TD bank offers commercial and small banking services. The bank operates as a subsidiary of TD Bank United States Holding Company

- Branch / ATM Locator

- Website: https://www.tdbank.com/

- Routing Number: 011103093

- Swift Code: See Details

- Telephone Number: +1 888-751-9000

- Mobile App: Android | iPhone

- Founded: 1852 (173 years ago)

- Bank's Rating:

TD Bank Online banking services have made it easy for customers to bank any time provided they have enrolled for free services. Customers can also access their bank accounts online on their mobile web browsers or by downloading the mobile app of playstore and itunes. This guide will direct you on how to access your online account, how to reset the password in case you want to and enrolling for the internet banking services.

How to login

If you have an online account with TD Bank, you can login anytime provided you have the correct login details. Here are the necessary steps you will need to take to do so:

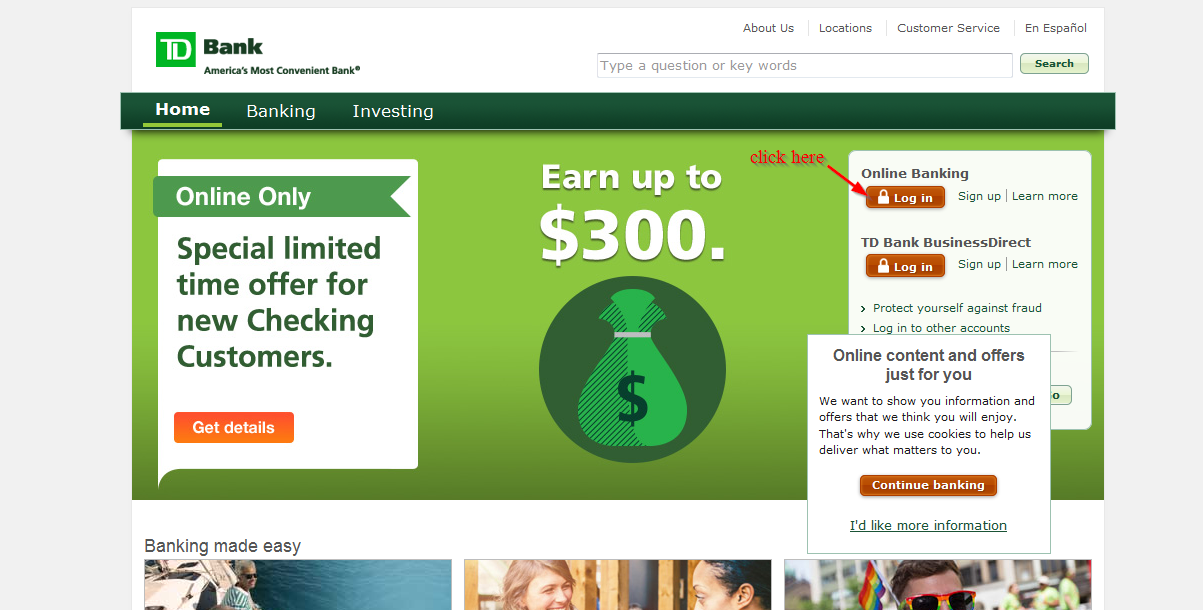

Step 1-Open https://www.tdbank.com/ in your web browser

Step 2-Click “login”

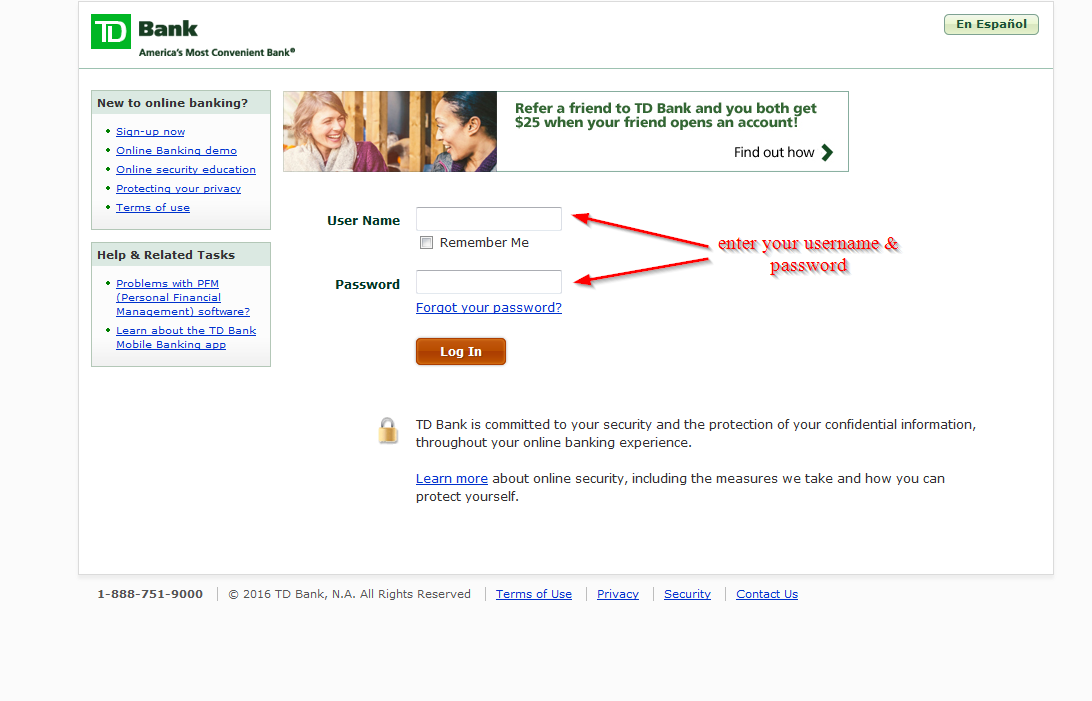

Step 3-Enter your username and password and click “login”

If the user ID and password you have used are correct, you will be granted direct access to your online account

Forgot your password?

Well, if you have forgotten your password, you can reset anytime to regain access to your online account. Here are steps you will need to follow to reset the password:

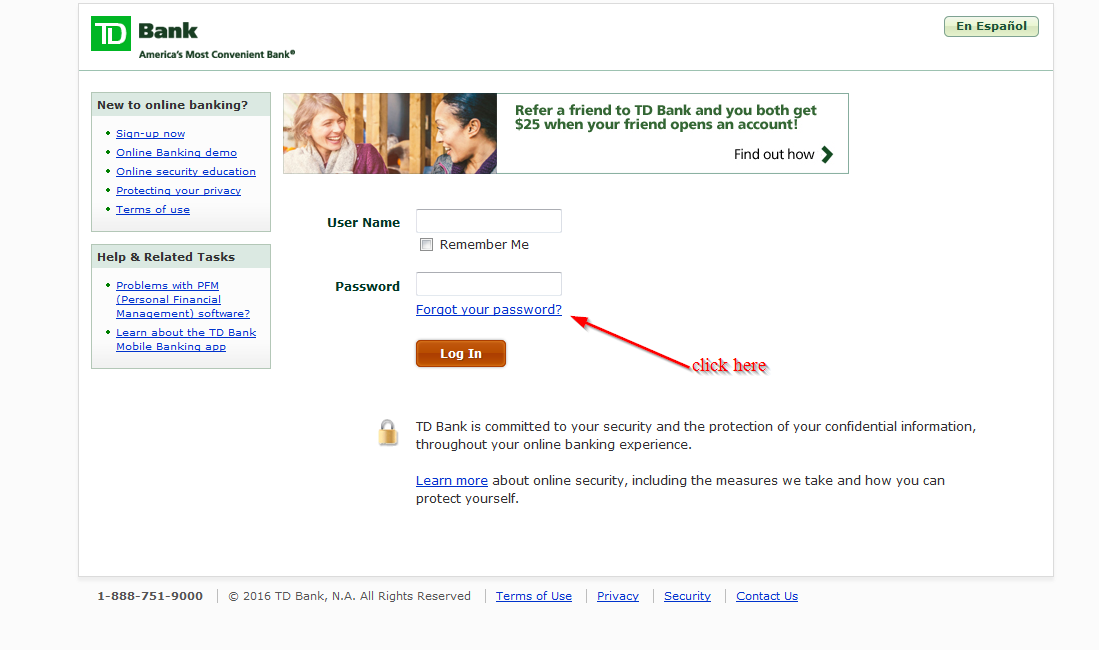

Step 1-Go back to the bank’s homepage and click “login”

Step 2-Click “forgot password?”

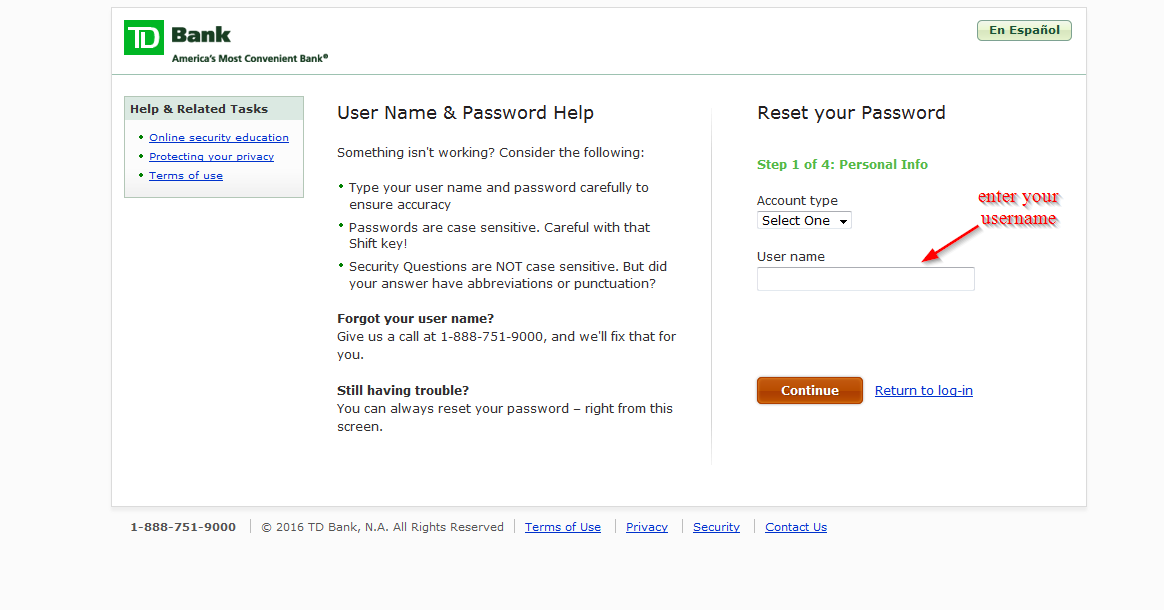

Step 4-Select your account type, enter your username and click “continue”

You will receive a new password in your email

How to enroll

Provided you are a customer with an account with the bank, you can enroll anytime. The internet banking services are available for both personal and business banking services. Just follow these simple steps to login:

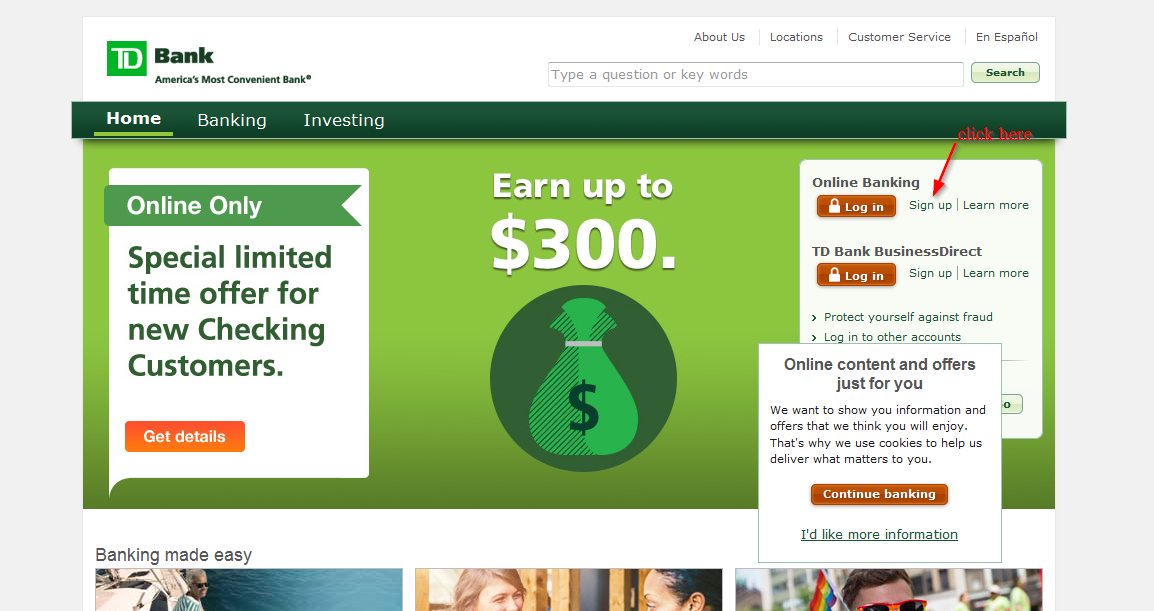

Step 1-Visit the Homepage and click “sign up”

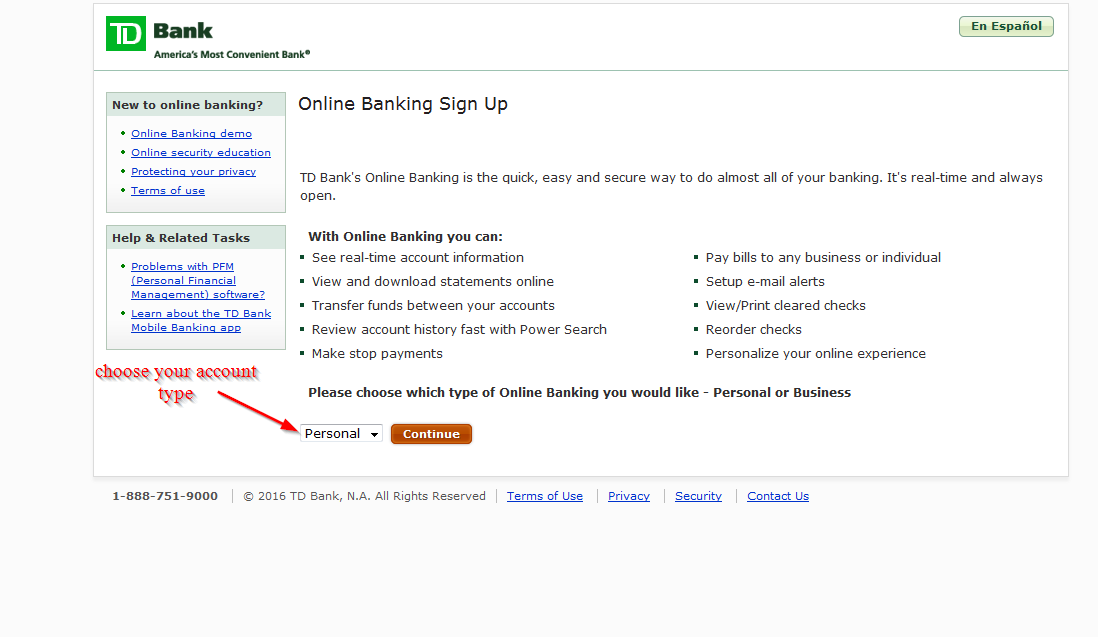

Step 2-Read the information on the page, choose the account you want to open, whether personal or business, and click “continue”

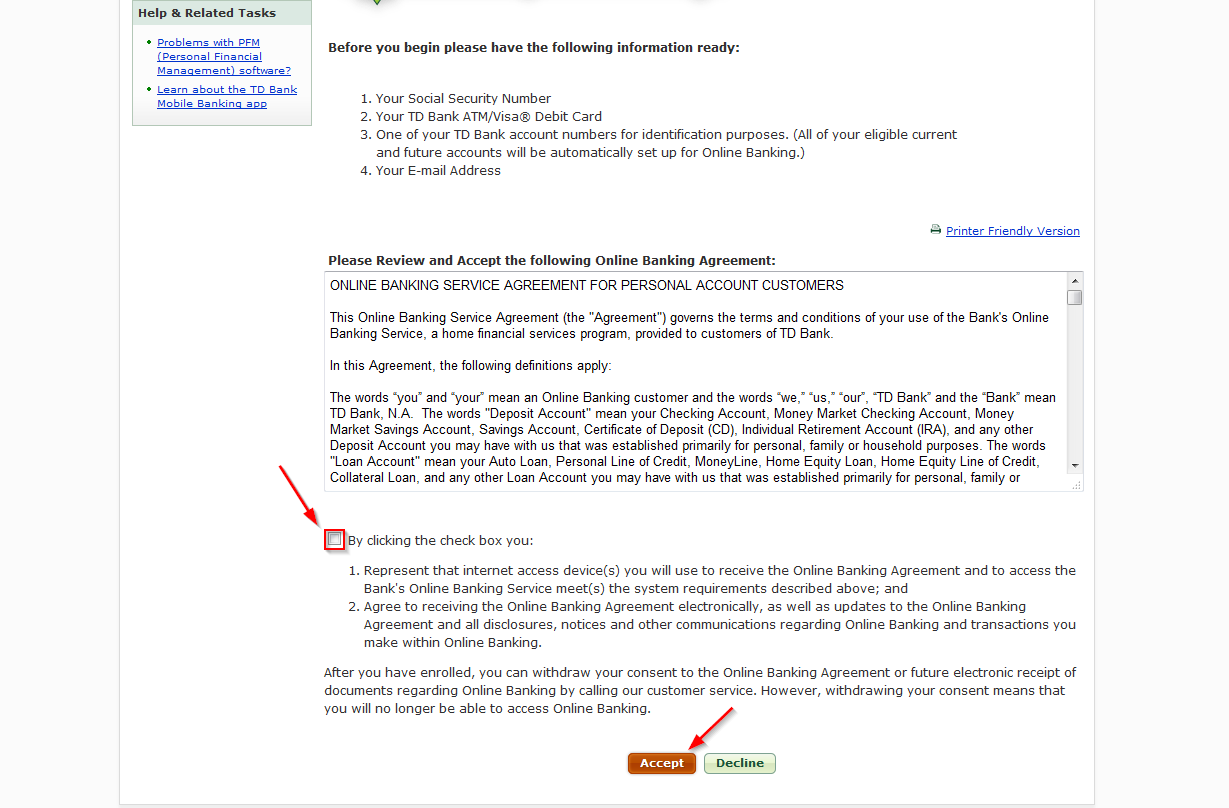

Step 3-Read the terms and conditions carefully, check the small box and click “accept”

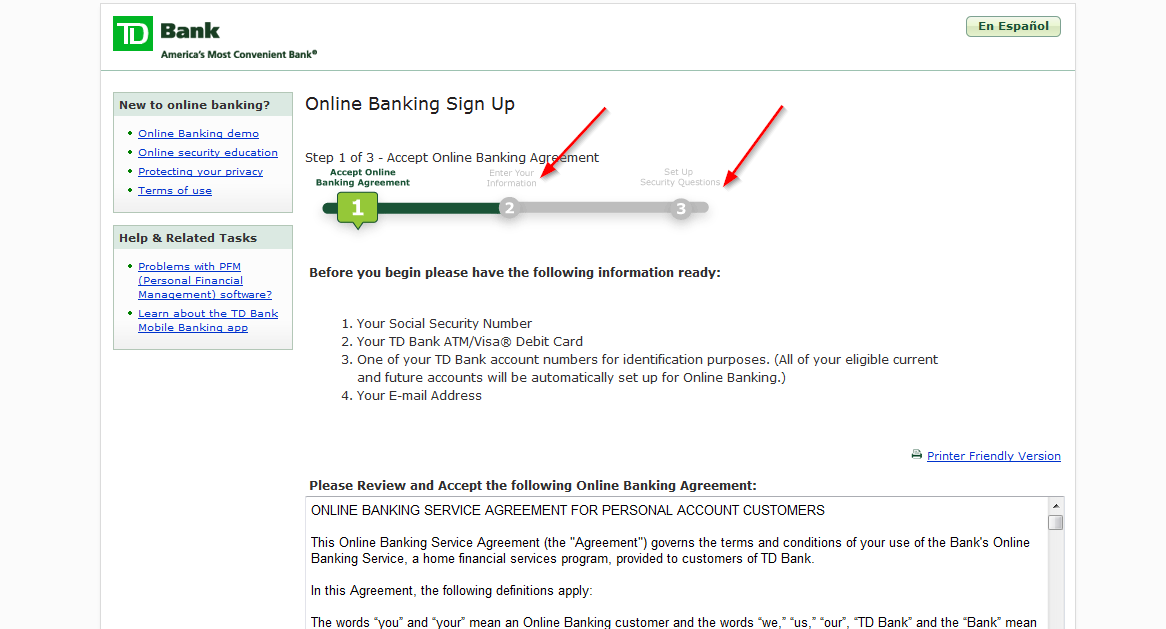

Step 4-Complete two more steps: banking information and security questions

Manage your TD Bank online account

Among the many advantages of having an online account with TD Bank includes:

- Full time access to your bank account

- You can check your account balance anytime

- You can request for an eStatement to check your transaction history

- Schedule transfer of funds

TD Bank Review

TD Bank (Toronto Dominion) is a Canadian international banking and financial services company based in Toronto. The bank was founded on 1st February 1955 through a merger of The Dominion Bank and the Bank of Toronto, which were founded in 1869 and 1855, respectively.

The bank is the 2nd largest bank in Canada by market capitalization, and according to Forbes, it is the 19th largest bank in the world.

TD Bank has more than 85,000 employees and more than 22 million clients worldwide. The bank operates in Canada as TD Canada Trust and serves over 11 million clients over 1,150 branches. In the U.S., the bank operates as TD Bank. The United States subsidiary was formed through the merger of Commerce Bank and TD Banknorth, and serves over 6.5 million clients with a network of over 1,300 branches in the eastern U.S.

The bank offers a wide range of financial services to small business and personal clients. It is pretty easy to open a savings or checking account at TD Bank once you have decided on the type of account that you think will be suitable for you.

Managing bank accounts: EasyWeb

The bank’s internet banking portal is called EasyWeb and makes it easy for clients to manage their bank accounts around the clock from anywhere in the world as long as they are connected to the internet. For those who want to bank even when they are on the go, there is a free app that they can download to their mobile devices. The EasyWeb portal and mobile apps offer online security guarantee and any unauthorized transactions are usually reimbursed by the bank.

Transferring money between accounts, paying bills and viewing eStatements can be easily accomplished on the bank’s web platform. The platform is not only easy to navigate but also robust, and includes the ability for users to download their account details as well as history to common 3rd party financial software.

Mortgages

TD Bank has a wide range of home mortgages that are common to all banks in Canada. The rates charged are based on Bank of Canada’s prime interest and offers terms from six months to ten years on amortization periods of between one to thirty years.

Credit cards

When it comes to credit cards, this bank deals exclusively with Visa, and offer a wide range of reward programs from cash back rewards to travel points. There are business and personal credit cards as well as special offers for students. The annual fees and interest rates vary between the different cards, but they all fall in marketplace averages.

Benefits

- Extended hours of service

- Customer service and award-winning security, both in-house and online

- Convenient and easy internet banking with mobile options

- Financial stability

- Full complement of financial and banking services

Downsides

- The bank does not pay any interest on checking account balances and there are low-interest rates on all savings accounts

- Monthly fees on checking accounts is high and also exorbitant minimum balance to waive the fee

- Very high fees on additional transaction on monthly minimums

TD Bank review summary

Those looking for a bank to handle their everyday financial needs should certainly find themselves satisfied with TD Bank. The bank’s account fees that are a top-ranked pet peeve of many people are a commonplace in the whole banking industry and are also the price that is paid for financial stability and security of the top Canadian financial institutions. The bank uses the money they get from fees to improve customer support and have acted to the requests of their clients for more convenient hours and improved online options.

The convenience that the internet has brought has made gone are the days of needing all your financial services under one roof. You can bank from anywhere in the world provided you have internet connection. And smartphones have made this a lot easy since you can now bank even when you are on the go. TD Bank has embraced technology in its endeavors to provide customers with reliable and convenient banking services. Customers only need to register on the bank’s website to get started with internet banking.