Valley National Bank is a regional bank with headquarters in Wayne, New Jersey. The bank has more than 20 branches in more than 30 counties. The bank offers its services in these branches and through its digital platforms.

- Branch / ATM Locator

- Website: https://www.valleynationalbank.com

- Routing Number: 021201383

- Swift Code: See Details

- Telephone Number: 1-800-522-4100

- Mobile App: Android | iPhone

- Founded: 1927 (98 years ago)

- Bank's Rating:

Valley National Bank is a regional bank with more than 200 branches and multiple digital platforms such as websites and mobile applications. The bank serves personal, business, and corporate and institutional clients. The services include savings, money management, and lending to its clients.

HOW TO LOGIN

To login to your online account for Valley National Bank, you should follow the following steps.

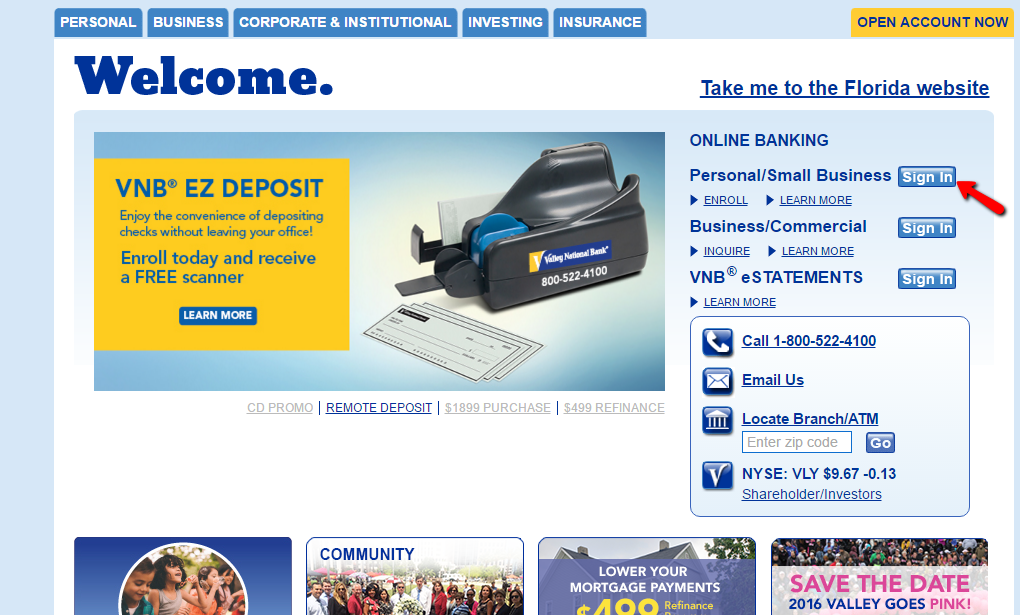

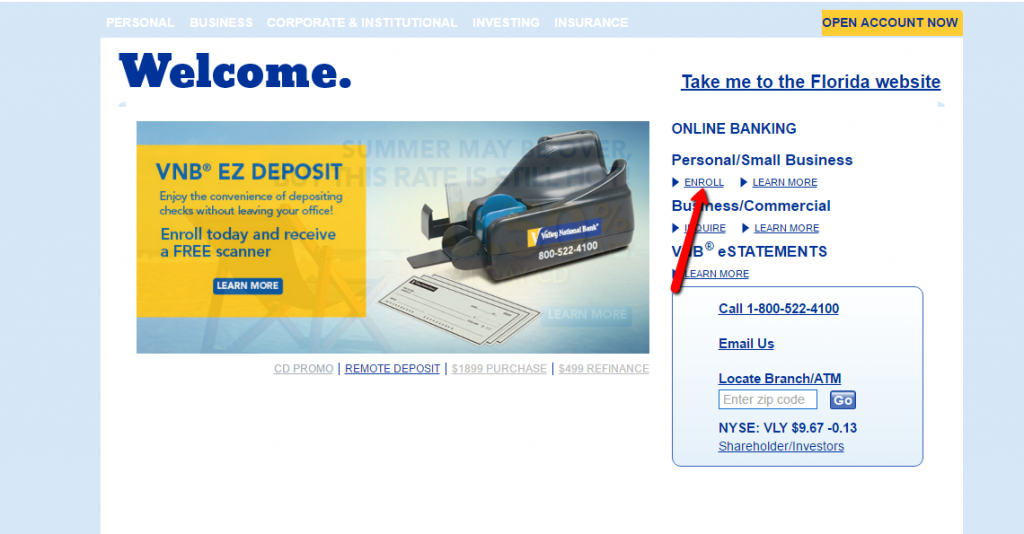

Step 1. The first step to login to your account is to go to the website using this link: www.valleynationalbank.com/.

Step 2. The next step is to go to the online banking tab and click sign in as shown below.

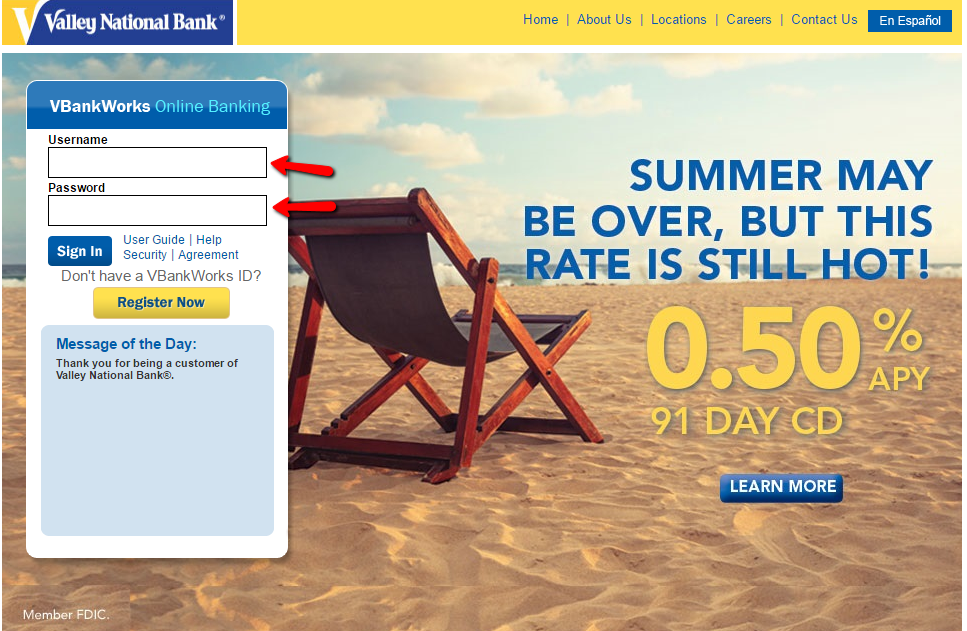

Step 3. On the next page, enter your username and your password and then click Login as shown below.

If you enter your correct details, you will be directed to your online account.

HOW TO RESET YOUR PASSWORD

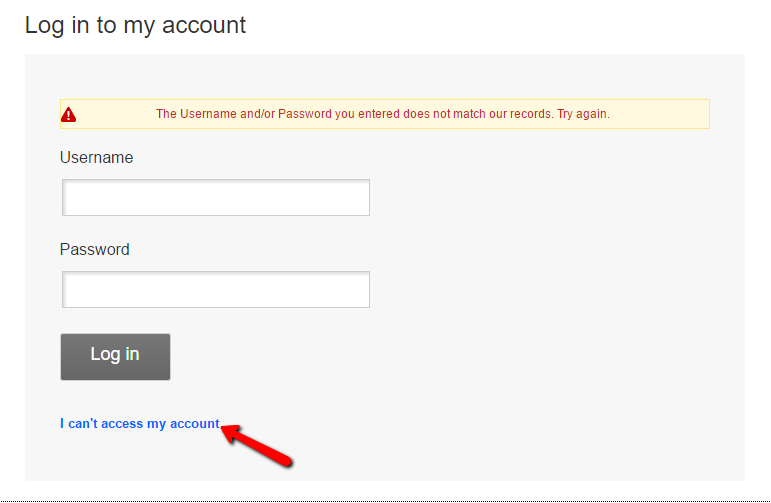

Step 1. If you can’t access your account because of your forgotten password, you should follow the steps above and click Sign In.

Step 2. In the next page, you should click I can’t access your account as shown below.

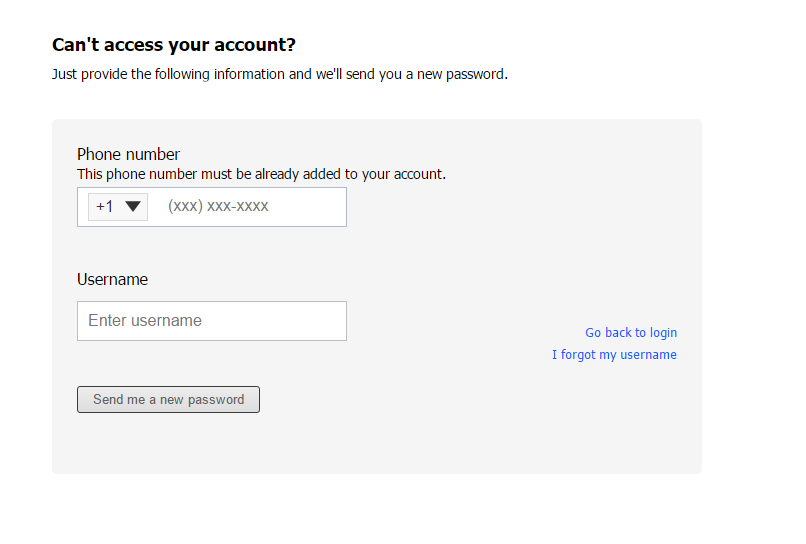

Step 3. On the next page, enter your phone number and your password as shown below. Then, click send me my password.

Your password will be sent to your phone number.

HOW TO ENROLL

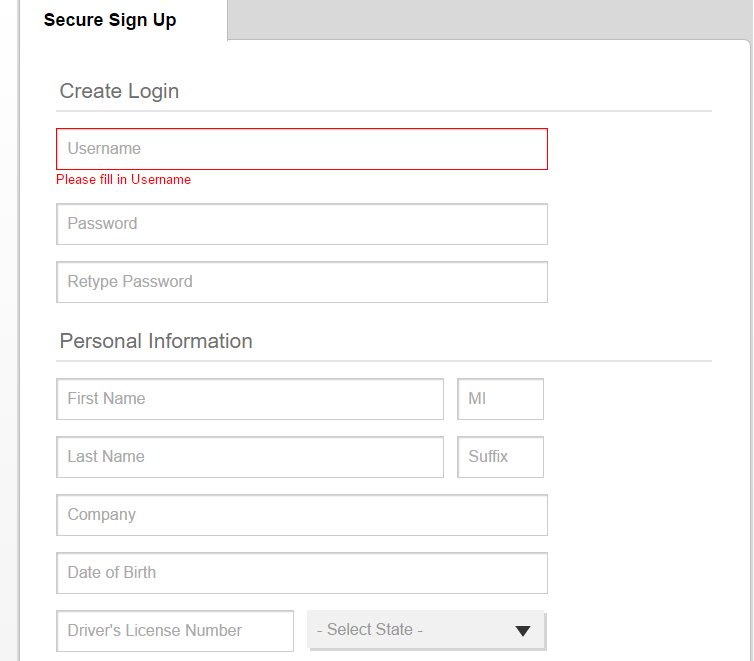

To enroll for an online account, you should follow the steps below.

Step 1. In the homepage, click the enroll link as shown below.

Step 2. In this page, enter the required information. A snapshot of the page is shown below.

Please ensure that you enter the correct details. This is because the information will be useful for you to maintain the account.

If you have any problem creating the account, you should get in touch with bank’s customer care through vbankworks@valleynationalbank.com.

WHAT YOU WILL FIND IN THE ONLINE ACCOUNT

The online account will help you do virtually all transactions wherever and whenever you are.

The Valley National Bank online account will help you do a number of things such as: checking your bank account, checking your balance, checking your transaction history, requesting your statement, sending money, making payments (such as electricity and other utility bills) and taking a loan.

Valley National Bank Review

Valley National Bank is a well-established and respected top banking company that also serves customers in Florida, New Jersey, and New York. The bank was established in 1927 and has 20 branch offices.

The bank operates as a subsidiary of Valley National Bancorp, headquartered in Wayne, New Jersey. It has over $21B in assets. It ranks among the top commercial banks in New Jersey also.

Benefits

Upon reviewing Valley National Bank, we found that this bank has a number of benefits, which makes it rank among the best banks in the United States.

- Tiered savings

Tiered savings account is a unique offering from the bank which reward account holders with higher balances. The account balance of the customer grows as well as the rate interest that they earn on savings.

Tiered savings requires a no monthly service fee and a minimum opening deposit of $250. Using an ATM card is also included and other free features associated with that come with tiered savings include mobile and online banking, email alerts, automated free banking, text alerts and activity downloads.

- Flexible checking accounts

Valley National Bank is a community bank that offers personalized service as well as extensive services that are in line with what you will find at a large national bank. This basically includes a number of different options for checking accounts-the most popular being Perfect Checking.

The full-serve account comes with free bill pay, unlimited check writing, and free online banking. When customers maintain a daily balance of $99, the monthly maintenance fee of $15 is waived.

Other checking account options include Basic Consumer, VNB-My Choice Checking, NOW Checking and Alternative checking.

- Industry-specific business checking

If Valley National Bank business customers want to bank with the bank, there are a few quality options that are available to them.

Uniquely, this is not just a community bank offering personal banking-it also provides business banking services based on industry specialization. The bank’s are of industry specialization include auto dealer solutions and healthcare financial services.

- Calculators

On the bank’s website, you will find very useful financial calculators that you to enter minimal amount of information in order to view the results in the form of graph, which are actionable and easy to understand.

Savings Goals Calculator is another tool where you can enter you plan and gets your results in a report and also a calculator for inflation, taxes, and savings.

There is also the IRA Savings Calculator which allows users to view the tax impact that traditional IRA would have and also the Health Savings Calculator which helps users to calculate the amount that they are allowed to contribute to HSA account for the present year.

Other advantages that you will enjoy when you bank with Valley National Bank include:

- Free online banking

- Free electronics statements

- Free telephone access to user account details

- Free bill pay

- Low initial opening deposit

- Unlimited check writing

Downsides

A review of Valley National Bank would not be complete without talking about the downsides of banking with the bank. Upon reviewing, we realized that the bank has some disadvantages, which you must know as a consumer. Despite being one of the oldest banks, it also has its own disadvantages:

- Limited locations

One thing about Valley National Bank is that they have limited locations considering the fact that they only operate in 30 counties in Central and northern New Jersey, Florida, Manhattan, Long Island, Brooklyn and Queens.

- Stringent requirements

Customers are required to maintain a minimum collected balance of $2,500 in order to earn interest. The fees may have an effect on your earnings. You also need to make a minimum opening deposit of $100. Paper statements are also charged $3.

Conclusion

Valley National Bank is basically one the best banks that you can bank with today. They have put all the measures they can to make sure that their customers have an amazing banking experience. Customers get to enjoy free online banking, free bill pay, free electronic statements,