Northwest Bank provides personal and business banking products and services. The company was founded in 1896 and it operates as a subsidiary of Northwest Bancshares, Inc.

- Branch / ATM Locator

- Website: https://www.northwestsavingsbank.com/

- Routing Number: 243374218

- Swift Code: See Details

- Telephone Number: 1-877-672-5678

- Mobile App: Android | iPhone

- Founded: 1896 (129 years ago)

- Bank's Rating:

Northwest Savings Bank is pleased to offer internet banking services to help their customers achieve their banking goals like checking account balances, transferring money between accounts, paying your bills and so much more. If you are interested, here is a guide on how you can login, reset your password and register.

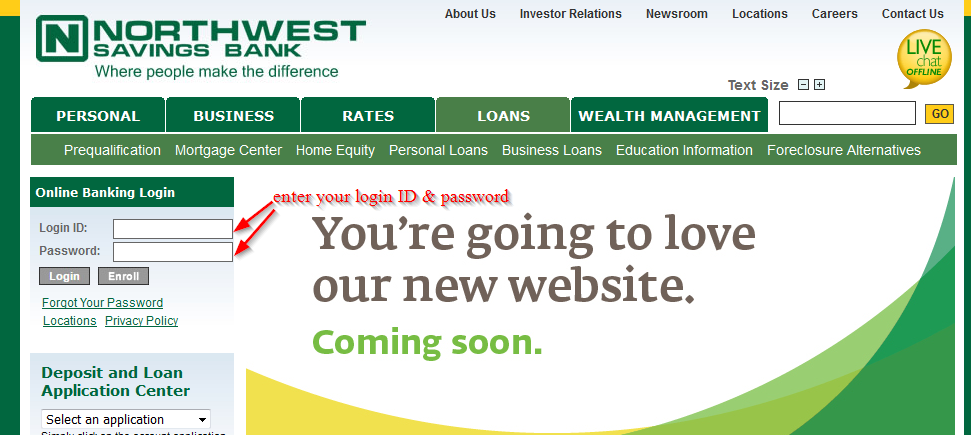

How to login

To login into your online account, you will need your user ID and password. You will only be able to access your online account if you use the correct logins. Follow this step by step guide to login into your online account:

Step 1-Open your web browser and go to https://www.northwestsavingsbank.com/

Step 2-Enter your username and password and click “login”

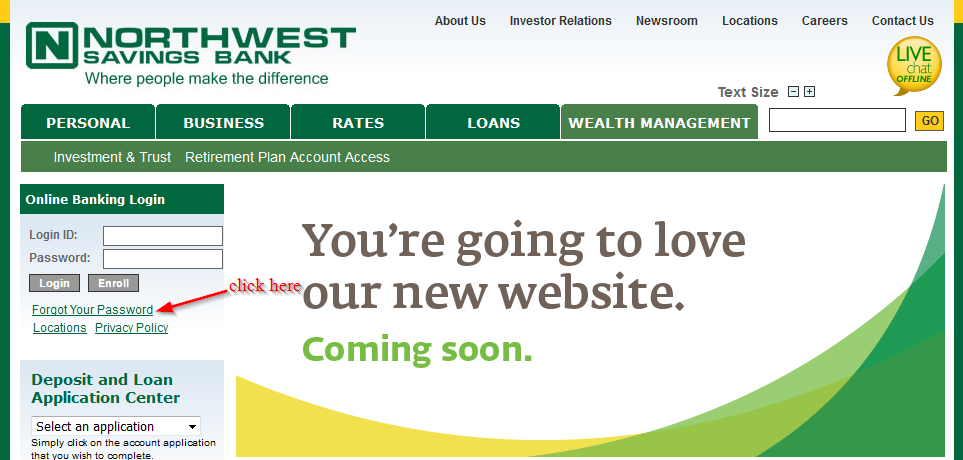

How to reset your password

Are you receiving a login error? It means that either your username or password is incorrect. If you reset your password, you will be able to regain access to your online account. Follow these simple steps to reset your password:

Step 1-Click “forgot your password”

Step 2-Enter your login ID and password and click “login”

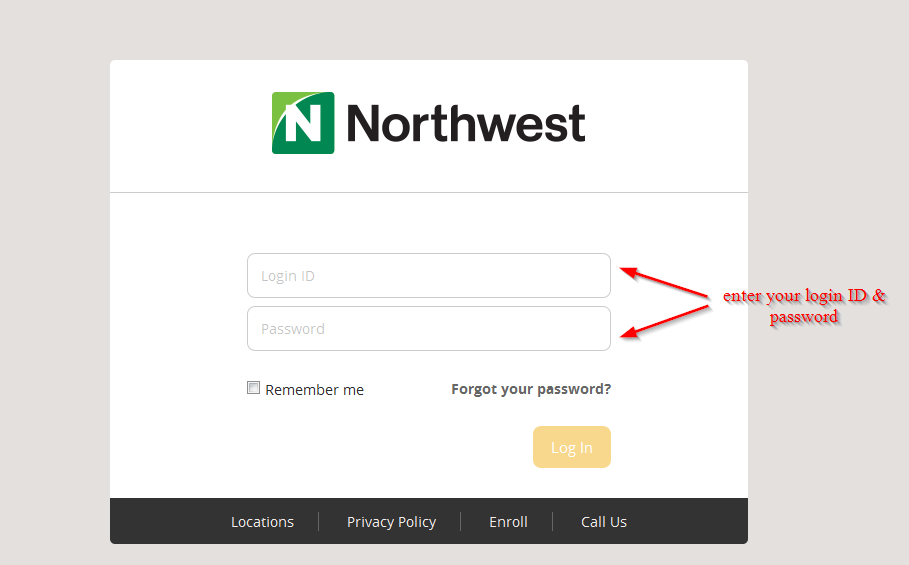

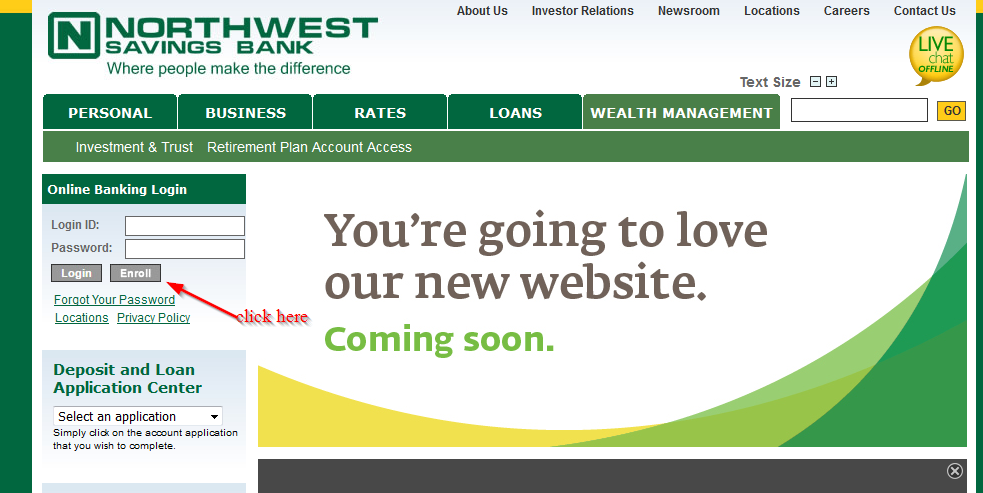

How to enroll

The internet banking services offered by Northwest Savings Bank are free and enable customers to conveniently manage their bank accounts. These internet banking service are 100% free, and customers can register anytime they want. Here are a few tips to help you enroll for the internet banking services:

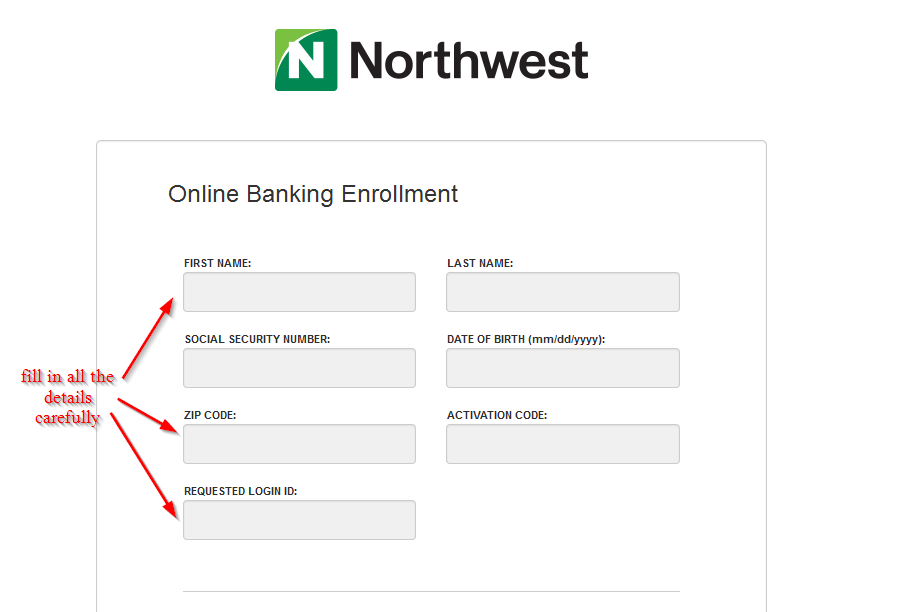

Step 1-Click “enroll” on the homepage. See the image below.

Step 2– Carefully fill in all the details that are required, including your names, social security number, zip code, activation code and requested login ID.

Manage your Northwest Savings Bank online account

Registering an online account with Northwest Savings Bank is easy and allows you to conveniently bank anytime. Here are a few advantages of having an online account with the bank:

- Gives you full time access to your bank account

- You can pay your bills

- Makes it possible to check your account balance

- Find the nearest ATM

Northwest Savings Bank Review

Northwest Savings Bank, currently known as Northwest Bank, is an American commercial bank founded in 1896 in Bradford, Pennsylvania. The bank moved its headquarters to Warren, Pennsylvania.

Today, the bank has 164 branches in New York, Ohio and Pennsylvania. The bank is a subsidiary of Northwest Bancshares, Inc., and has $9 billion in assets.

Northwest Savings Bank offers a range of individual and commercial products and services, including loans, banking, trust and investment, employee benefits and insurance.

In 2016, Northwest Savings Bank appeared in Forbes’ list of the Most Trustworthy Companies for the fourth time in 7 years.

During the same year, JD Power named the bank the “Highest Customer Satisfaction with Retail Banking in the Mid-Atlantic Region” for the fifth time in 7 years.

On 28th April 2016, following the merger between First Niagara Bank and Keybank, Northwest Savings Bank agreed to acquire 18 First Niagara branches in Niagara and Erie counties in New York for antitrust reasons, thus boosting the Northwest Savings Bank’s market share in the Western New York region.

Checking accounts

Northwest Savings Bank offers a few checking account options that you can choose from:

- MyNorthwest Checking-This account features overdraft protect, free linked savings account, online bill pay, deposit checks from mobile phone, mobile banking, surcharge-free ATM access, person-person payments, unlimited check writing, debit card with rewards and monthly eStatements

- MyNorthwest interest checking-This account earns interest on balances, free linked savings account, deposit checks from mobile phones, mobile banking, overdraft protection, surcharge-free ATMs, debit card rewards, monthly eStatements and unlimited check writing

- Student checking-This account features overdraft protection, person-to-person payments, monthly eStatements, debit card with rewards, online bill pay, deposit checks from mobile phone, mobile banking and unlimited check writing.

Savings account

Northwest Savings Bank has a number of savings account options that you should obviously know about:

- Student savings-This account requires a minimum deposit of $50 to open, interest is credited monthly, maintain an average minimum balance of $100 to earn interest and you can make withdrawals and deposits anytime

- Insured Monetary fund-Requires a minimum deposit of $50 to open, tiered interest and the $10 monthly service fee by maintaining an average daily balance of $2,500

- Certificate of deposit-The terms for this account ranges from between seven day and 10 years and the interest rates depends on terms that are chosen by customers.

- Club accounts-This account requires a minimum deposit of $1, and it is the best account for holidays and vacations

- IRAs-To open this account, you will need a minimum deposit of $25 and has an 18-onth variable rate CD. The interest for this account depends on the balance of the account

- Health savings account-This account requires a minimum balance of $50 to open, maintain an average daily balance of $1,000 to avoid the monthly service charge of $3 and earn interest on higher balances

Online and banking

Northwest Savings Bank online banking and mobile banking gives its customers modern technology, including A2A which allows the transfer of funds from an account other banks, person to person payments, and others.

Whether you are using a desktop or mobile phone the experience is usually the same. Online bill pay is fast, secure and easy. You will spend little time paying bills.

Benefits

Northwest Savings Bank is one of the most trusted banks in the United States. It is committed to providing quality financial services to its customers. More benefits include:

- Low minimum opening deposit

- Monthly service fee can be waived if certain requirements are met

- Online and mobile banking

- Safe and secure website

- Convenient locations

- Inexpensive and friendly hometown bank feel

- Fast and courteous

Downsides

Despite being a great bank, Northwest Savings Bank also has its own downsides whish potential customers should certainly know about:

- Limited locations with few branches and ATMs

- Some customers have complained of the bank’s machine longer taking deposits

- Poor customer support

- Minimal product selection

- Limited hours of operation

- Understaffed

- Takes longer to respond to fraud cases

Conclusion

Northwest Savings Bank is one most of the best banks in the United States that require a low minimum deposit and monthly charges can be waived. However, they have limited locations and some customers have complained of limited hours of operation.