Zion Bank was founded in 1873 and is based in London, United Kingdom. The bank operates as a subsidiary of Zions Bancorp.

- Branch / ATM Locator

- Website: https://www.zionsbank.com/

- Routing Number: 124000054

- Swift Code: See Details

- Telephone Number: 800-974-8800

- Mobile App: Android | iPhone

- Founded: 1873 (152 years ago)

- Bank's Rating:

With a Zions Bank online account, customers can track their transaction history, check their account balances, pay their bills etc. There’s just so much that you can do with your online banking account. The good news is that it’s completely free and easy to enroll. Continue following this guide to learn how you can login into your online account; change your password and register.

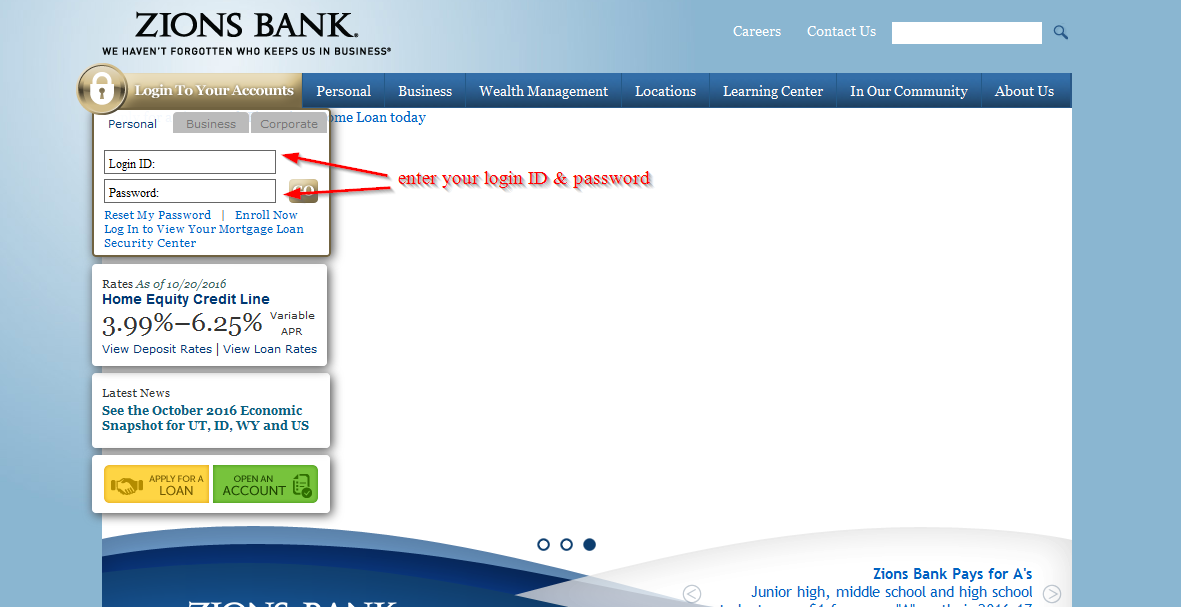

How to login

Logging into your Zions Bank online account is pretty simple as long as you have valid login details. You can login on your web browser or your mobile app on your Smartphone. Here are simple steps to follow to login:

Step 1-Start your computer, open your web browser and type in https://www.zionsbank.com/

Step 2-Enter your username and password and click “login”

If the logins are correct, you will have access to your online account

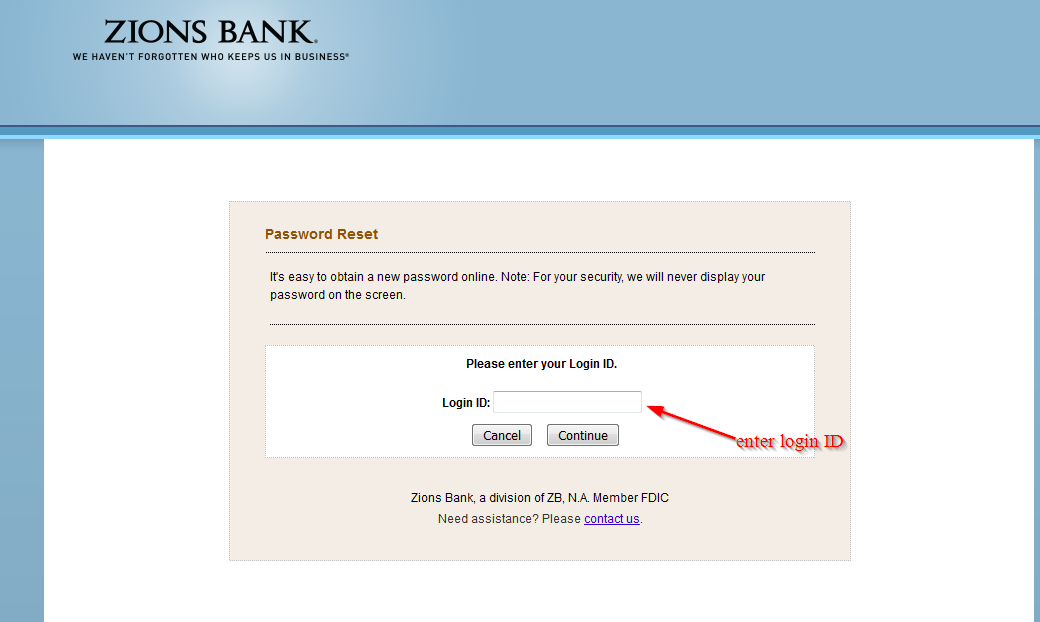

How to reset your password

If you don’t use the correct password, you won’t be granted access to your online account. But Zions Bank has made it easy for customers who have an online account with the bank to reset it. Follow this guide to learn how you can reset your password:

Step 1-Click “reset my password” on the homepage

Step 2– Enter login ID and click “continue”

You will receive a new password in your email

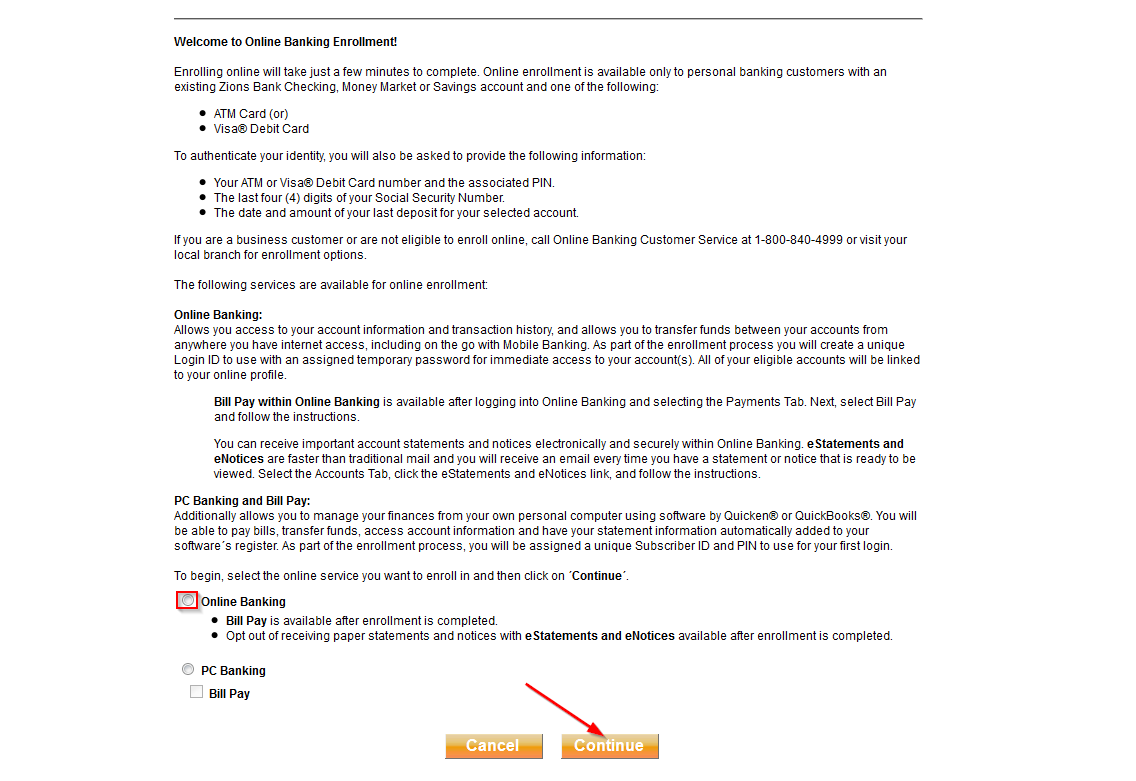

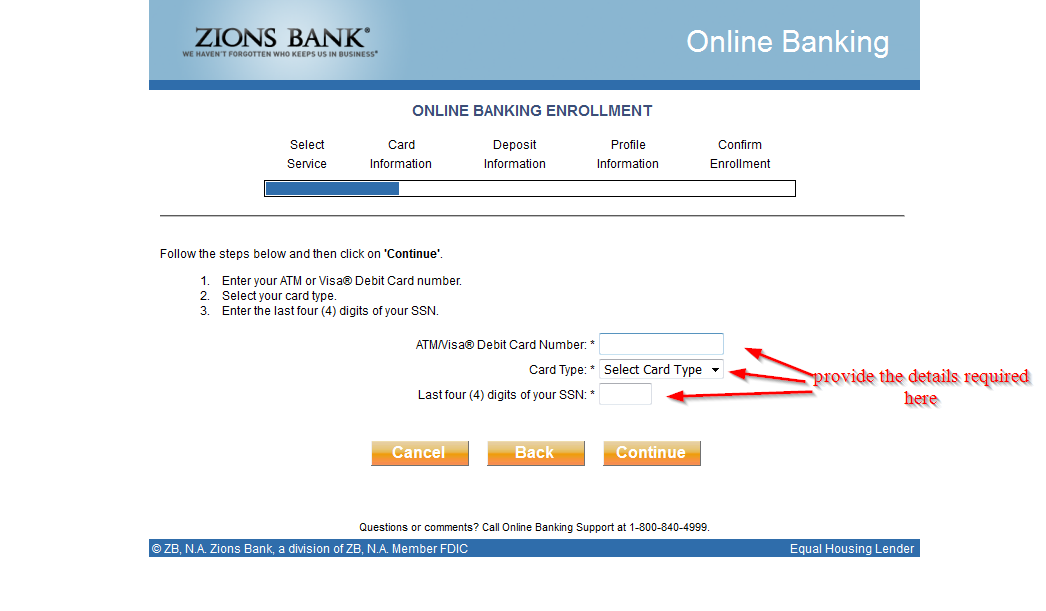

How to enroll

Creating an online account with Zions Bank is easy as long as you have an account with the bank. You will also be required to provide a few details about your bank account. Follow these simple steps to login into your online account:

Step 1-On the homepage, click “enroll now”

Step 2-Read the terms and conditions and click “continue”

Step 3-Enter your debit card number, card types and the last four digits of your SSN

You may be required to provide more information in a few more steps to complete your registration.

Manage your Zions Bank online account

The following are the benefits of having an online account with Zions Bank:

- Online customer support

- 24/7 access to your bank account

- Business and personal banking services

- Access to the nearest ATM

Zions Bank Review

Since it was founded in 1837, Zions Bank has been providing banking services to the communities of Intermountain West, especially in Idaho and Utah, for over 130 years.

Zions Bank is a subsidiary of Zions Bancorporation which operates over 500 offices and 600 ATMs in ten western States: Washington, Arizona, Utah, California, Texas, Colorado, Oregon, Idaho, New Mexico and Nevada.

Aside from a wide range of banking services, the bank offers an array or mortgage and investment services and has loan origination offices for small businesses in the country.

Being a full-service bank, Zions Bank offers military interest checking, mortgage loans, and installments as well as savings and checking program. The bank also offers internet banking for online transaction that pertains to IRA CDs, savings deposit and money market accounts.

Aside from car and home loans, student loans and farmland loans are possible. The bank also provides personal consultations to educate banking customers on topics that are related to owning a home.

For those who are looking for a bank that is appealing, then this bank higher interest on its online savings account than savings accounts that are open at its financial centers.

Zions online savings account

A savings account makes it possible and easy for customers to save and keep their money readily available. As of September, 13th 2017, the average national interest rate for savings accounts is 0.06% APY.

For clients who do not need a physical banking service, they can enjoy interest rate of 0.5% APY in the Zions Bank online savings account.

This account can be open easily online through the bank’s website or even on the phone.

Customers need a minimum of $1000 to open the savings account, through electronic transfer from deposit accounts, wire transfer or mailing a check.

Zion Bank services and products

Although opening an online account with Zions Bank is easy, there are a few additional requirements to help customers get maximum interest rates on the savings account. In order to earn interest, the account must maintain a minimum balance of $1,000.

The rate for either relationship or non-relationship accounts is usually determined by how customers bank with them and don’t increase as the balance grows.

The non-relationship interest rate is reported at 0.45% APY as of 13th Sept 2017and the relationship interest rate was at 0.50% APY. Relationship interest rate usually applies to savings account if customer satisfies at least of these qualifications:

- Use a Zions Bank-issued credit card at least once during the statement period

- Have one of the Checking products by Zions Bank

- Maintain the bank’s direct brokerage account and don’t opt out of sharing your personal details with the affiliates of Zions Direct

Benefits

Zions Bank is one of the most trusted banks in the United States. There are many benefits that the bank brings to the table. They include:

- Online banking is one of the main benefits of banking with Zions bank. The bank gives you full time access to your account through your computer and mobile phone. In addition, Zions bank accounts are all covered by the FDIC up to $250,000 per depositor

- In addition, clients also have access to more than 100 brick and motor locations in Utah and Idaho.

- No closing costs-One of the best things about getting a home loan from the bank is that it does not charge closing costs. Very few companies offer this advantage which saves borrowers a lot of money

Downsides

Zions Bank has its own downsides, which is important that customers know before choosing it as the preferred bank:

- Undisclosed interest rate-It is unfortunate that the bank has not disclosed interest rates on its website. Clients are forced to contact the bank to get more information.

- High minimum credit score-Zions bank does not lend to borrowers who have a credit score below 660. This means that consumers must have perfect credit.

- Another disadvantage is limited locations. The bank does not have branches in all the states

Conclusion

Zions Bank offers the best savings account rates for its online savings account. Its online banking services make it easier for customers to bank from anywhere provided they have registered for internet banking. However, the bank has limited locations.