M&T bank allows your banking to be convenient, quick and simple. It has a clean and easy design which allows you to send money, review transactions and check balances.

- Branch / ATM Locator

- Website: https://www.mtb.com/

- Routing Number: 022000046

- Swift Code: See Details

- Telephone Number: +1 800-724-2440

- Mobile App: Android | iPhone

- Founded: 1856 (169 years ago)

- Bank's Rating:

M&T Bank has made it easy for customers to easily access their banks through the internet. The internet banking system uses the latest technology, including encryption and firewalls, to give customers the best user experience. If you are a customer with an account with M&T Bank, we will walk you through the steps of logging into your online account, recovering your lost password and enrolling.

How to login

If you have an online account with M&T Bank, you can login anytime. It’s easy to access you online account, and just like Facebook, you will need your login details. Follow this step-by-step process to login into your online account:

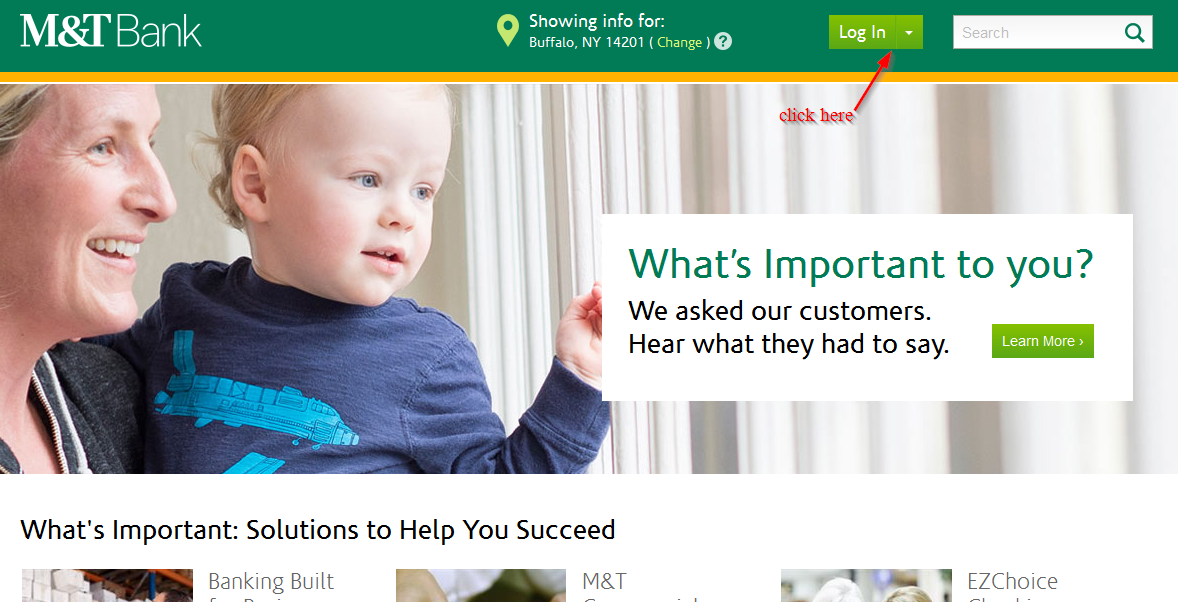

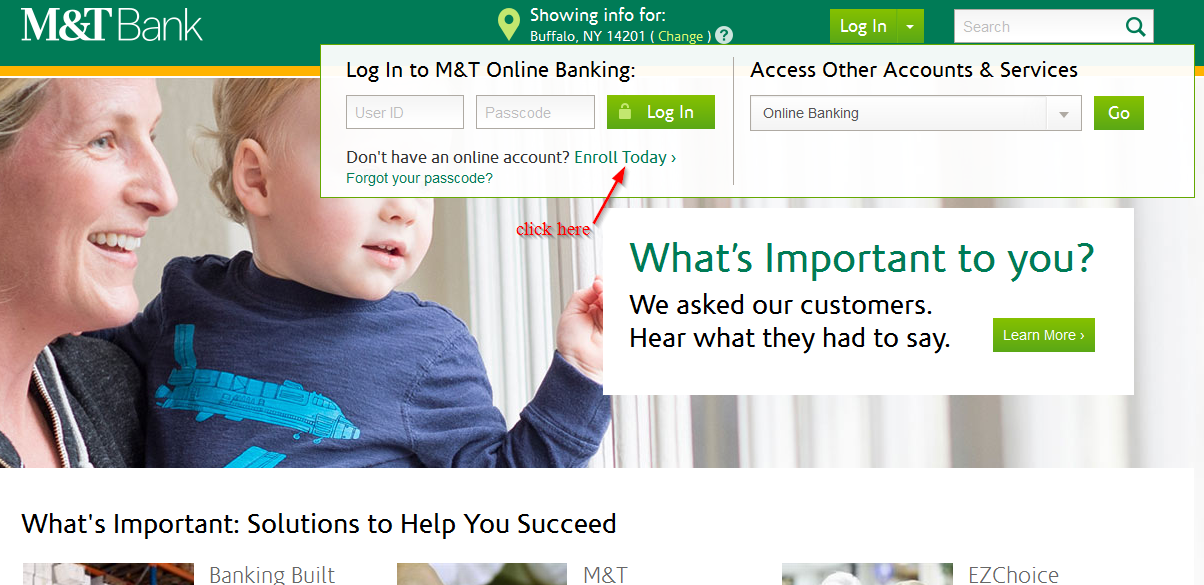

Step 1-Start your computer, open your browser and enter https://www.mtb.com/

Step 2-Click “login”

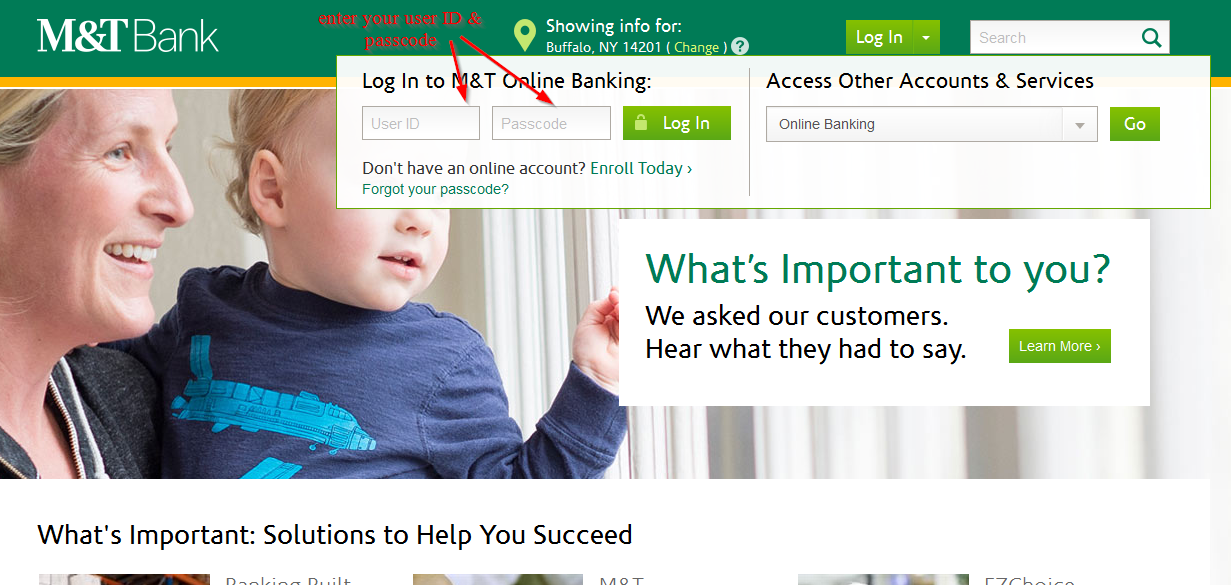

Step 3-Enter your user ID and password and click “login”

If the logins are correct, you will be able to access your online account for M&T Bank

How to reset your password

M&T Bank allows its customers to reset their passwords in case they forgot them. The process is pretty straight forward and customers can have a new password in as short as 3 minutes. Follow these steps to reset your password:

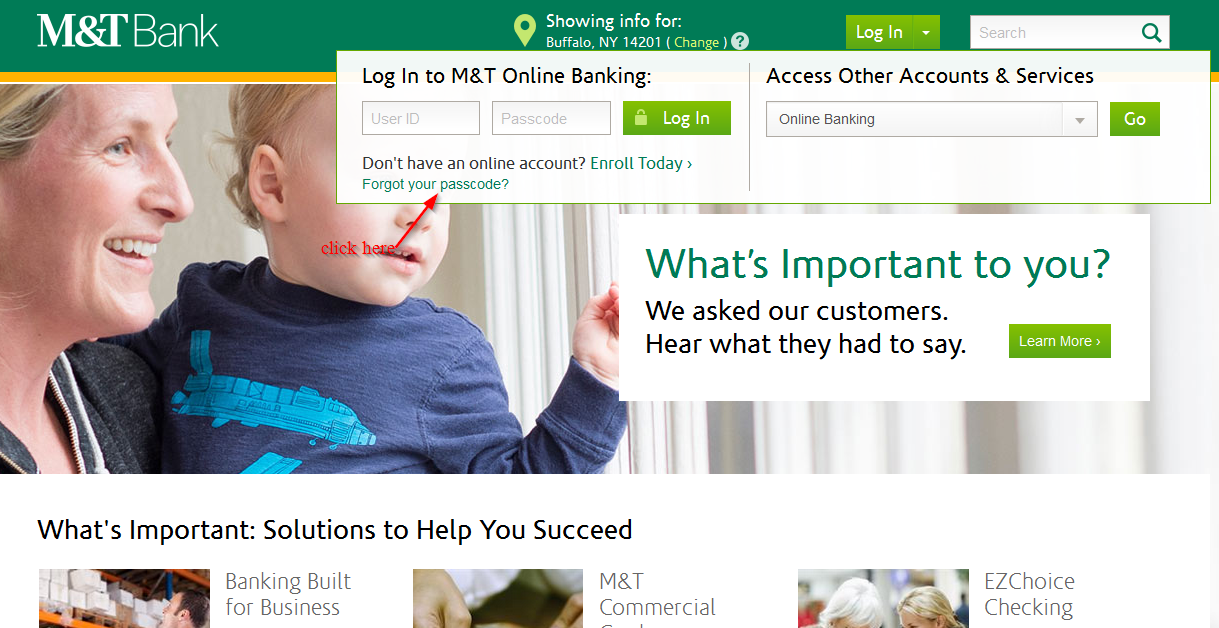

Step 1-Start on the Homepage and click “login”

Step 2– Click “forgot your passcode?”

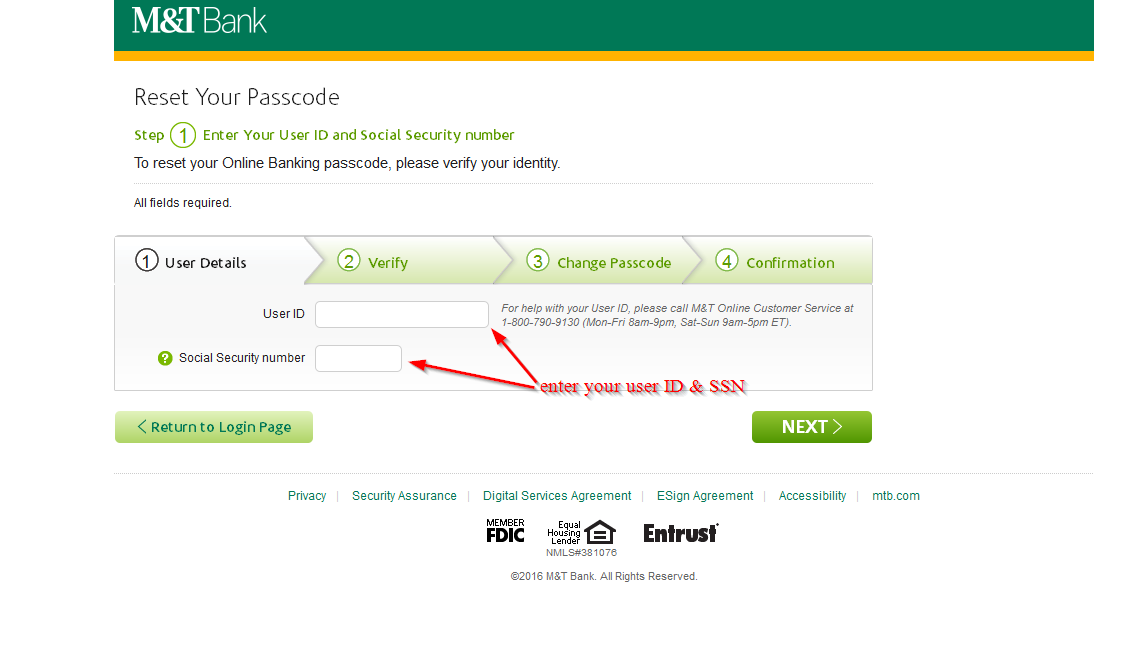

Step 3-Enter your user ID, social security number and complete three more steps to reset your password.

How to enroll

The internet banking services offered by Synchrony Bank are free and customers can register anytime to start managing their bank accounts. You must however be a customer to register for the online banking services offered. Follow these simple steps to register:

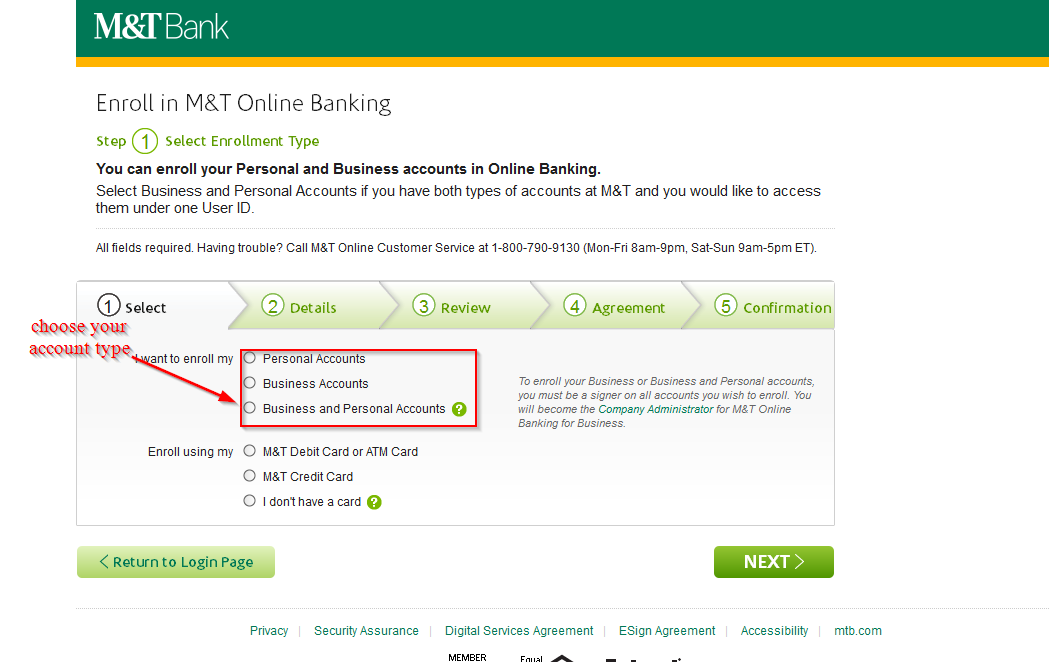

Step 1-Again, start on the homepage and click “enroll today”

Step 2– Choose your type of account (whether personal account, business account or personal and business accounts) and click “next”

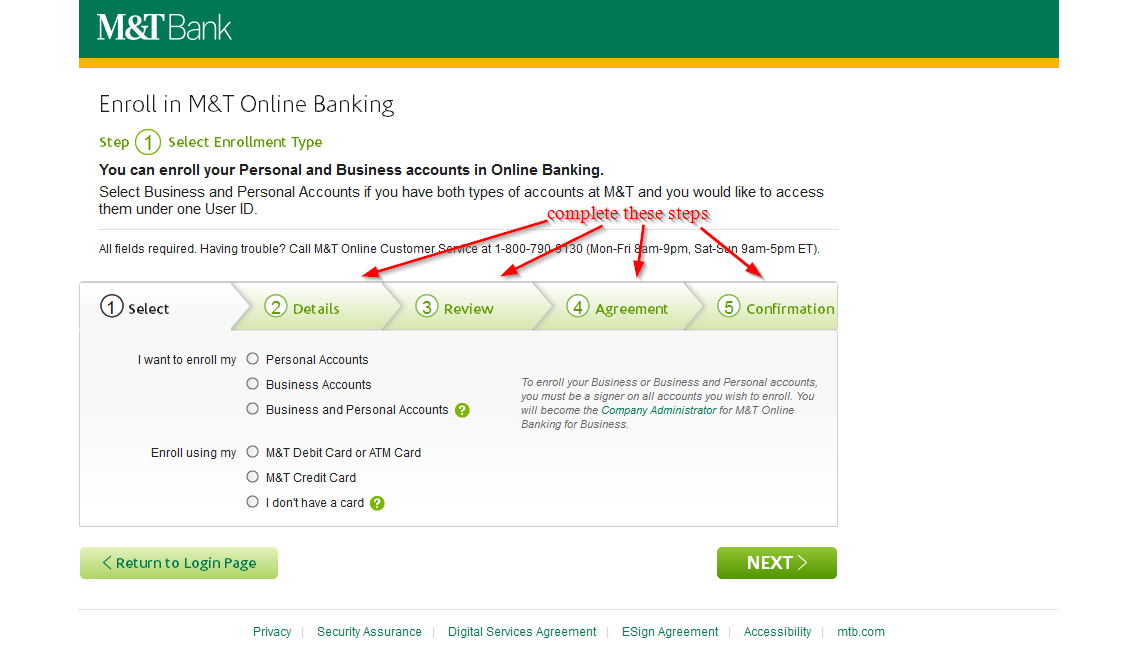

Step 3-Complete three more steps (details, review, agreement and confirmation)

Manage your M&T Bank online account

It’s not only free to register an online account with M&T Bank, but you will also enjoy the following benefits:

- Full time access to your bank account

- Access to online banking services

- Locate the nearest ATM

- Apply for loans and mortgage

- Transfer money between bank accounts

M&T Bank Review

M&T Bank is a bank holding company based in Buffalo, New York. The bank operates over 800 branches in Pennsylvania, West Virginia, New York, Washington D.C, Maryland, New Jersey, Connecticut and Delaware.

The bank No. 455 on the Fortune 500 and is one of the largest banks in the United States. The bank was founded in 1856 and was trading under the name Manufactures and Traders Bank. The bank has been making profit every quarter since 1976, and as of 2014, the bank had assets worth $97 billion.

It has more than 650 locations and over 1,500 ATMs across the United States. The bank prides in being in a community bank with a symbiotic relationship with its local community where it has branches.

Benefits

Being one of the best banks in the United States, M&T Bank has many benefits that customers have seen over the period it has been in service. In this post, we will be looking at some of the advantages of opening an account with the bank:

Built it yourself account

The bank’s most beautiful feature is certainly the build it yourself account add-on, which features:

- No fee charged at other Bank’s ATMs

- Credit score

- No overdraft protect transfer fees

- Refund of other bank’s ATM fees

- Safe deposit and standard checks

In addition, checking accounts makes it easy for customers to get these Custom Add-ons free of charge. Otherwise, there shall be a monthly subscription fee of $4.95 per add-on.

Checking account

M&T Bank offers a number of checking accounts, its main account being EZ Checking for customers looking for an economic-friendly option. These options include:

- No monthly fee for customers who complete at least one transaction or monthly deposit. This could be anything from direct deposit, cash, check or debit card purchase

- A $4.95 monthly fee for add-on features

- $0 overdraft fee or Non-sufficient funds (NSF) if customers don’t have enough available money in their checking account to make a transaction of less than $5.

Savings account

The bank’s most popular savings account is e-Money Market Savings Account. It has no-fee costs and:

- No monthly maintenance charges

- No minimum balance

- Six free transfers and withdrawals per month

The M&T Bank Debit card has not monthly or annual fee. Transaction fees usually vary and it’s mandatory that customers check their Telephone Transaction and Electronic Banking Card Disclosure and Agreement for more details.

Auto loans

M&T Bank also offers auto loans and has partnered with TrueCar, a program which provides customers with a chance to buy new and used cars. This is also an information tool which educates consumers about buying cars and connects customers to certified dealers.

Auto loan features include:

- Payment calculator

- Fixed rates

- Fast approval

- Minimum amount to borrow is $2,000

- New/used cars and trucks

- Terms up to 72 months

- Buy from a private party or a dealership

- Promise of on-time professional attention

Downsides

Despite being one of the oldest and best banks in the United States, M&T Bank also has its own downsides which will be looking at in this post:

Disadvantages

Despite the bank’s cost-efficient financial product offers, it is important that customers take note of this:

- Customer must open or have a checking account to open a Select CD

- Customers may be penalized for early withdrawal. Earnings on the account could be reduced by fees. The maximum deposit per customer is $1 million. In addition, rates may be changed without notifying customers.

- Interest rates for Savings Account are variable; therefore, the current rate for opening an account may be changed

Conclusion

M&T Bank has been in service since the 18th century, starting out in New York as Manufactures and Traders Bank. After several mergers and acquisitions, the bank has made a name for itself. M&T Bank prides in being a community bank with a close relationship with its branches across the eastern U.S., from Virginia to New York. The bank’s main selling point is its customizable checking accounts and flexible banking options. Its customizable add-ons for their personal checking accounts have a monthly subscription fee. This is one of the best banks to bank with.