Navy Federal Credit Union is the largest credit union with more than 6 million members, over 14,000 employees and over $77 billion. Founded in 1933, the bank is headquartered in Vienna, Virginia.

- Branch / ATM Locator

- Website: https://www.navyfederal.org/

- Routing Number: 256074974

- Swift Code: See Details

- Telephone Number: 1-888-842-6328

- Mobile App: Android | iPhone

- Founded: 1933 (92 years ago)

- Bank's Rating:

Navy Federal Credit Union bank offers online banking services that make it easy for their customers to access their bank accounts. These online services are available for both personal and business banking services and the good thing is that you don’t have to pay anything to enroll. Here is a step-by-step guide on how to log in to your online account, how to change your password and enrolling for the internet banking services.

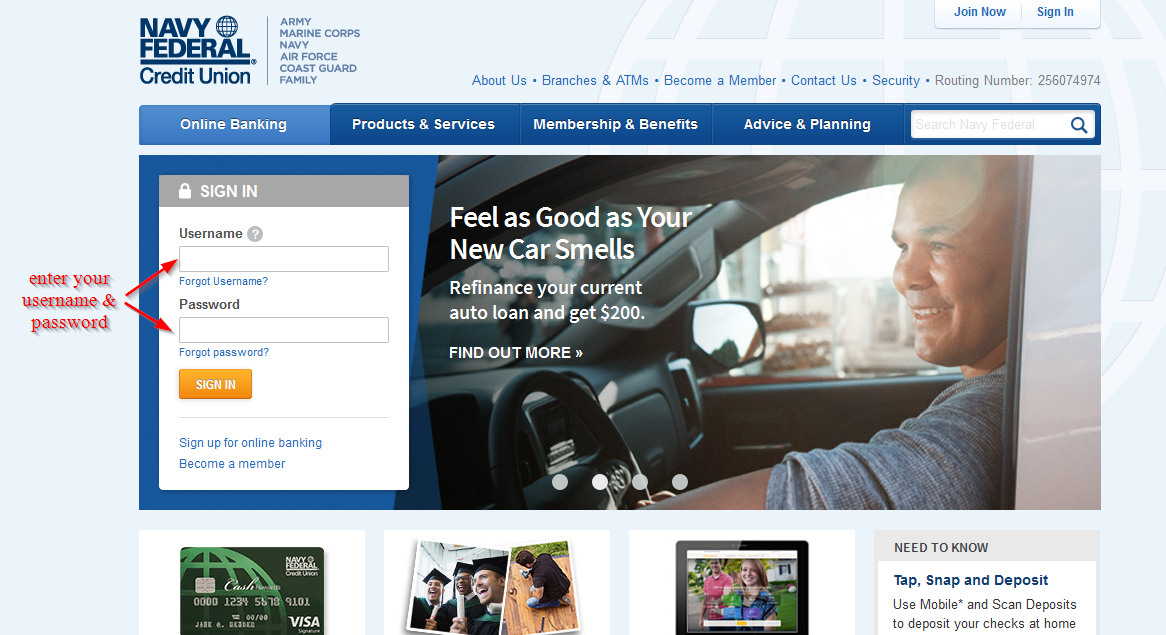

How to login

If you have created an online account with the bank, you can log in anytime and manage your account. The process is pretty straight forward and customers login anytime. Here are the steps to follow:

Step 1-Open https://www.navyfederal.org/ in your web browser

Step 2-Enter your user username and password and click “sign in”

If the password you have used is correct, you will be directed to your online account

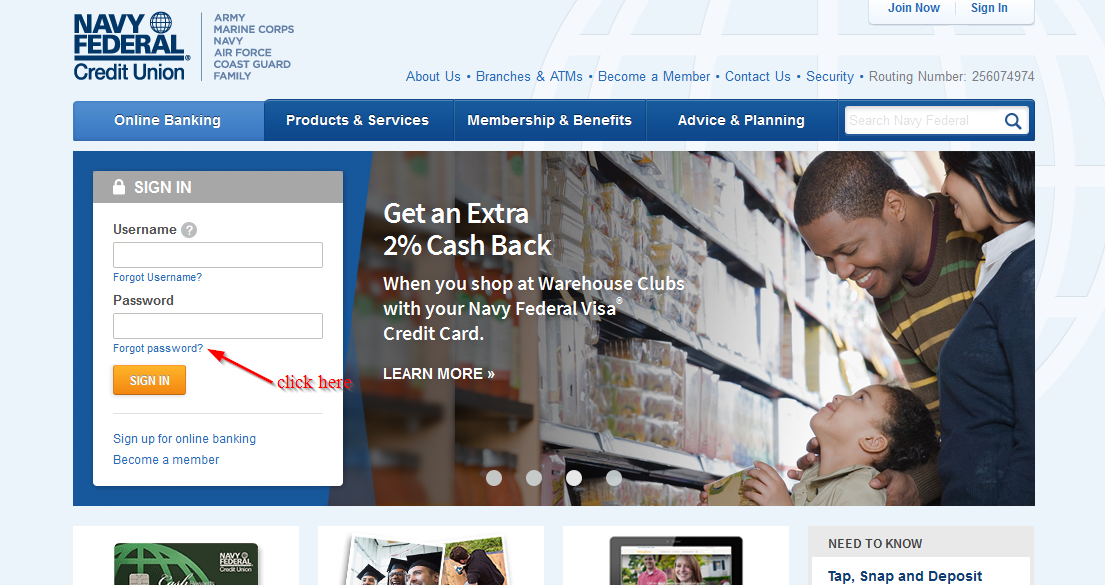

Forgot your password?

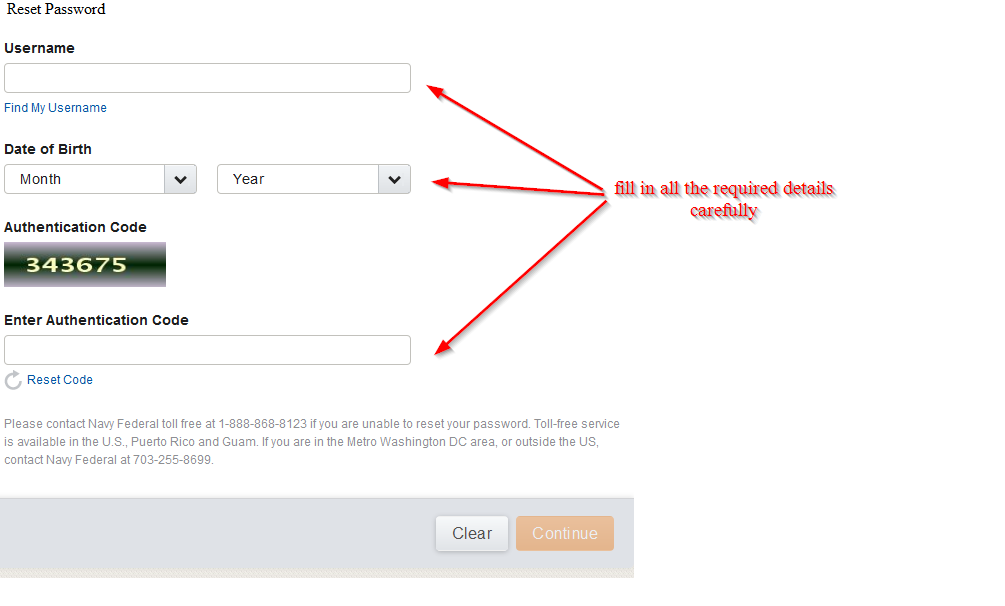

You can reset your password if you are blocked from accessing it because of using a wrong password. This is an important security step that must be taken to protect your account. To reset your password, follow these steps:

Step 1-Start over on the bank’s Homepage and click “forgot password”

Step 2-Enter your username and date of birth, enter your authentication code and click “continue”

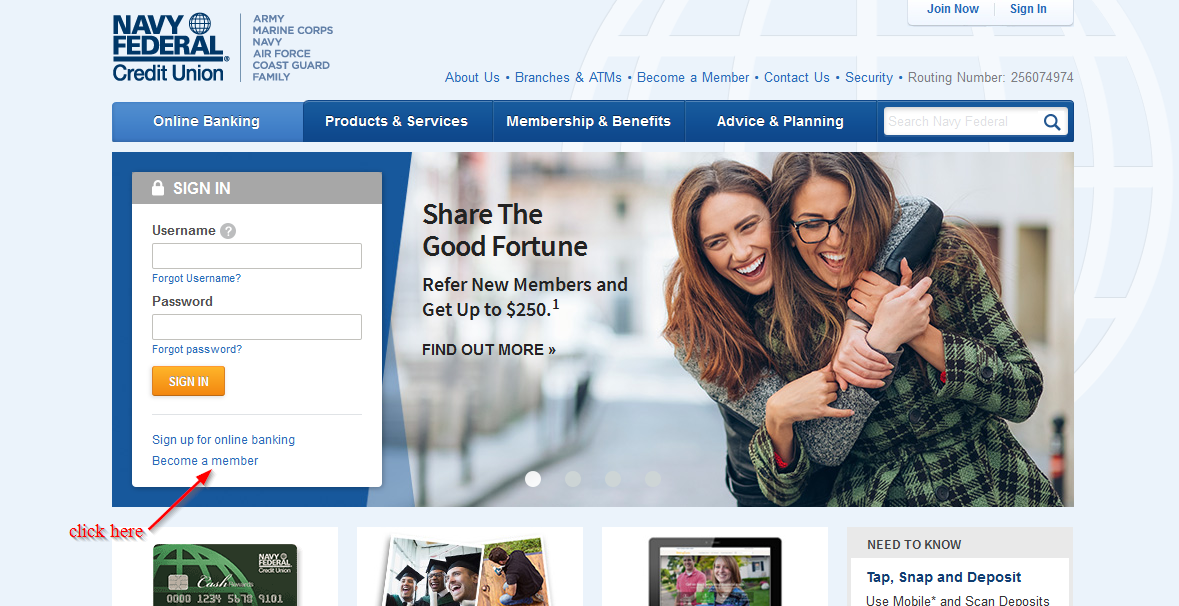

How to enroll

It only takes a few minutes to set up an online account with Navy Federal Credit Union Bank. Follow these steps to enroll for the online banking services offered:

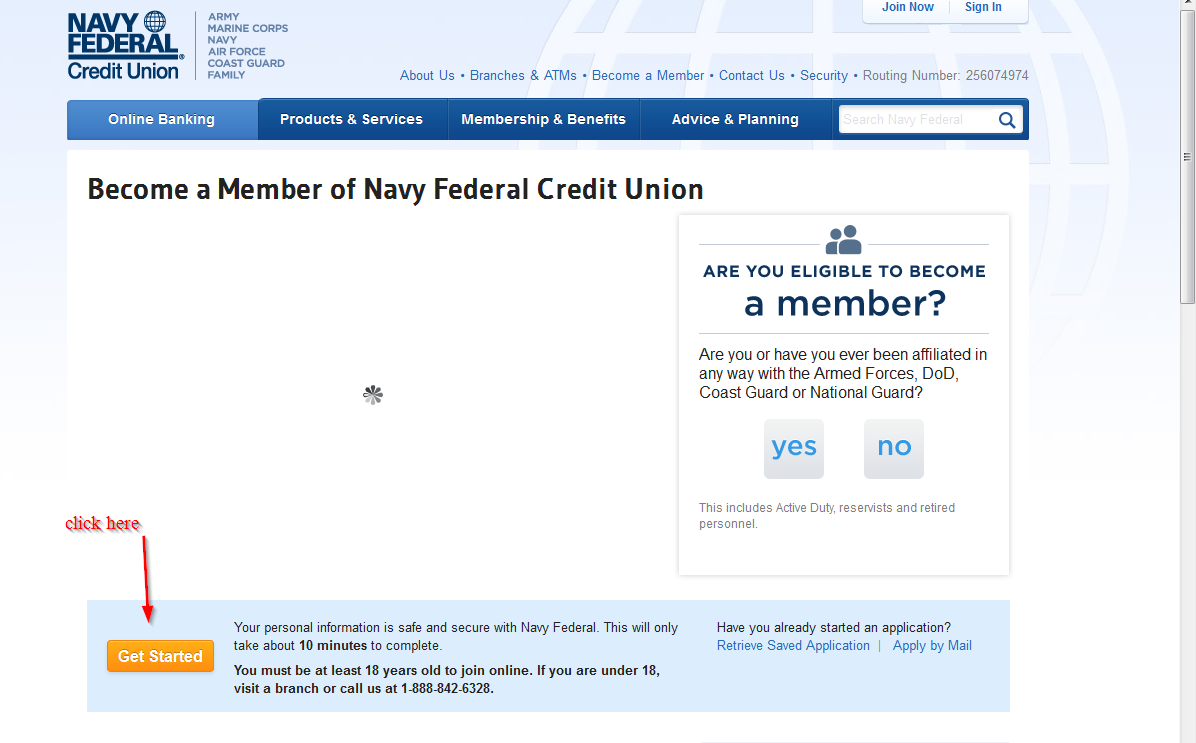

Step 1-Again, go to the Homepage and click “become a member”

Step 2-Click “get started”

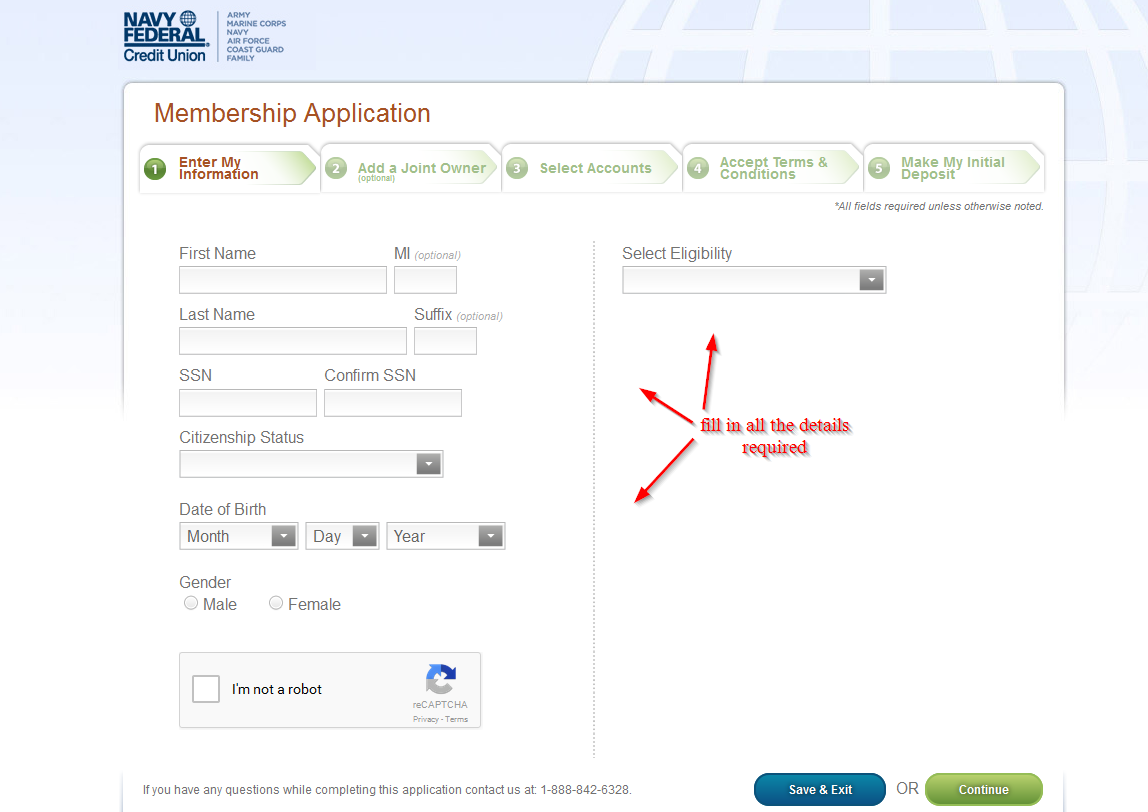

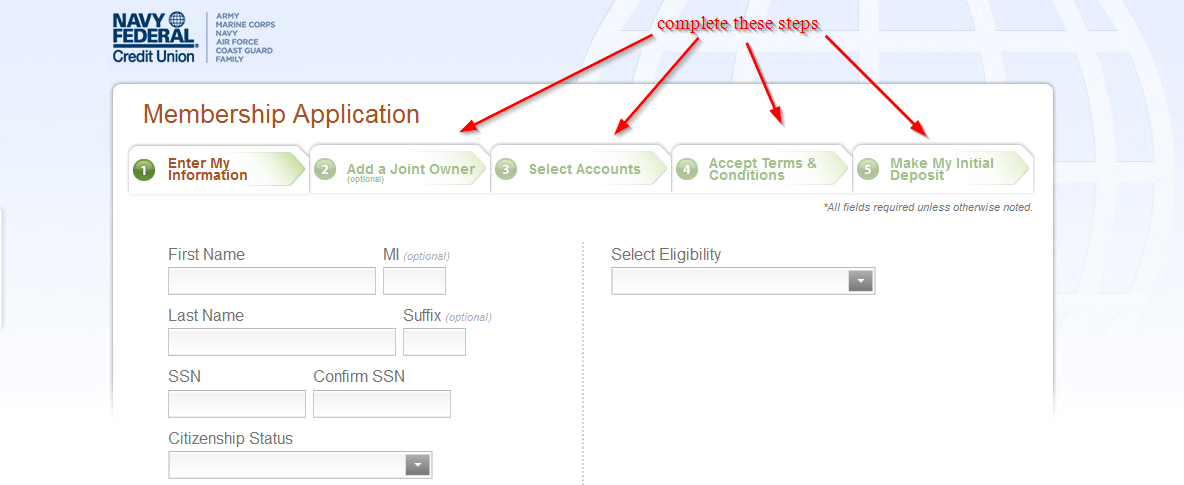

Step 3-Fill in the details required carefully and click “continue”

Step 4-Provide details in four more steps to complete your registration

Manage your Navy Federal Credit Union bank online account

As mention earlier on, creating an online account with the bank is completely free. You’ll just need to provider certain detail about your bank account. Here are the advantages of having an online account:

- Check your bank statement

- Apply for loans

- Check your account balance

- Pay your bills

- Transfer money between accounts

Navy Federal Credit Union Review

Navy Federal Credit Union is a United States credit union based in Vienna, Virginia, regulated and chartered under the National Credit Union Administration. The credit union is the largest natural member in the U.S., both in membership and asset size. As of May 2017, the credit union had more than $81 billion in assets and about 7 million members.

Navy Federal Credit Union was founded on 17th January 1933 as the Navy Department Employees’ Credit Union. Only Navy employees were allowed to join the credit union. After the Federal Credit Union Act was signed into law by President Roosevelt, the credit union found basis for business.

Loans

Navy Federal Credit Union provides mortgages, motorcycle loans, collateral loans, equity loans, just to mention a few. When you visit the credit unions website, you will be able to see the current loan rates. The aim of the credit union is to be an all-rounded provider for everything that its members need. The credit union’s consolidation loans and student loans have interest rates that are lower than the average.

Checking and savings accounts

Navy Federal Credit Union is a credit union; therefore their main focus is on savings and checkings. When you visit the checking account services page, you will see “checking account design for real people”. The page also has a short questionnaire that helps you to choose the right checking account.

The credit union also provides online and mobile banking, multiple checking protection options, direct deposit and mobile deposits.

Navy Federal Credit union offers 4 savings plans: the basic, estate management, SaveFirst and education savings. SaveFirst is a pretty interesting account since it is a high-yield, short-term savings account. The period can be from 3 months up to 5 years, during which you receive dividends and you are allowed to choose a maturity date that’s convenient to you.

Cards

Navy Federal Credit Union provides 5 different credit cards, most with amazing rewards. The interest rates are lower when compared to other major credit card issuers.

The credit union provides a secure credit card that you can use to repair or rebuild credit. In addition, checking account holders are issued with a Navy Federal debit card which comes with security features to protect their funds.

Navy Federal Credit Union also provides prepaid cards. This card does not have monthly fees, can be managed through the mobile apps (both iOS and Android versions) and can hold up to $10,000.

The credit union also issues Visa Buxx cards which are designed for students but managed by parents. That is, parents can load the cards with funds and monitor the usage of the funds. These cards can hold up to $2,000.

Online and mobile banking

Navy Federal Credit Union offers online and mobile banking. Customers can download apps on Playstore, iTunes and Kindle Fire. If your phone isn’t compatible with the mobile apps provided, you can still access the credit union’s website on any mobile device and also do some banking via SMS messaging.

Business services

Navy Federal provides business services, whether it is a start-up or has been in service for some time. Members are required to speak to a personal Business Development Officer on the next move and access to saving and checking accounts. The credit union also offers small business loans of up to $50,000 and retirement packages.

Benefits

- Unlike banks, Navy Federal Credit Union does not charge any monthly fees on checking accounts

- There are many services and products other than what a standard credit union offers

- No application fees

- There are payment protection plans

- Linked to 3rd party free credit score site

- Auto loan calculator

Drawbacks

- Members are required to maintain a high balance in their accounts in order to avoid fees

- You must meet eligibility requirement to join

- Only military members are allowed

- No free credit checks

Conclusion

Navy Federal Credit Union is one of the most popular options for members of the military. The credit union’s representatives usually visit boot camps in the country to offer its services to members.