers. The bank offers a range of business and personal financial products, in addition to insurance and investment products.

Bank review

Are you looking for a better bank? If you believe Key Bank could be a better bank for you, then you need to continue reading this review to learn more.

Savings account-Key Bank offers five saving accounts for your money. You can choose from a money market account or basic savings account. For those who have high insurance deductible, then a health savings account could be the solution. And for those who have children, the bank has an account for kids which provide early lessons on money management.

Checking account-There are seven different choices of checking accounts. Whether you are looking for a student checking, basic account with zero monthly fees, or an interest-earning checking account, Key Bank is the solution. You can get started created and set up a safe place to keep your money. In addition, a bank account with the bank opens to other conveniences like direct deposit. When you give employers your account number and routing number, your earnings will be deposited into the account.

Certificate of Deposit– The bank’s CD rates can increase your funds much faster than regular money market or savings account. You can choose between a Jumbo, short-term or tiered CD. You can open a Key Bank CD account with a minimum of $2,500 ad choose a term between 7 days to 10 years.

Mortgage loan-The bank can help you to buy or refinance a home. You can choose between adjustable rates with low initial payments, predictable or fixed-rate home loan. Make inquiries about low down payment home loans. You will find a solution for almost every situation and with affordable mortgage rates, buying could be easier than you ever imagined.

Auto loans-While some banks offer only certain types of auto loans, Key Bank offers loans for a range of vehicle purchases. You will be able to enjoy varying terms, fast approvals and competitive rates.

Credit card-For those looking for a credit card that has a low interest rate, rewards program or no annual fee, then you should look no further than Key Bank credit card. There are two types of credit cards offered by Key Bank. Go online and apply today to transfer your credit card balance and then start saving.

Benefits

- Key Bank has been receiving many positive reviews from its customers. The bank’s customer service is very impressive, with a significant number of customers rating it as “outstanding.” The bank also has many loan options which are highly appreciated by customers. They can apply for auto loans and mortgage as well as unsecured personal loans, home improvement loans and unsecure lines of credit.

- Key Bank remains among the best banks in the United States with regards to the latest electronic features. The bank gives customers full-time access to their accounts, and they can set up account alerts and most branches are open until 6 P.M on Fridays.

- Customer support is also great when working with a branch directly when compared to the national line. The bank’s branch loan offices are more than willing to answer questions.

- The bank also offer online and mobile banking services which allow customers to conveniently bank from any geographical location as long as they have sign up for the online banking services

- You can also use your property or second home as collateral

Downsides

- Key Bank is only limited to 14 states in the U.S.

- Customers may be required to pay closing fees

Conclusion

You may be wondering whether Key Bank is the right bank for you. It actually depends on what you are looking for in a bank. If what you are looking for is excellent service, a range of checking or saving options, and the convenience of online banking then this is the best bank for you. To open an account with the bank, visit its website today